Question

The setup of the problem implicitly assumes that the bank will let the Joness borrow from their savings account and will charge them the same

The setup of the problem implicitly assumes that the bank will let the Joness borrow from their savings account and will charge them the same 8% it was paying on positive balances. This is unlikely!

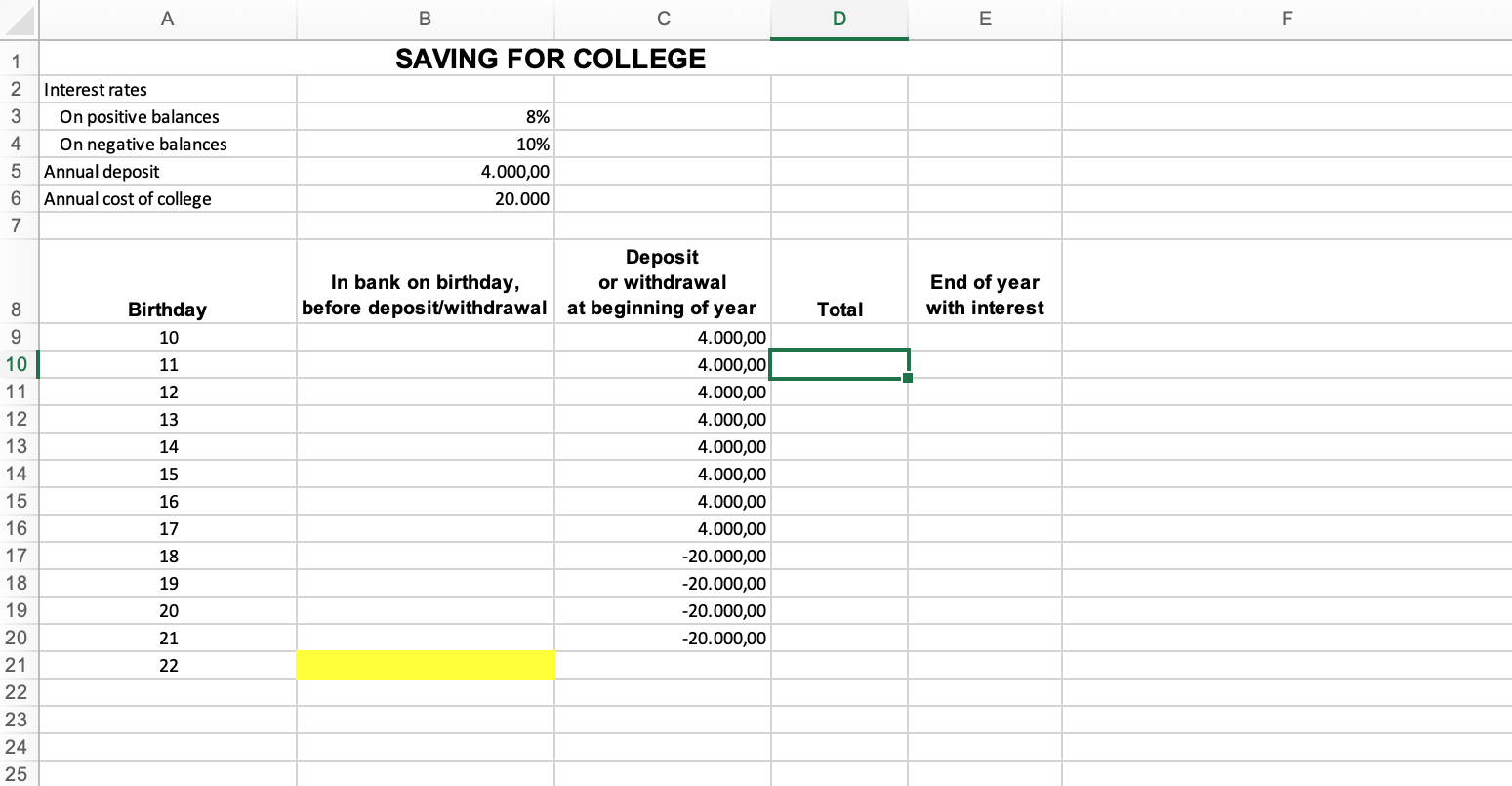

In it, you will assume that the bank pays Lindas parents 8% on positive account balances but charges them 10% on negative balances.

If Lindas parents can only deposit $4,000 per year in the years preceding college, how much will they owe the bank at the beginning of year 22 (the year after Linda finishes college)?

Using Excel formula like PV, FV... when it's possible.

A 1 2 Interest rates 3 On positive balances 4 On negative balances 5 Annual deposit 6 Annual cost of college 7 Birthday 10 11 12 13 14 15 16 17 18 19 20 21 22 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 B C SAVING FOR COLLEGE 8% 10% 4.000,00 20.000 Deposit In bank on birthday, or withdrawal before deposit/withdrawal at beginning of year 4.000,00 4.000,00 4.000,00 4.000,00 4.000,00 4.000,00 4.000,00 4.000,00 -20.000,00 -20.000,00 -20.000,00 -20.000,00 D Total E End of year with interest FStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started