Question

The shares of EHA Ltd (a non-dividend paying stock) are currently selling for $20.00 per share. You have developed the following probability distribution of the

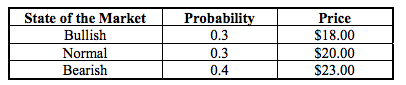

The shares of EHA Ltd (a non-dividend paying stock) are currently selling for $20.00 per share. You have developed the following probability distribution of the price next year.

a) Calculate the expected return and standard deviation of return for EHA Ltd.

b) A Treasury bill with one year to maturity and a face value of $10,000 can be purchased today for $9,524. Given this, does EHA Ltd seem like a good investment at $20.00 per share? Assume that you intend to invest equal dollar amounts in either the Treasury bill or EHA Ltds shares. If there was a market consensus with the above probability distribution for EHA Ltds shares, what would you expect to happen to its share price? Explain. (No calculations required.)

Probability Price State of the Market Bullish Normal Bearish 0.3 0.3 0.4 $18.00 $20.00 S23.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started