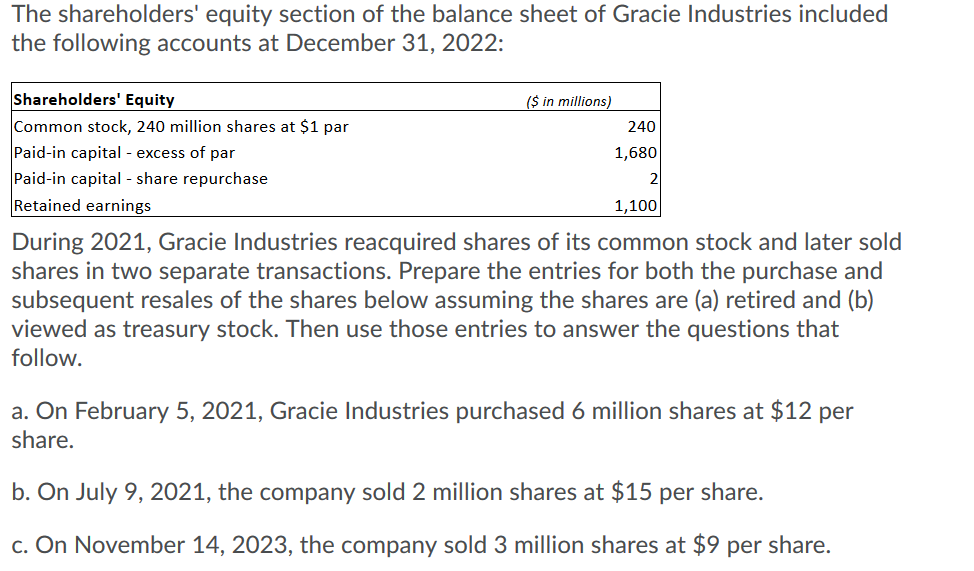

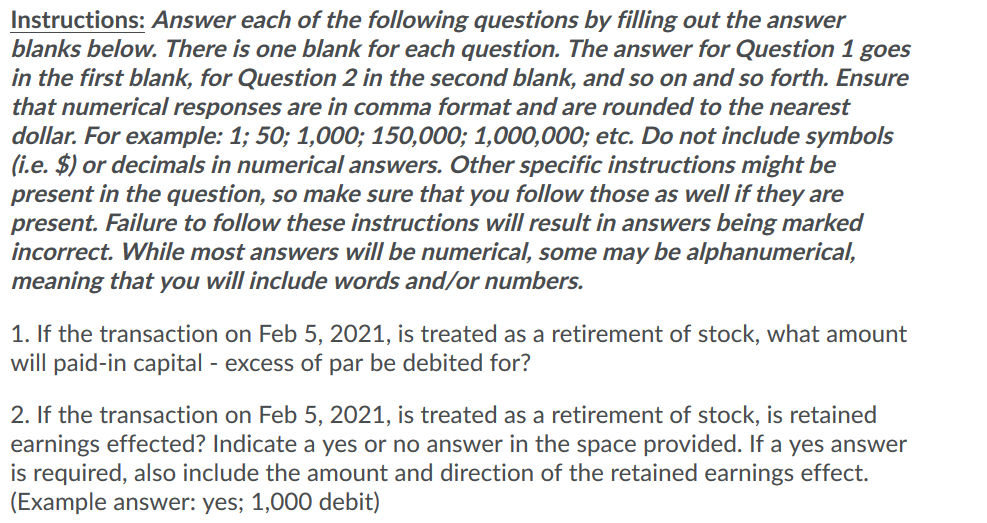

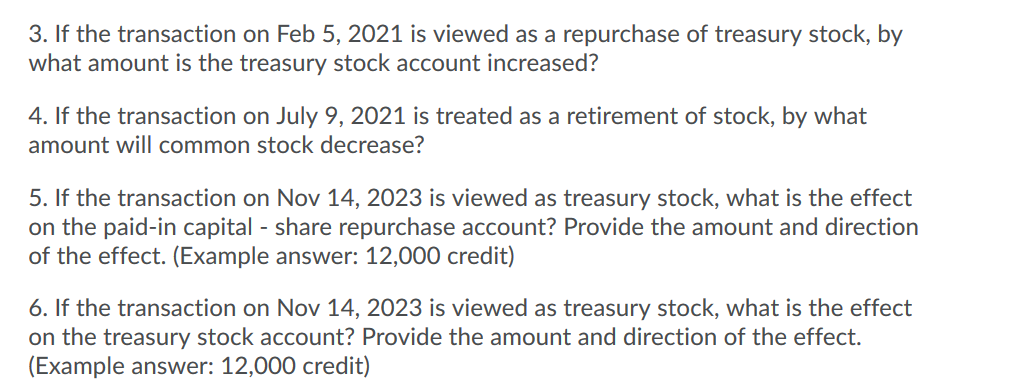

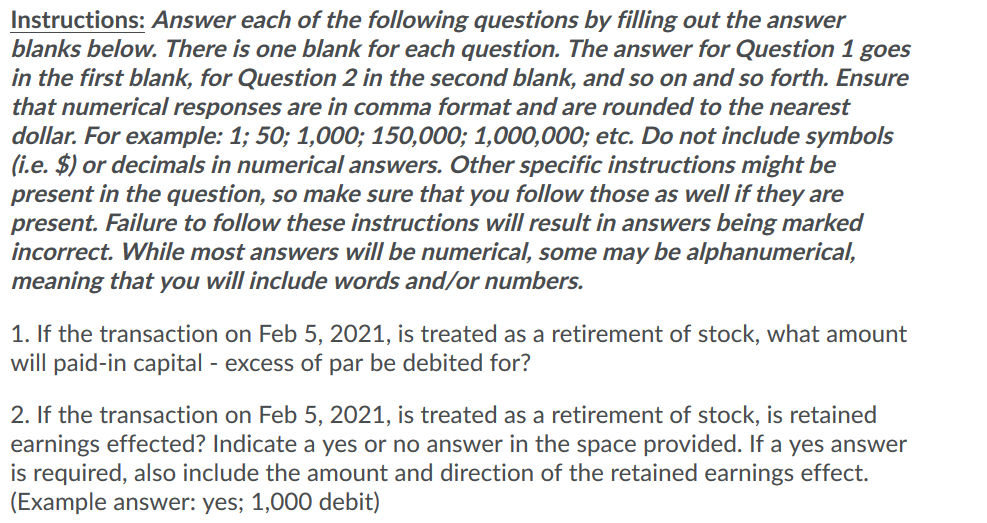

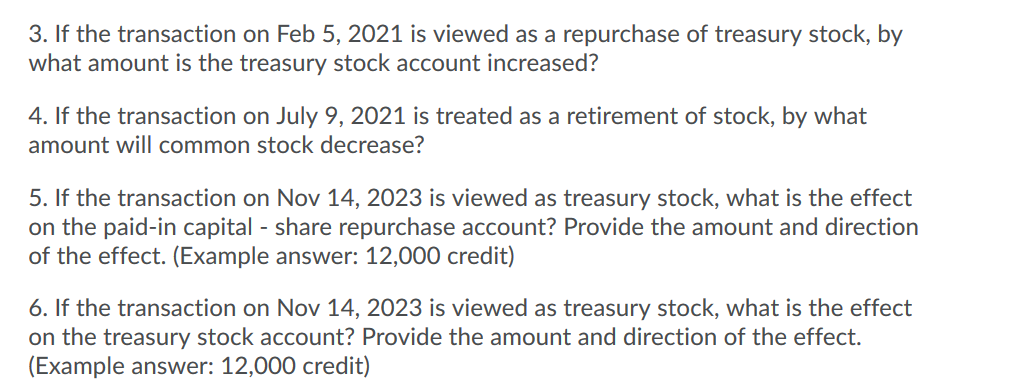

The shareholders' equity section of the balance sheet of Gracie Industries included the following accounts at December 31, 2022: 2 1,100 Shareholders' Equity ($ in millions) Common stock, 240 million shares at $1 par 240 Paid-in capital - excess of par 1,680 Paid-in capital - share repurchase Retained earnings During 2021, Gracie Industries reacquired shares of its common stock and later sold shares in two separate transactions. Prepare the entries for both the purchase and subsequent resales of the shares below assuming the shares are (a) retired and (b) viewed as treasury stock. Then use those entries to answer the questions that follow. a. On February 5, 2021, Gracie Industries purchased 6 million shares at $12 per share. b. On July 9, 2021, the company sold 2 million shares at $15 per share. c. On November 14, 2023, the company sold 3 million shares at $9 per share. Instructions: Answer each of the following questions by filling out the answer blanks below. There is one blank for each question. The answer for Question 1 goes in the first blank, for Question 2 in the second blank, and so on and so forth. Ensure that numerical responses are in comma format and are rounded to the nearest dollar. For example: 1; 50; 1,000; 150,000; 1,000,000; etc. Do not include symbols (i.e. $) or decimals in numerical answers. Other specific instructions might be present in the question, so make sure that you follow those as well if they are present. Failure to follow these instructions will result in answers being marked incorrect. While most answers will be numerical, some may be alphanumerical, meaning that you will include words and/or numbers. 1. If the transaction on Feb 5, 2021, is treated as a retirement of stock, what amount will paid-in capital - excess of par be debited for? 2. If the transaction on Feb 5, 2021, is treated as a retirement of stock, is retained earnings effected? Indicate a yes or no answer in the space provided. If a yes answer is required, also include the amount and direction of the retained earnings effect. (Example answer: yes; 1,000 debit) 3. If the transaction on Feb 5, 2021 is viewed as a repurchase of treasury stock, by what amount is the treasury stock account increased? 4. If the transaction on July 9, 2021 is treated as a retirement of stock, by what amount will common stock decrease? 5. If the transaction on Nov 14, 2023 is viewed as treasury stock, what is the effect on the paid-in capital - share repurchase account? Provide the amount and direction of the effect. (Example answer: 12,000 credit) 6. If the transaction on Nov 14, 2023 is viewed as treasury stock, what is the effect on the treasury stock account? Provide the amount and direction of the effect. (Example answer: 12,000 credit)