Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Sheffield Theater is nearing the end of the year and is preparing for a meeting with its bankers to discuss the renewal of a

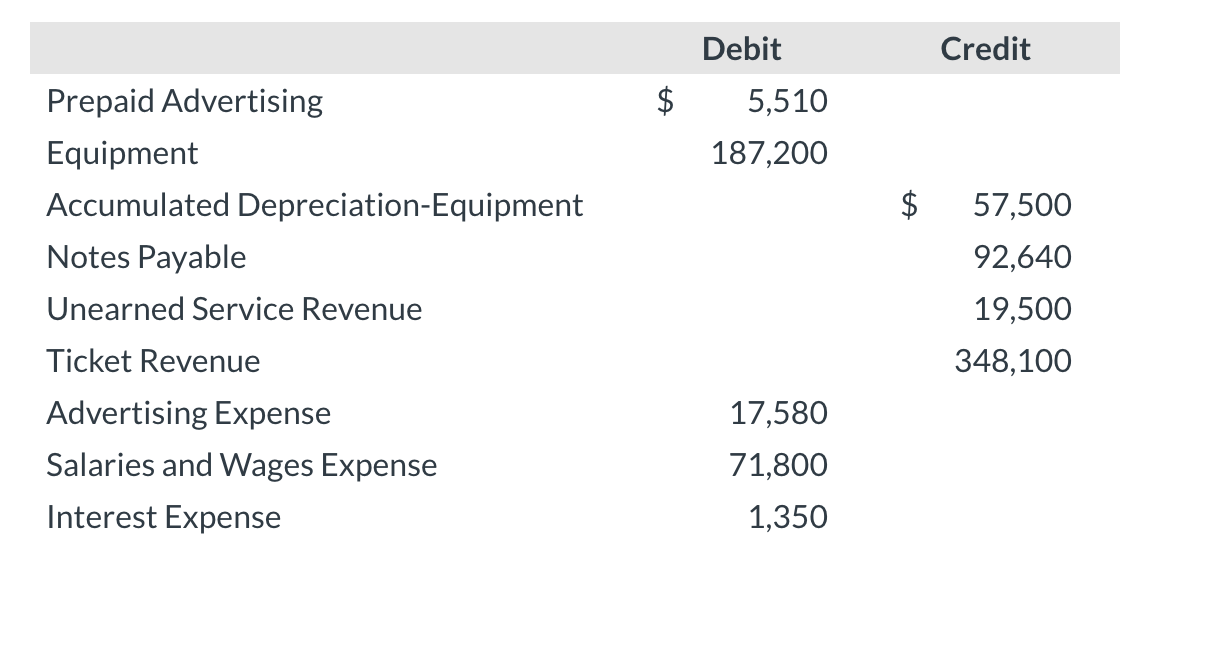

The Sheffield Theater is nearing the end of the year and is preparing for a meeting with its bankers to discuss the renewal of a loan. The accounts listed below appeared in the December 31, 2020, trial balance.

Additional information is available as follows.

| 1. | The equipment has an estimated useful life of 16 years and a salvage value of $40,000 at the end of that time. Sheffield uses the straight-line method for depreciation. | ||

| 2. | The note payable is a one-year note given to the bank January 31 and bearing interest at 10%. Interest is calculated on a monthly basis. | ||

| 3. | Late in December 2020, the theater sold 390 coupon ticket books at $50 each. 240 of these ticket books books have been used by year-end. The cash received was recorded as Unearned Service Revenue. | ||

| 4. | Advertising paid in advance was $5,510 and was debited to Prepaid Advertising. The company has used $2,500 of the advertising as of December 31, 2020. | ||

| 5. | Salaries and wages accrued but unpaid at December 31, 2020, were $3,680. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started