Answered step by step

Verified Expert Solution

Question

1 Approved Answer

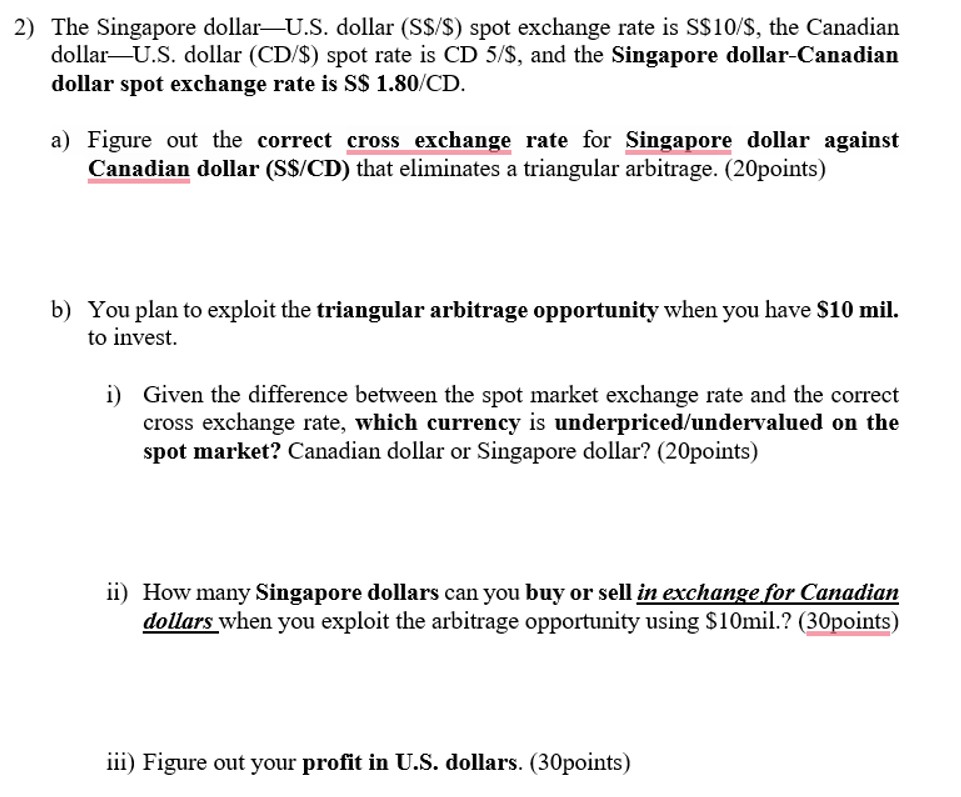

The Singapore dollar - U . S . dollar ) spot exchange rate is S $ 1 0 $ , the Canadian dollar - U

The Singapore dollarUS dollar spot exchange rate is $ the Canadian

dollarUS dollar CD$ spot rate is CD and the Singapore dollarCanadian

dollar spot exchange rate is $

a Figure out the correct cross exchange rate for Singapore dollar against

Canadian dollar S$CD that eliminates a triangular arbitrage. points

b You plan to exploit the triangular arbitrage opportunity when you have $mil.

to invest.

i Given the difference between the spot market exchange rate and the correct

cross exchange rate, which currency is underpricedundervalued on the

spot market? Canadian dollar or Singapore dollar? points

ii How many Singapore dollars can you buy or sell in exchange for Canadian

dollars when you exploit the arbitrage opportunity using $mil.? points

iii Figure out your profit in US dollars. points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started