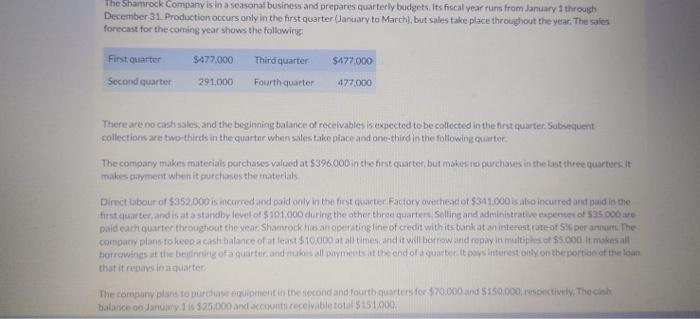

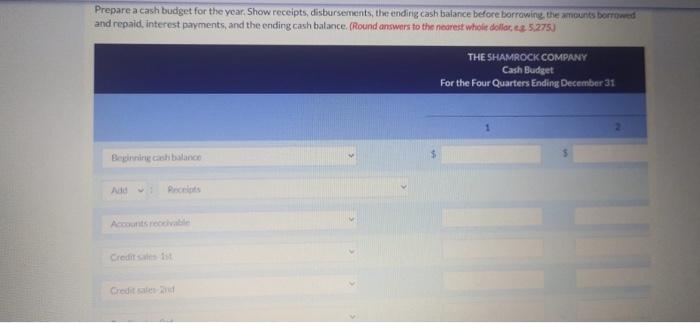

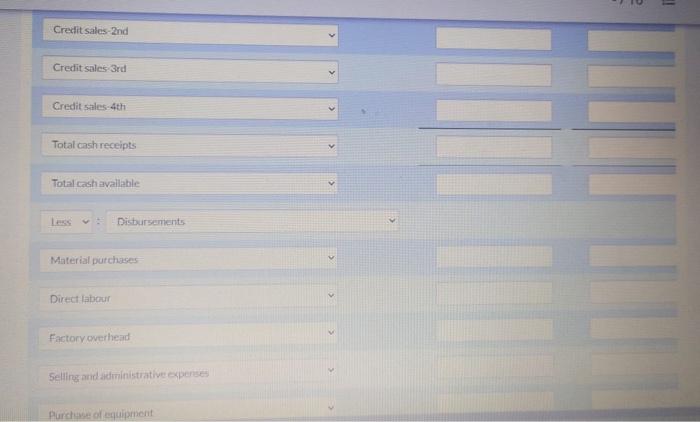

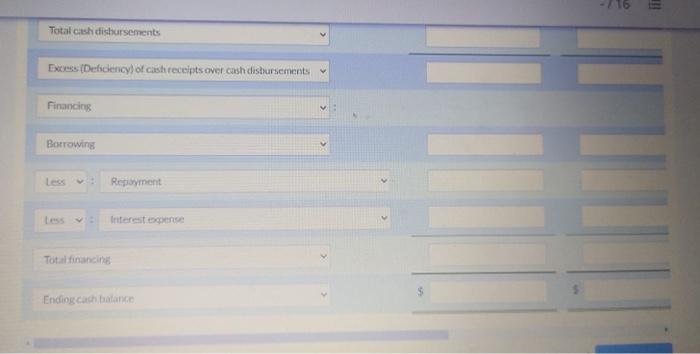

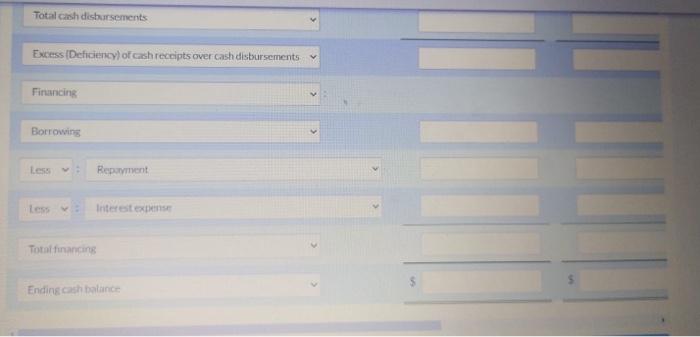

The Shamrock Company is in a seasonal business and prepares quarterly budgets. Its fiscal year runs from January 1 through December 31. Production occurs only in the first quarter January to March), but sales take place throughout the year. The sales forecast for the coming year shows the following: First quarter $477,000 $477.000 Third quarter Fourth quarter Second quarter 291.000 477,000 There are no cast sales, and the beginning balance of receivables is expected to be collected in the first quarter Subsequent collections are two-thirds in the quarter when sales take place and one-third in the following quarter The company makes materials purchases valued at $396.000 in the first quarter, but makes no purchases in the last three quarters. It makes payment when it purchases the materials Direct labour of 5352.000 is incurred and paid only in the first quarter Factory overhead of $341.000 is also incurred and paid in the first quarter, and is at a standby level of $101.000 during the other three quarter Selling and administrative expenses of $35.000 ure paid each quarter throughout the year Shamrock his operating line of credit with its bank at an interest rate of 5% per annum. The company plans to keep a casti balance of at least 510,000 at all times and it will borrow and repair mais of $5.000. It makes all borrowings at the bedning of a quarter and make all payments at the end of a quartet it as interest osly on the portion of the loan that it recurs in a quarter The company plans to purchase equipment in the second and fourth quarters for $70.000 and $150.000, sbectively. The inh balance on January 1595.000 and accounts receivable total 5151000 Prepare a cash budget for the year. Show receipts, disbursements, the ending cash balance before borrowing, the amounts borrowed and repaid, interest payments, and the ending cash balance. (Round answers to the nearest wholt dollara 5.275) THE SHAMROCK COMPANY Cash Budget For the Four Quarters Ending December 31 Beginning cash balance Aadi Pecelets Credit sales ti Credit sales and Credit sales-2nd Credit sales 3rd Credit sales-4th Total cash receipts Total cash avallable Disbursements Material purchase Direct labour Factory overhead Selling and administrative expenses Purchase of equipment Total cash disbursements Excess (Defidency of cash receipts over cash disbursements Financing Borrowing Les Repayment Interestedense Total financing Ending cash and Total cash disbursements Excess (Deficiency) or cash receipts over cash disbursements Financing Borrowing Less Repayment less v Interest expense Total financing Ending cash balance