Answered step by step

Verified Expert Solution

Question

1 Approved Answer

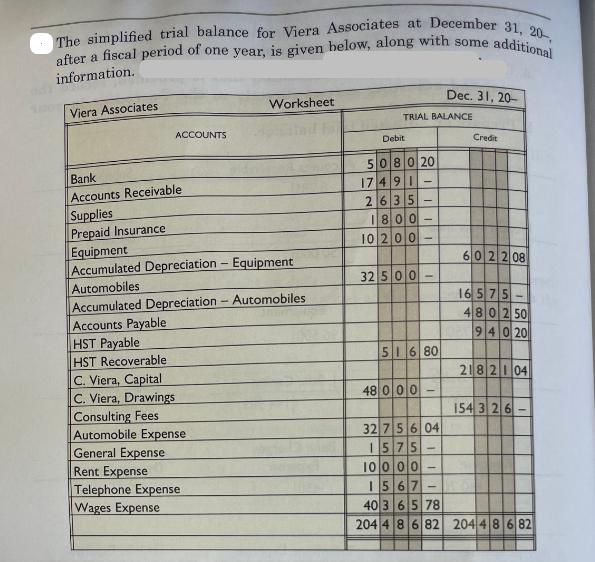

The simplified trial balance for Viera Associates at December 31, 20-, after a fiscal period of one year, is given below, along with some

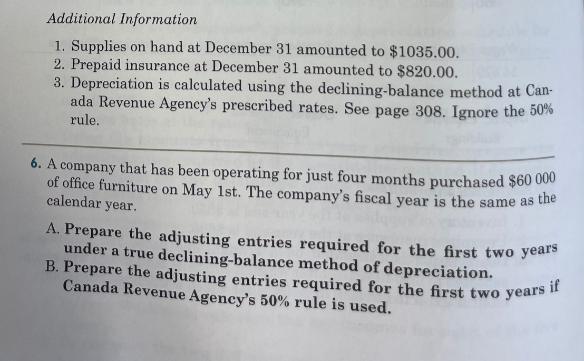

The simplified trial balance for Viera Associates at December 31, 20-, after a fiscal period of one year, is given below, along with some additional information. Viera Associates ACCOUNTS Bank Accounts Receivable Supplies Prepaid Insurance Worksheet Equipment Accumulated Depreciation - Equipment Automobiles Accumulated Depreciation - Automobiles Accounts Payable HST Payable HST Recoverable C. Viera, Capital C. Viera, Drawings Consulting Fees Automobile Expense General Expense Rent Expense Telephone Expense Wages Expense TRIAL BALANCE Debit 508020 17491 2635 1800 10200 32 500 21111 48000 - 516 80 32756 04 1575 10000 1567 - Dec. 31, 20- - Credit 602208 16575 480250 94020 21821 04 154 326 I 403 65 78 204 4 8 6 82 2044 8 6 82 Additional Information 1. Supplies on hand at December 31 amounted to $1035.00. 2. Prepaid insurance at December 31 amounted to $820.00. 3. Depreciation is calculated using the declining-balance method at Can- ada Revenue Agency's prescribed rates. See page 308. Ignore the 50% rule. 6. A company that has been operating for just four months purchased $60 000 of office furniture on May 1st. The company's fiscal year is the same as the calendar year. A. Prepare the adjusting entries required for the first two years under a true declining-balance method of depreciation. B. Prepare the adjusting entries required for the first two years Canada Revenue Agency's 50% rule is used. if

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Okay lets work through this stepbystep A Preparing the adjusting entries under the true decliningbal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started