Answered step by step

Verified Expert Solution

Question

1 Approved Answer

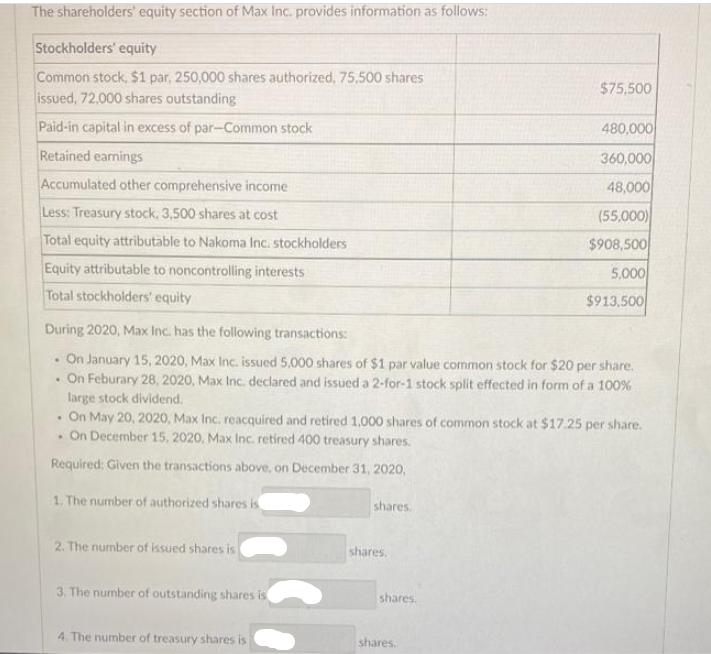

The shareholders' equity section of Max Inc. provides information as follows: Stockholders' equity Common stock, $1 par, 250,000 shares authorized, 75,500 shares issued, 72,000

The shareholders' equity section of Max Inc. provides information as follows: Stockholders' equity Common stock, $1 par, 250,000 shares authorized, 75,500 shares issued, 72,000 shares outstanding Paid-in capital in excess of par-Common stock Retained earnings Accumulated other comprehensive income Less: Treasury stock. 3,500 shares at cost Total equity attributable to Nakoma Inc. stockholders Equity attributable to noncontrolling interests Total stockholders' equity . During 2020, Max Inc. has the following transactions: . On January 15, 2020, Max Inc. issued 5,000 shares of $1 par value common stock for $20 per share. On Feburary 28, 2020, Max Inc. declared and issued a 2-for-1 stock split effected in form of a 100% large stock dividend. . On May 20, 2020, Max Inc. reacquired and retired 1,000 shares of common stock at $17.25 per share. . On December 15, 2020, Max Inc. retired 400 treasury shares. Required: Given the transactions above, on December 31, 2020, 1. The number of authorized shares is 2. The number of issued shares is 3. The number of outstanding shares is 4. The number of treasury shares is shares. shares. shares. $75,500 shares. 480,000 360,000 48,000 (55,000) $908,500 5.000 $913.500

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down the transactions and calculate the required information step by step 1 The number of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started