Question

Analyze the prior year Income Statement and current year Master Budget along with the assumptions. Evaluate the budget, identifying errors and correcting both errors and

Analyze the prior year Income Statement and current year Master Budget along with the assumptions. Evaluate the budget, identifying errors and correcting both errors and assumptions as needed.

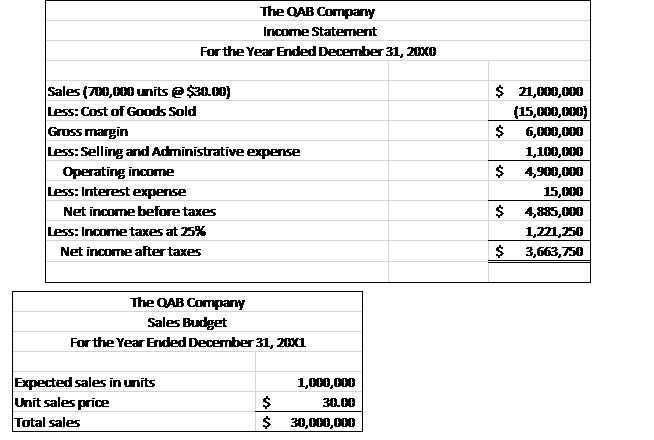

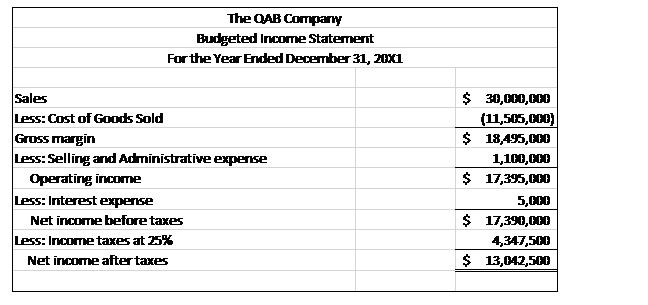

The senior executives at QAB Company want to quickly grow the company, and they need your help. They have provided last year’s income statement (20X0), assumptions for the current year (20X1), as well as budget information for the current year (20X1). They want to increase revenue, reduce costs, and insure they will receive bonuses for their fine work. See below for the information provided us.

Assumptions for 20X1:

- Increase sales by approximately 43%.

- Keep selling price the same.

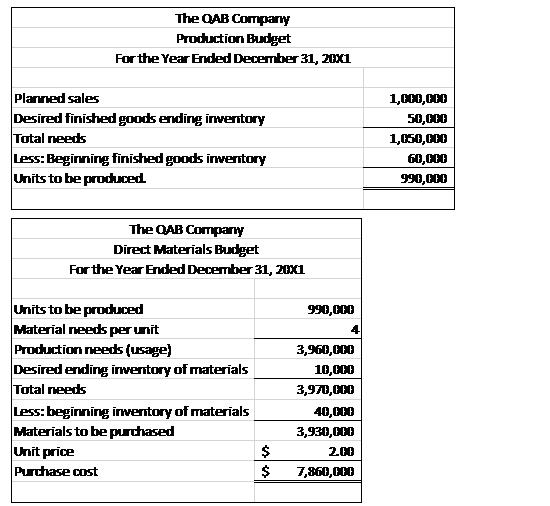

- Reduce cost of goods sold by getting a lower cost for materials by buying in larger quantities.

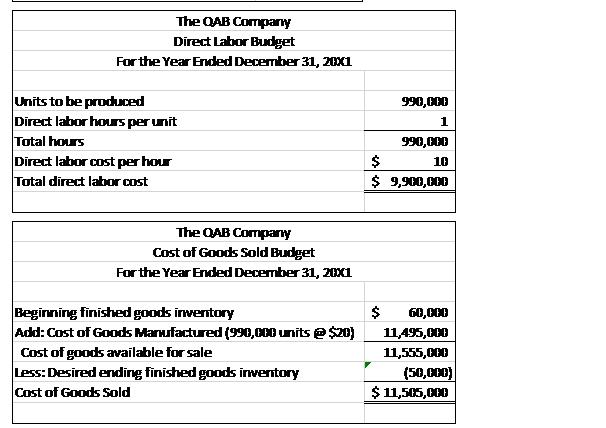

- Reduce labor costs by lowering wages from $11 to $10 per hour.

- Keep Selling and G & A at the same level by giving small pay raises while cutting advertising and commissions to sales personnel.

- The larger net income will allow an increase in dividends to shareholders.

Information from client files shows:

- Senior executives own 35% of the common stock.

- Each year there is a significant turnover of lower level employees.

- Customer returns increase each year due to poor quality workmanship.

The QAB Company Income Statement For the Year Ended December 31, 20X0 Sales (700,000 units @ $30.00) Less: Cost of Goods Sold Gross margin Less: Selling and Administrative expense Operating income Less: Interest expense Net income before taxes Less: Income taxes at 25% Net income after taxes The QAB Company Sales Budget For the Year Ended December 31, 2001 Expected sales in units Unit sales price Total sales $ $ 1,000,000 30.00 30,000,000 $ 21,000,000 (15,000,000) 6,000,000 1,100,000 4,900,000 $ $ 15,000 $ 4,885,000 1,221,250 3,663,750 $

Step by Step Solution

3.55 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER BUDGET EVALUATION PROPSED BUDGET 1 MATERIAL COST REDUCED FORM 211 PU TO 20 PU 2LABOUR COST RE...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started