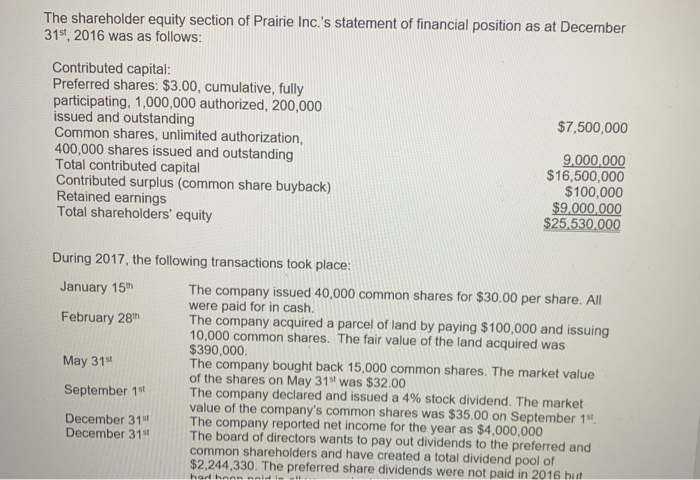

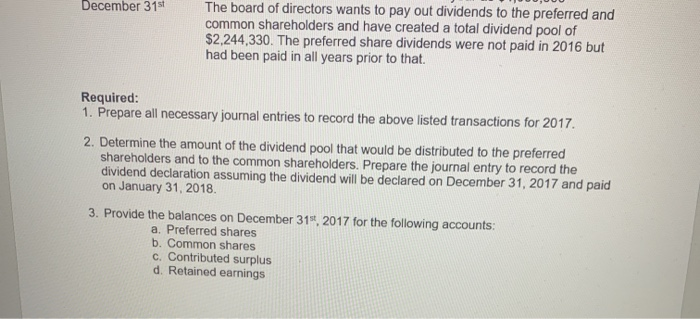

The shareholder equity section of Prairie Inc.'s statement of financial position as at December 31st, 2016 was as follows: $7,500,000 Contributed capital: Preferred shares: $3.00, cumulative, fully participating, 1,000,000 authorized, 200,000 issued and outstanding Common shares, unlimited authorization, 400,000 shares issued and outstanding Total contributed capital Contributed surplus (common share buyback) Retained earnings Total shareholders' equity 9,000,000 $16,500,000 $100,000 $9,000,000 $25,530,000 During 2017, the following transactions took place: January 15th The company issued 40,000 common shares for $30.00 per share. All were paid for in cash. February 28th The company acquired a parcel of land by paying $100,000 and issuing 10,000 common shares. The fair value of the land acquired was $390,000 May 31 The company bought back 15,000 common shares. The market value of the shares on May 31" was $32.00 September 19 The company declared and issued a 4% stock dividend. The market value of the company's common shares was $35.00 on September 1st December 31 The company reported net income for the year as $4,000,000 December 314 The board of directors wants to pay out dividends to the preferred and common shareholders and have created a total dividend pool of $2,244,330. The preferred share dividends were not paid in 2016 hut har hann neid December 315 The board of directors wants to pay out dividends to the preferred and common shareholders and have created a total dividend pool of $2,244,330. The preferred share dividends were not paid in 2016 but had been paid in all years prior to that. Required: 1. Prepare all necessary journal entries to record the above listed transactions for 2017. 2. Determine the amount of the dividend pool that would be distributed to the preferred shareholders and to the common shareholders. Prepare the journal entry to record the dividend declaration assuming the dividend will be declared on December 31, 2017 and paid on January 31, 2018 3. Provide the balances on December 31, 2017 for the following accounts: a. Preferred shares b. Common shares c. Contributed surplus d. Retained earnings