Question

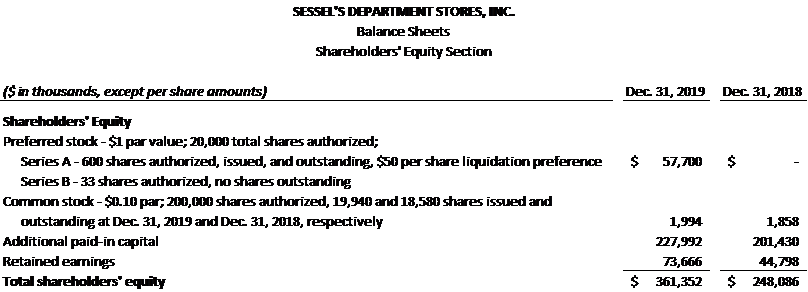

The shareholders equity portion of the balance sheet of Sessels Department Stores, Inc., a large regional specialty retailer, is as follows: Disclosures in Sessels annual

The shareholders equity portion of the balance sheet of Sessels Department Stores, Inc., a large regional specialty retailer, is as follows: Disclosures in Sessels annual report revealed the following changes in shareholders equity accounts for 2019 and 2018:

2019: The only changes in retained earnings during 2019 were net income and preferred dividends of $3,388,000 on preferred stock.

The Series B preferred stock is convertible. During 2019, shares of Series B preferred stock were issued for $6,592,000, and all shares were converted into 320,000 shares of common stock. No gain or loss was recorded on the conversion.

Common shares were issued in 2019, in a public offering and upon the exercise of stock options. On the statement of shareholders equity, Sessels reports these two items on a single line entitled Issuance of shares.

2018:

Net income: $12,126,000

Issuance of common stock: 5,580,000 shares at $112,706,000

Using the information given, prepare comparative statements of shareholders equity for 2019 and 2018, omitting the column for number of shares outstanding.

Discuss how a current shareholder might react to the 2019 increases in shareholders equity.

Sessel uses both debt and equity as sources of financing, as do most companies. In addition to the data typically given in the balance sheet and shareholders equity statement, what information about these sources of financing should a company provide to its investors and creditors in the note disclosures? comment on the amount, type, and usefulness of the information you see.

Also discuss any additional information you think should be disclosed, and support your reasoning.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started