Answered step by step

Verified Expert Solution

Question

1 Approved Answer

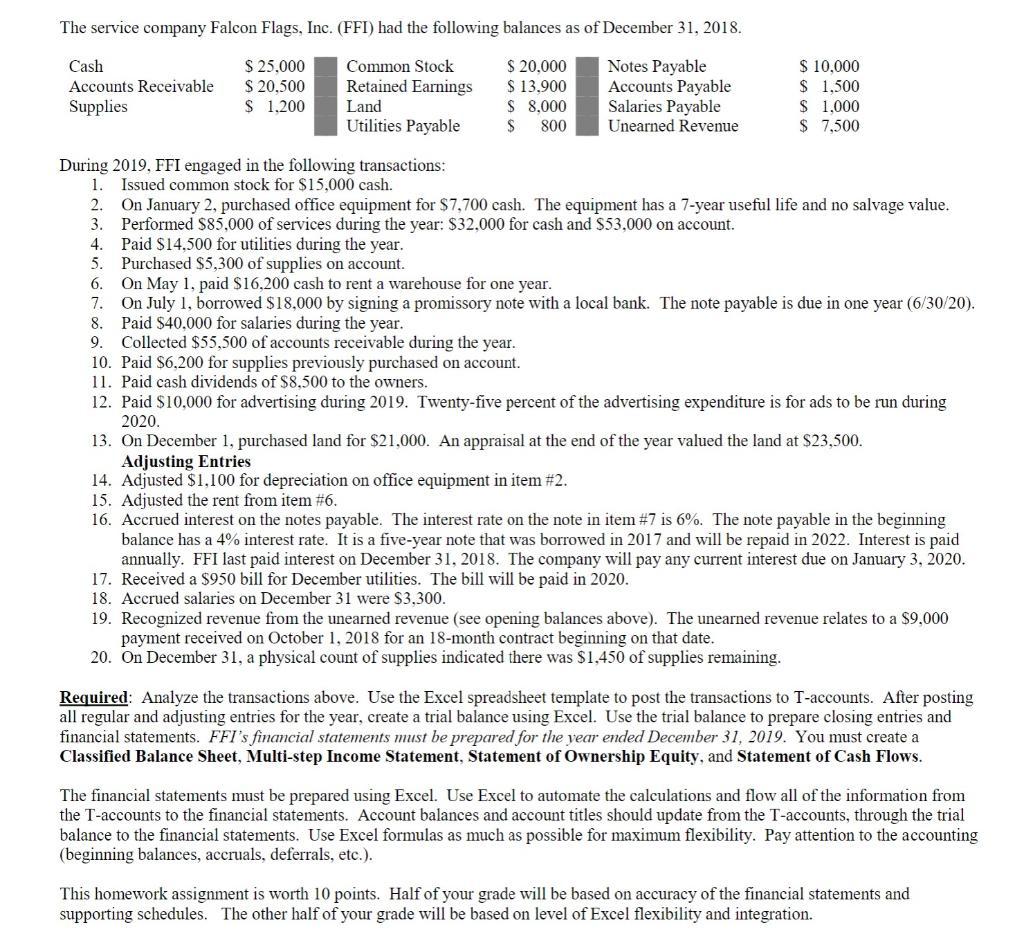

The service company Falcon Flags, Inc. (FFI) had the following balances as of December 31, 2018. $ 25,000 $ 20,500 $ 1,200 Common Stock

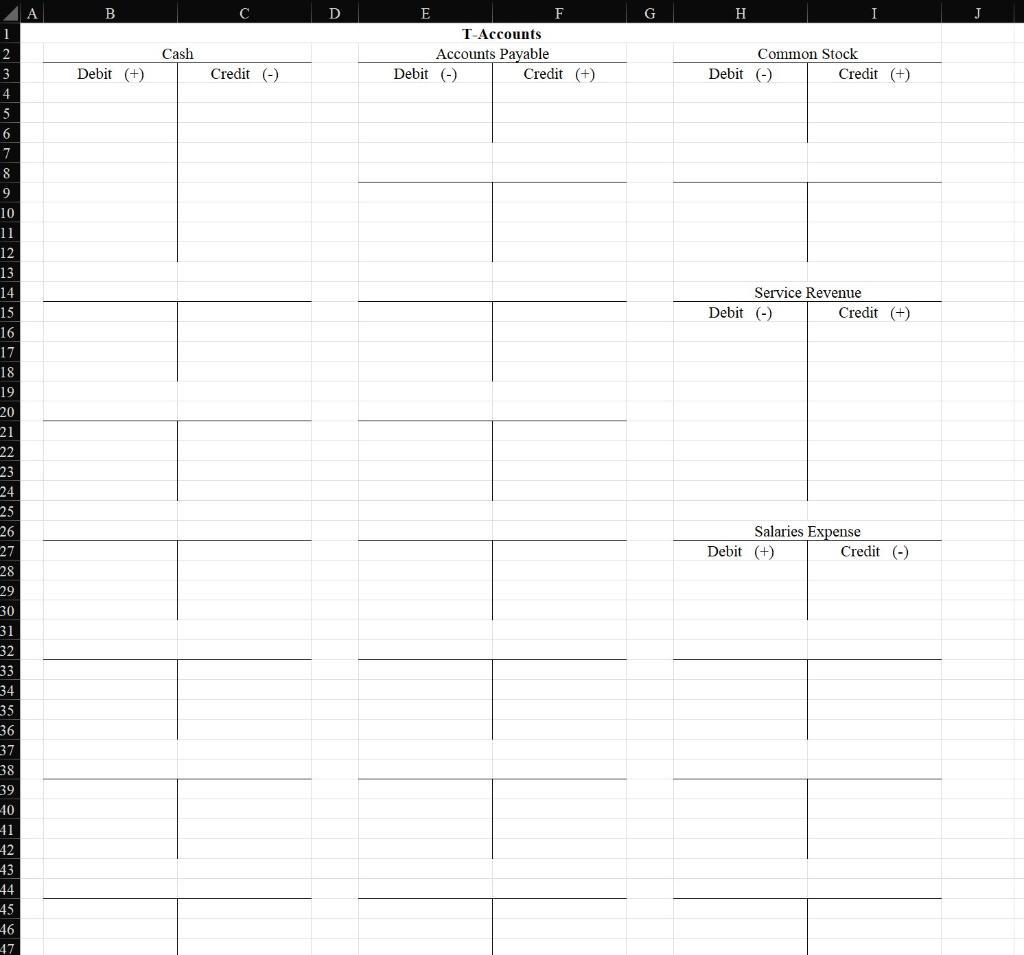

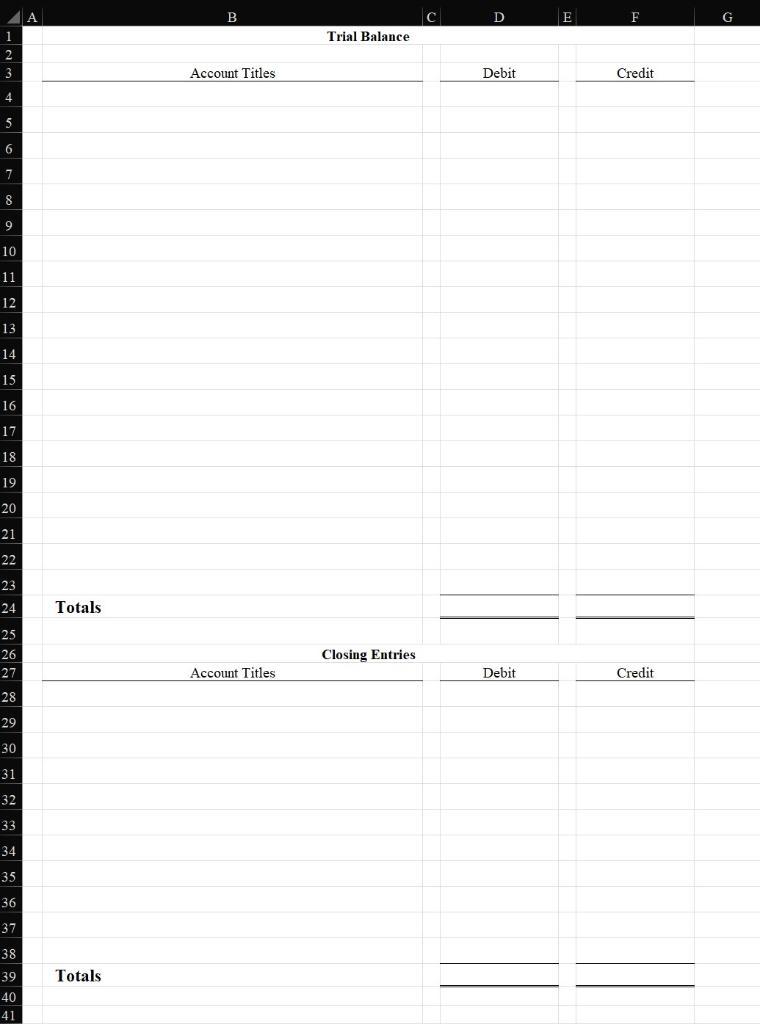

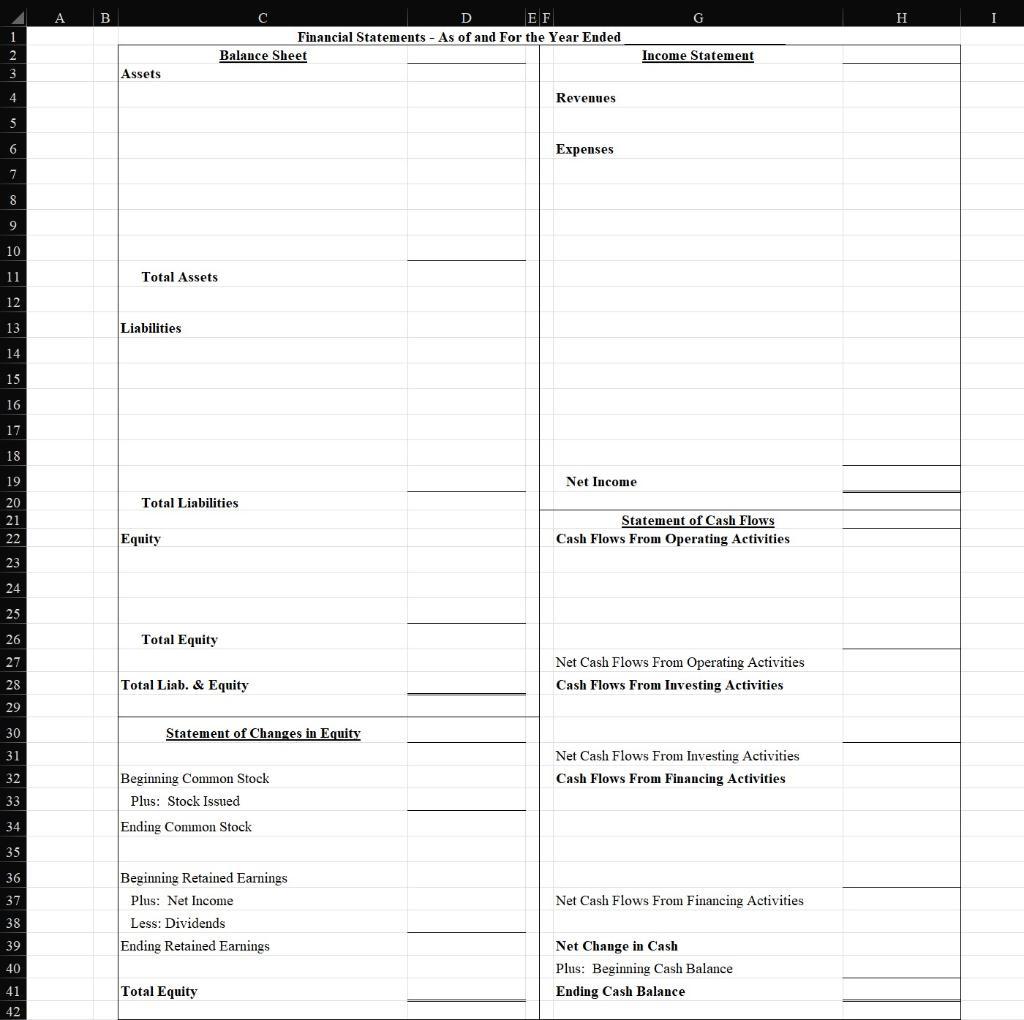

The service company Falcon Flags, Inc. (FFI) had the following balances as of December 31, 2018. $ 25,000 $ 20,500 $ 1,200 Common Stock Retained Earnings Land Utilities Payable Notes Payable Accounts Payable Salaries Payable Unearned Revenue Cash Accounts Receivable Supplies During 2019, FFI engaged in the following transactions: 1. Issued common stock for $15,000 cash. 2. $ 20,000 $ 13,900 $ 8,000 $ 800 On January 2, purchased office equipment for $7,700 cash. The equipment has a 7-year useful life and no salvage value. Performed $85,000 of services during the year: $32,000 for cash and $53,000 on account. Paid $14,500 for utilities during the year.. $ 10,000 $ 1,500 $ 1,000 $ 7,500 3. 4. 5. Purchased $5,300 of supplies on account. 6. On May 1, paid $16,200 cash to rent a warehouse for one year. 7. On July 1, borrowed $18,000 by signing a promissory note with a local bank. The note payable is due in one year (6/30/20). 8. Paid $40,000 for salaries during the year. 9. Collected $55,500 of accounts receivable during the year. 10. Paid $6.200 for supplies previously purchased on account. 11. Paid cash dividends of $8,500 to the owners. 12. Paid $10,000 for advertising during 2019. Twenty-five percent of the advertising expenditure is for ads to be run during 2020. 13. On December 1, purchased land for $21,000. An appraisal at the end of the year valued the land at $23,500. Adjusting Entries 14. Adjusted $1,100 for depreciation on office equipment in item #2. 15. Adjusted the rent from item #6. 16. Accrued interest on the notes payable. The interest rate on the note in item #7 is 6%. The note payable in the beginning balance has a 4% interest rate. It is a five-year note that was borrowed in 2017 and will be repaid in 2022. Interest is paid annually. FFI last paid interest on December 31, 2018. The company will pay any current interest due on January 3, 2020. 17. Received a $950 bill for December utilities. The bill will be paid in 2020. 18. Accrued salaries on December 31 were $3,300. 19. Recognized revenue from the unearned revenue (see opening balances above). The unearned revenue relates to a $9,000 payment received on October 1, 2018 for an 18-month contract beginning on that date. 20. On December 31, a physical count of supplies indicated there was $1,450 of supplies remaining. Required: Analyze the transactions above. Use the Excel spreadsheet template to post the transactions to T-accounts. After posting all regular and adjusting entries for the year, create a trial balance using Excel. Use the trial balance to prepare closing entries and financial statements. FFI's financial statements must be prepared for the year ended December 31, 2019. You must create a Classified Balance Sheet, Multi-step Income Statement, Statement of Ownership Equity, and Statement of Cash Flows. The financial statements must be prepared using Excel. Use Excel to automate the calculations and flow all of the information from the T-accounts to the financial statements. Account balances and account titles should update from the T-accounts, through the trial balance to the financial statements. Use Excel formulas as much as possible for maximum flexibility. Pay attention to the accounting (beginning balances, accruals, deferrals, etc.). This homework assignment is worth 10 points. Half of your grade will be based on accuracy of the financial statements and supporting schedules. The other half of your grade will be based on level of Excel flexibility and integration. 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 -40 41 42 43 44 45 46 47 A B Debit (+) Cash Credit (-) D E T-Accounts Accounts Payable Debit (-) F Credit (+) G H Common Stock Debit (-) Debit (-) Service Revenue Credit (+) I Credit (+) Salaries Expense Debit (+) Credit (-) J 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 A Totals Totals B Account Titles Account Titles Trial Balance Closing Entries D Debit Debit E F Credit Credit G 1 2 3 4 5 6 7 8 9 10 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 A B Assets Total Assets Liabilities Total Liabilities Equity Total Equity Total Liab. & Equity C Balance Sheet Statement of Changes in Equity Beginning Common Stock. Plus: Stock Issued Ending Common Stock Total Equity D EF Financial Statements - As of and For the Year Ended Beginning Retained Earnings Plus: Net Income Less: Dividends Ending Retained Earnings Revenues Expenses Net Income G Income Statement Statement of Cash Flows Cash Flows From Operating Activities Net Cash Flows From Operating Activities Cash Flows From Investing Activities Net Cash Flows From Investing Activities Cash Flows From Financing Activities Net Cash Flows From Financing Activities Net Change in Cash Plus: Beginning Cash Balance Ending Cash Balance H

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started