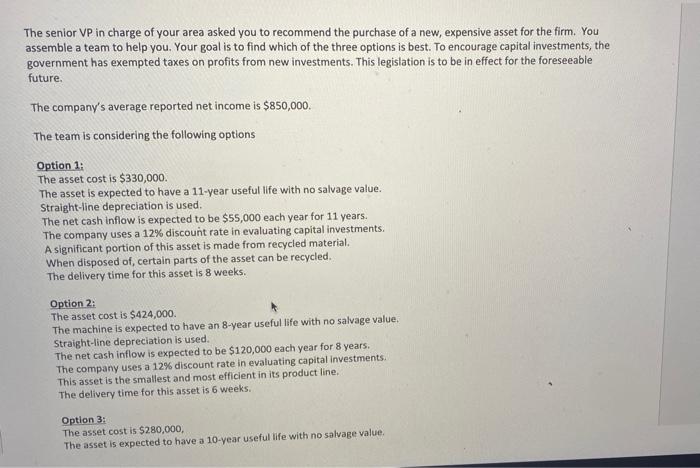

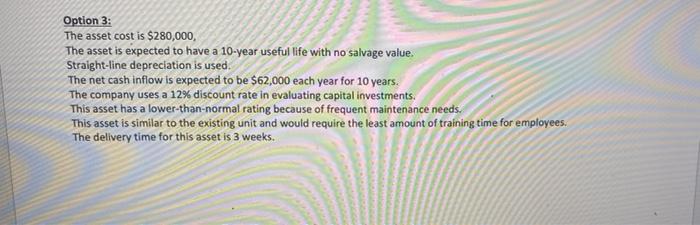

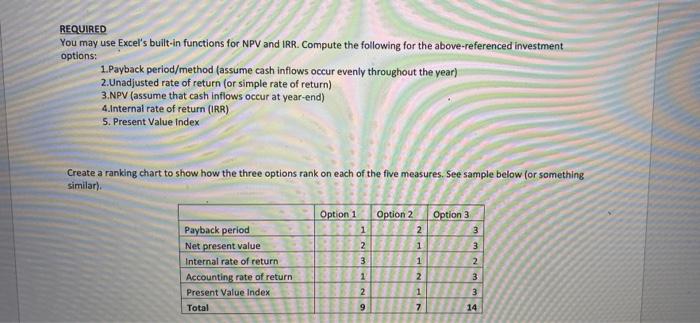

The senior VP in charge of your area asked you to recommend the purchase of a new, expensive asset for the firm. You assemble a team to help you. Your goal is to find which of the three options is best. To encourage capital investments, the government has exempted taxes on profits from new investments. This legislation is to be in effect for the foreseeable future. The company's average reported net income is $850,000. The team is considering the following options Option 1: The asset cost is $330,000. The asset is expected to have a 11-year useful life with no salvage value. Straight-line depreciation is used. The net cash inflow is expected to be $55,000 each year for 11 years. The company uses a 12% discount rate in evaluating capital investments. A significant portion of this asset is made from recycled material. When disposed of, certain parts of the asset can be recycled. The delivery time for this asset is 8 weeks. Option 2: The asset cost is $424,000. The machine is expected to have an 8-year useful life with no salvage value. Straight-line depreciation is used. The net cash inflow is expected to be $120,000 each year for 8 years, The company uses a 12% discount rate in evaluating capital investments. This asset is the smallest and most efficient in its product line. The delivery time for this asset is 6 weeks. Option 3: The asset cost is $280,000, The asset is expected to have a 10-year useful life with no salvage value Option 3: The asset cost is $280,000, The asset is expected to have a 10-year useful life with no salvage value. Straight-line depreciation is used. The net cash inflow is expected to be $62,000 each year for 10 years. The company uses a 12% discount rate in evaluating capital investments. This asset has a lower-than-normal rating because of frequent maintenance needs. This asset is similar to the existing unit and would require the least amount of training time for employees. The delivery time for this asset is 3 weeks. REQUIRED You may use Excel's built-in functions for NPV and IRR. Compute the following for the above-referenced investment options: 1.Payback period/method (assume cash inflows occur evenly throughout the year) 2.Unadjusted rate of return for simple rate of return) 3.NPV (assume that cash inflows occur at year-end) 4.Internal rate of return (IRR) 5. Present Value Index Create a ranking chart to show how the three options rank on each of the five measures. See sample below for something similar). Option 2 2 Option 3 Option 1 1 2 3 1 3 1 2 Payback period Net present value Internal rate of return Accounting rate of return Present Value Index Total 1 3 2 1 3 2 9 7 14