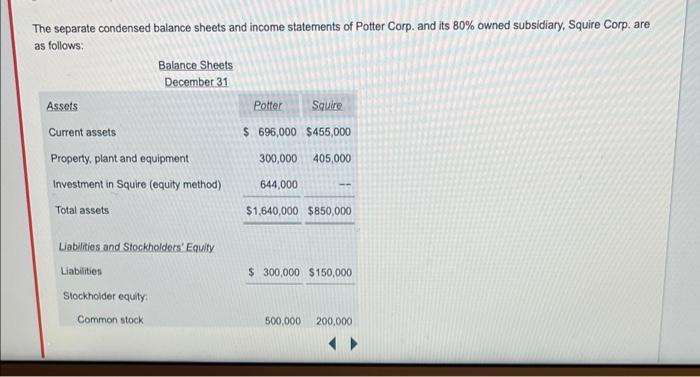

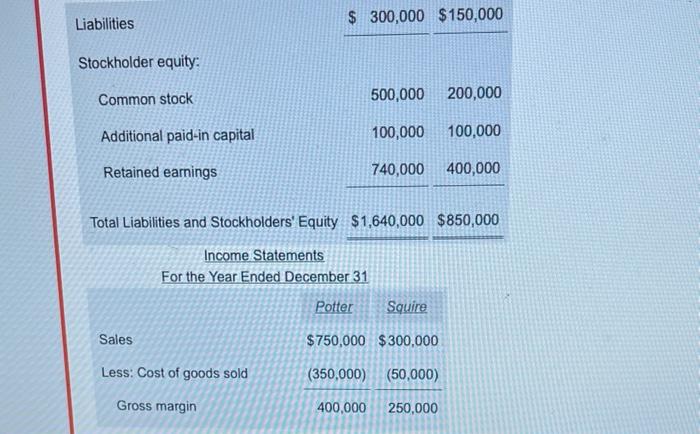

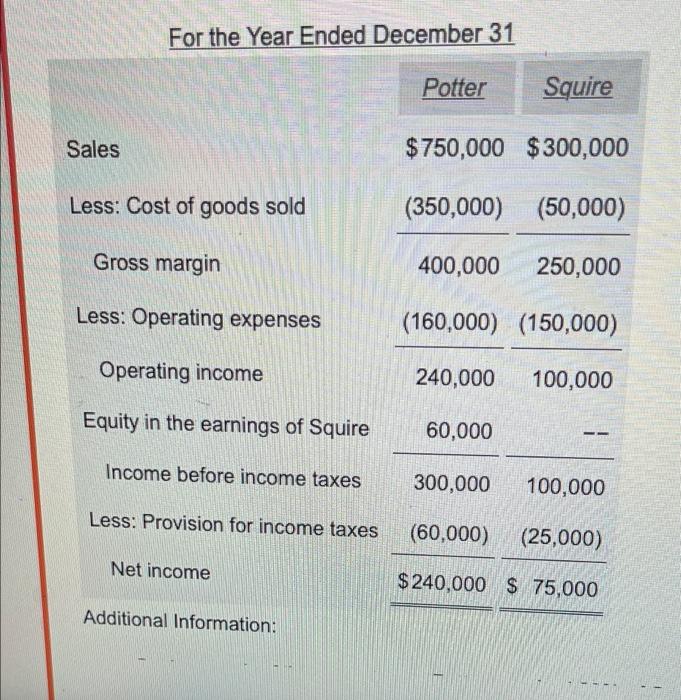

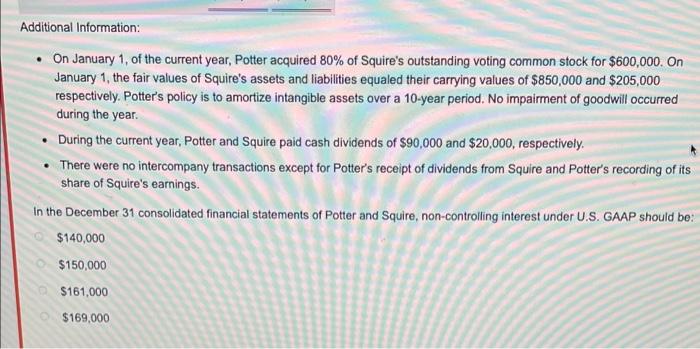

The separate condensed balance sheets and income statements of Potter Corp. and its 80% owned subsidiary, Squire Corp. are as follows: Balance Sheets December 31 Assets Potter Squire Current assets $ 696,000 $455,000 300,000 405,000 Property, plant and equipment Investment in Squire (equity method) 644,000 Total assets $1,640,000 $850,000 Liabilities and Stockholders' Equity Liabilities $ 300,000 $150,000 Stockholder equity Common stock 500,000 200,000 Liabilities $ 300,000 $150,000 Stockholder equity: Common stock 500,000 200,000 Additional paid-in capital 100,000 100,000 Retained earnings 740,000 400,000 Total Liabilities and Stockholders' Equity $1,640,000 $850,000 Income Statements For the Year Ended December 31 Potter Squire Sales $750,000 $300,000 Less: Cost of goods sold (350,000) (50,000) Gross margin 400,000 250,000 For the Year Ended December 31 Potter Squire Sales $750,000 $300,000 Less: Cost of goods sold (350,000) (50,000) Gross margin 400,000 250,000 Less: Operating expenses (160,000) (150,000) Operating income 240,000 100,000 Equity in the earnings of Squire 60,000 Income before income taxes 300,000 100,000 Less: Provision for income taxes (60,000) (25,000) Net income $240,000 $75,000 Additional Information: Additional Information: On January 1, of the current year, Potter acquired 80% of Squire's outstanding voting common stock for $600,000. On January 1, the fair values of Squire's assets and liabilities equaled their carrying values of $850,000 and $205,000 respectively. Potter's policy is to amortize intangible assets over a 10-year period. No impairment of goodwill occurred during the year. . During the current year, Potter and Squire paid cash dividends of $90,000 and $20,000, respectively. There were no intercompany transactions except for Potter's receipt of dividends from Squire and Potter's recording of its share of Squire's earnings. In the December 31 consolidated financial statements of Potter and Squire, non-controlling interest under U.S. GAAP should be: $140,000 $150,000 $161,000 $169,000 The separate condensed balance sheets and income statements of Potter Corp. and its 80% owned subsidiary, Squire Corp. are as follows: Balance Sheets December 31 Assets Potter Squire Current assets $ 696,000 $455,000 300,000 405,000 Property, plant and equipment Investment in Squire (equity method) 644,000 Total assets $1,640,000 $850,000 Liabilities and Stockholders' Equity Liabilities $ 300,000 $150,000 Stockholder equity Common stock 500,000 200,000 Liabilities $ 300,000 $150,000 Stockholder equity: Common stock 500,000 200,000 Additional paid-in capital 100,000 100,000 Retained earnings 740,000 400,000 Total Liabilities and Stockholders' Equity $1,640,000 $850,000 Income Statements For the Year Ended December 31 Potter Squire Sales $750,000 $300,000 Less: Cost of goods sold (350,000) (50,000) Gross margin 400,000 250,000 For the Year Ended December 31 Potter Squire Sales $750,000 $300,000 Less: Cost of goods sold (350,000) (50,000) Gross margin 400,000 250,000 Less: Operating expenses (160,000) (150,000) Operating income 240,000 100,000 Equity in the earnings of Squire 60,000 Income before income taxes 300,000 100,000 Less: Provision for income taxes (60,000) (25,000) Net income $240,000 $75,000 Additional Information: Additional Information: On January 1, of the current year, Potter acquired 80% of Squire's outstanding voting common stock for $600,000. On January 1, the fair values of Squire's assets and liabilities equaled their carrying values of $850,000 and $205,000 respectively. Potter's policy is to amortize intangible assets over a 10-year period. No impairment of goodwill occurred during the year. . During the current year, Potter and Squire paid cash dividends of $90,000 and $20,000, respectively. There were no intercompany transactions except for Potter's receipt of dividends from Squire and Potter's recording of its share of Squire's earnings. In the December 31 consolidated financial statements of Potter and Squire, non-controlling interest under U.S. GAAP should be: $140,000 $150,000 $161,000 $169,000