Question

The singer Michaela in Frankfurt and is a well-known artist. She travels a lot around the world but has spent 7 months last year in

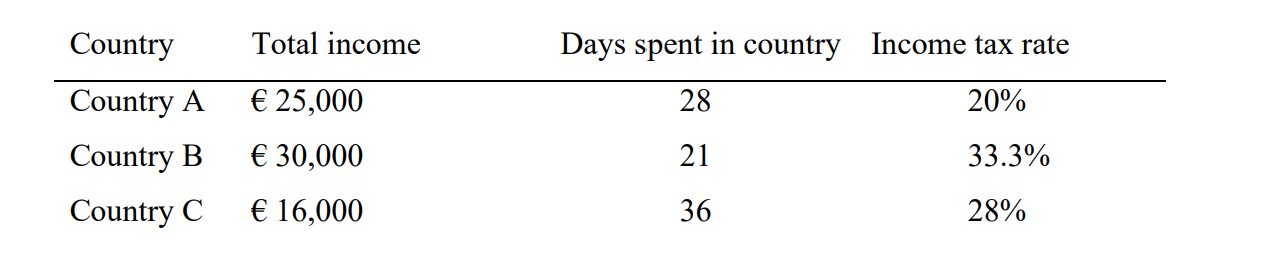

The singer Michaela in Frankfurt and is a well-known artist. She travels a lot around the world but has spent 7 months last year in her apartment in Frankfurt. She owns two studios located in Germany. She runs both as a sole proprietor. One of his studios realized a loss of 8,000. Her other studio in which she produces her songs earned a profit of 53,000. She has no other income in Germany. The following table summarizes her income generated in foreign countries, the number of days she spent in the respective country, and the income tax rate. Country Total income Days spent in country Income tax rate

[see screenshot below]

The double tax treaties between Germany and Country A and Country B rule that Germany applies the exemption with progression method. There is no double tax treaty with Country C. In this case of no treaty with Country C, Germany taxes the income after all the taxes that she paid in Country C again (i.e., Germany applies she deduction method for income derived in countries without a double tax treaty).

a) In which country is Michaela a tax resident and a non-resident?

b) Please calculate Michaelas overall tax burden on her worldwide income.

c) Her manager offers her a tax planning structure. She could run the business through a legitimate business located in a country which has a double tax treaty with both Germany and Country C. Effectively, Michaela would then be taxed according to the exemption with progression method. Would you implement this structure if you know that this tax planning strategy costs (i) 3,000 EUR or (ii) 5,000 EUR?

Country Total income Days spent in country Income tax rate 25,000 28 20% Country A Country B Country C 30,000 21 33.3% 16,000 36 28%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started