Answered step by step

Verified Expert Solution

Question

1 Approved Answer

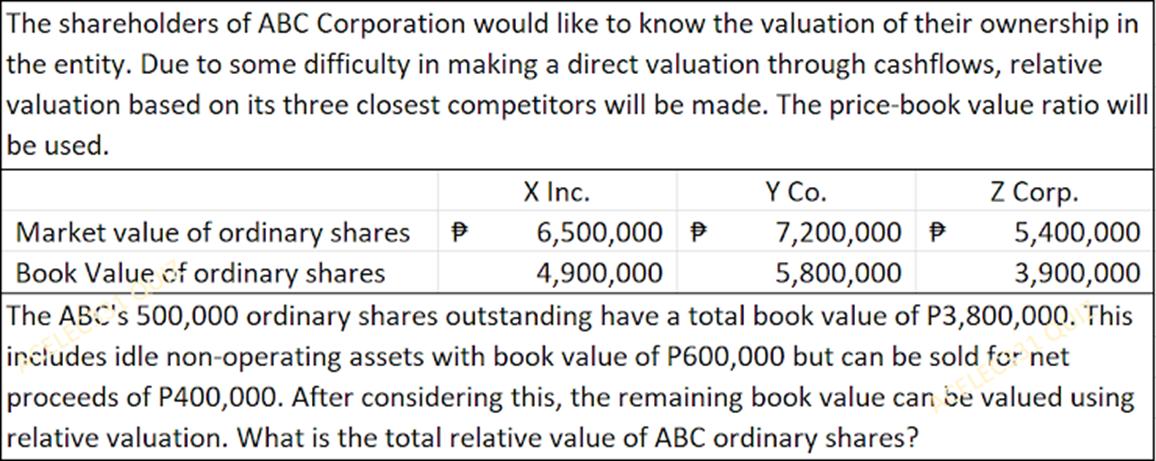

The shareholders of ABC Corporation would like to know the valuation of their ownership in the entity. Due to some difficulty in making a

The shareholders of ABC Corporation would like to know the valuation of their ownership in the entity. Due to some difficulty in making a direct valuation through cashflows, relative valuation based on its three closest competitors will be made. The price-book value ratio will be used. P X Inc. 6,500,000 4,900,000 Y Co. 7,200,000 5,800,000 Z Corp. Market value of ordinary shares Book Value of ordinary shares The ABC's 500,000 ordinary shares outstanding have a total book value of P3,800,000. This includes idle non-operating assets with book value of P600,000 but can be sold for net proceeds of P400,000. After considering this, the remaining book value can be valued using relative valuation. What is the total relative value of ABC ordinary shares? 5,400,000 3,900,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculate the pricebook value ratio for each of ABCs closest competitors PriceBook Value Ratio Marke...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started