Answered step by step

Verified Expert Solution

Question

1 Approved Answer

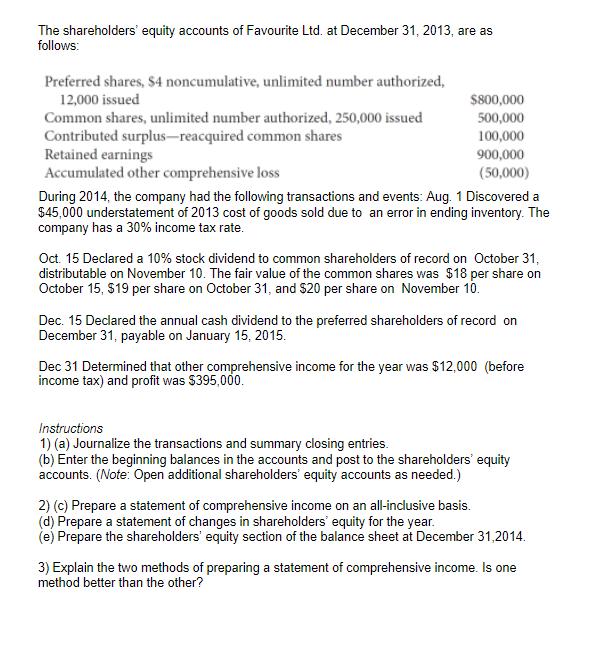

The shareholders' equity accounts of Favourite Ltd. at December 31, 2013, are as follows: Preferred shares, $4 noncumulative, unlimited number authorized, 12,000 issued $800,000

The shareholders' equity accounts of Favourite Ltd. at December 31, 2013, are as follows: Preferred shares, $4 noncumulative, unlimited number authorized, 12,000 issued $800,000 Common shares, unlimited number authorized, 250,000 issued 500,000 Contributed surplus-reacquired common shares Retained earnings Accumulated other comprehensive loss During 2014, the company had the following transactions and events: Aug. 1 Discovered a $45,000 understatement of 2013 cost of goods sold due to an error in ending inventory. The company has a 30% income tax rate. 100,000 900,000 (50,000) Oct. 15 Declared a 10% stock dividend to common shareholders of record on October 31, distributable on November 10. The fair value of the common shares was $18 per share on October 15, $19 per share on October 31, and $20 per share on November 10. Dec. 15 Declared the annual cash dividend to the preferred shareholders of record on December 31, payable on January 15, 2015. Dec 31 Determined that other comprehensive income for the year was $12,000 (before income tax) and profit was $395,000. Instructions 1) (a) Journalize the transactions and summary closing entries. (b) Enter the beginning balances in the accounts and post to the shareholders' equity accounts. (Note: Open additional shareholders' equity accounts as needed.) 2) (c) Prepare a statement of comprehensive income on an all-indlusive basis. (d) Prepare a statement of changes in shareholders' equity for the year. (e) Prepare the shareholders' equity section of the balance sheet at December 31,2014. 3) Explain the two methods of preparing a statement of comprehensive income. Is one method better than the other?

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Q 1 a Journalize the transactions and summary closing entries Answer Aug 1 Discovered a 45000 understatement of 2013 cost of goods sold due to an error in ending inventory The company has a 30 income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started