Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tindo ltd. bought a motor van KD-1 1/1/2018 for Sh. 800,000 paying by cheque. On 1/04/2019, the company bought another motor van KD-2 for

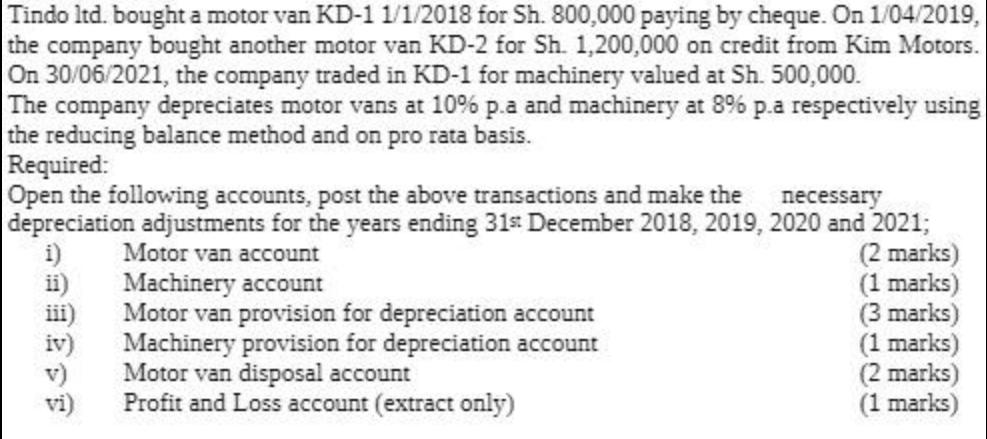

Tindo ltd. bought a motor van KD-1 1/1/2018 for Sh. 800,000 paying by cheque. On 1/04/2019, the company bought another motor van KD-2 for Sh. 1,200,000 on credit from Kim Motors. On 30/06/2021, the company traded in KD-1 for machinery valued at Sh. 500,000. The company depreciates motor vans at 10% p.a and machinery at 8% p.a respectively using the reducing balance method and on pro rata basis. Required: Open the following accounts, post the above transactions and make the necessary depreciation adjustments for the years ending 31st December 2018, 2019, 2020 and 2021; i) Motor van account ii) iii) iv) vi) Machinery account Motor van provision for depreciation account Machinery provision for depreciation account Motor van disposal account Profit and Loss account (extract only) (2 marks) (1 marks) (3 marks) (1 marks) (2 marks) (1 marks)

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

i Motor Van Account Date Particulars Debit Credit 112018 Motor Van KD1 800000 142019 Motor Van KD2 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started