Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Singhs have mode an appointment with you today they have found a property valued at $499.000. This is the information the you know about

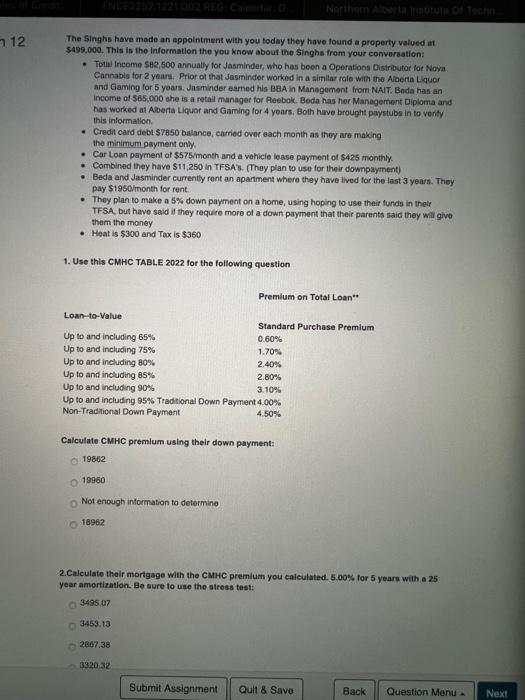

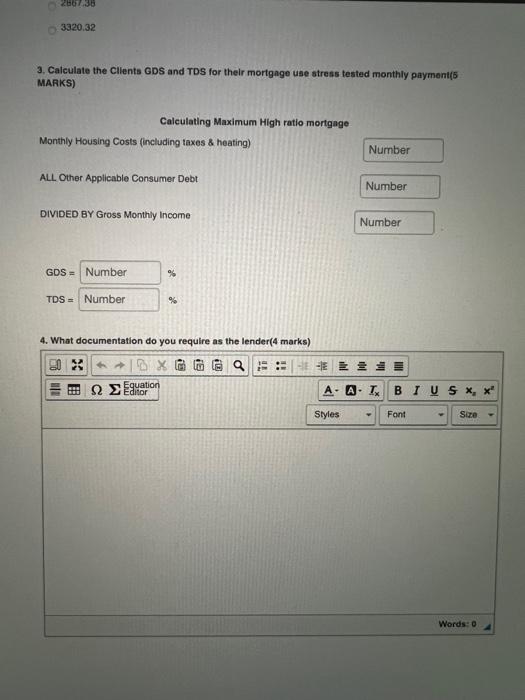

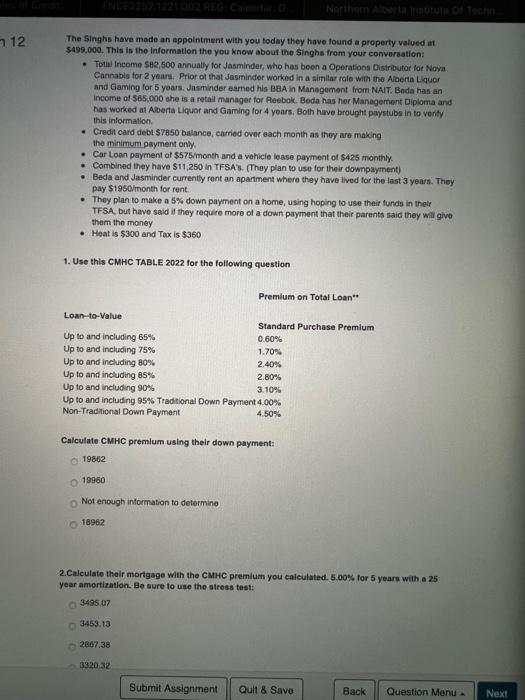

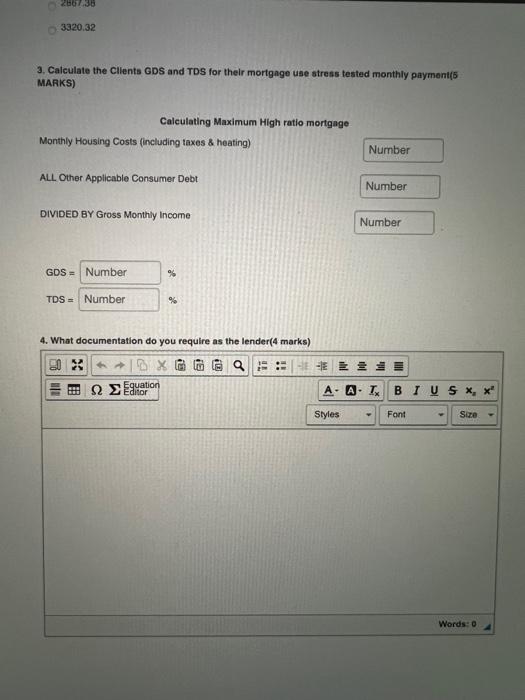

The Singhs have mode an appointment with you today they have found a property valued at $499.000. This is the information the you know about the Singhs from your conversation: - Toial Income S82,500 annually for Jasminder, who has been a Operatons Oistributor for Nova. Cannabis for 2 years. Prior of that Jasminder worked in a similar rale with the Afeerta Liquer and Gaming for 5 years. Jastinder earned his BBA in Manegement from NAIT. Bnda has an income of $65,000 she is a retail manager for Peebolc. Beda has her Management Diploma and has worked at Aberta Liquor and Gaming for 4 years. Bolh hieve brought paystubn in to venty this information. - Credit card debi \$7850 balance, carried over each month as they are making the minimum payment only. - Car Loan payment al \$575/month and a vehicie lease payment of $425 monthly. - Combined they have $11,250 in TFSA s. (They plan to use for their downpayment) - Beda and Jasminder currently rent an apartment where they have lived for the last 3 yeara. They pay S1950imonth for rent. - They plan to make a 5% down payment on a home, using hoping to use their funds in their TFSA, but have said it they require more of a down payment that their parents said they will give them the money - Heat is $300 and Tax is $360 1. Use this CMHCTABLE 2022 for the following question Calculate CMHC premium using their down payment: 19862 19960 Not enough information to determine 18962 2.Calculate their mortgage with the CMHC premium you caleulated. 5.00% for 5 yeare with a 25 year amortizatlon. Be sure to use the atress test: 395.07 3459.13 2867.38 3920=12 3320.32 3. Calculate the Clients GDS and TDS for their mortgage use stress tested monthly payment(5 MARKS) Calculating Maximum High ratio mortgage Monthly Housing Costs (including taxes \& heating) ALL. Other Applicable Consumer Debt DIVIDED BY Gross Monthly income 4. What documentation do you require as the lender( 4 marks ) The Singhs have mode an appointment with you today they have found a property valued at $499.000. This is the information the you know about the Singhs from your conversation: - Toial Income S82,500 annually for Jasminder, who has been a Operatons Oistributor for Nova. Cannabis for 2 years. Prior of that Jasminder worked in a similar rale with the Afeerta Liquer and Gaming for 5 years. Jastinder earned his BBA in Manegement from NAIT. Bnda has an income of $65,000 she is a retail manager for Peebolc. Beda has her Management Diploma and has worked at Aberta Liquor and Gaming for 4 years. Bolh hieve brought paystubn in to venty this information. - Credit card debi \$7850 balance, carried over each month as they are making the minimum payment only. - Car Loan payment al \$575/month and a vehicie lease payment of $425 monthly. - Combined they have $11,250 in TFSA s. (They plan to use for their downpayment) - Beda and Jasminder currently rent an apartment where they have lived for the last 3 yeara. They pay S1950imonth for rent. - They plan to make a 5% down payment on a home, using hoping to use their funds in their TFSA, but have said it they require more of a down payment that their parents said they will give them the money - Heat is $300 and Tax is $360 1. Use this CMHCTABLE 2022 for the following question Calculate CMHC premium using their down payment: 19862 19960 Not enough information to determine 18962 2.Calculate their mortgage with the CMHC premium you caleulated. 5.00% for 5 yeare with a 25 year amortizatlon. Be sure to use the atress test: 395.07 3459.13 2867.38 3920=12 3320.32 3. Calculate the Clients GDS and TDS for their mortgage use stress tested monthly payment(5 MARKS) Calculating Maximum High ratio mortgage Monthly Housing Costs (including taxes \& heating) ALL. Other Applicable Consumer Debt DIVIDED BY Gross Monthly income 4. What documentation do you require as the lender( 4 marks )

The Singhs have mode an appointment with you today they have found a property valued at $499.000. This is the information the you know about the Singhs from your conversation: - Toial Income S82,500 annually for Jasminder, who has been a Operatons Oistributor for Nova. Cannabis for 2 years. Prior of that Jasminder worked in a similar rale with the Afeerta Liquer and Gaming for 5 years. Jastinder earned his BBA in Manegement from NAIT. Bnda has an income of $65,000 she is a retail manager for Peebolc. Beda has her Management Diploma and has worked at Aberta Liquor and Gaming for 4 years. Bolh hieve brought paystubn in to venty this information. - Credit card debi \$7850 balance, carried over each month as they are making the minimum payment only. - Car Loan payment al \$575/month and a vehicie lease payment of $425 monthly. - Combined they have $11,250 in TFSA s. (They plan to use for their downpayment) - Beda and Jasminder currently rent an apartment where they have lived for the last 3 yeara. They pay S1950imonth for rent. - They plan to make a 5% down payment on a home, using hoping to use their funds in their TFSA, but have said it they require more of a down payment that their parents said they will give them the money - Heat is $300 and Tax is $360 1. Use this CMHCTABLE 2022 for the following question Calculate CMHC premium using their down payment: 19862 19960 Not enough information to determine 18962 2.Calculate their mortgage with the CMHC premium you caleulated. 5.00% for 5 yeare with a 25 year amortizatlon. Be sure to use the atress test: 395.07 3459.13 2867.38 3920=12 3320.32 3. Calculate the Clients GDS and TDS for their mortgage use stress tested monthly payment(5 MARKS) Calculating Maximum High ratio mortgage Monthly Housing Costs (including taxes \& heating) ALL. Other Applicable Consumer Debt DIVIDED BY Gross Monthly income 4. What documentation do you require as the lender( 4 marks ) The Singhs have mode an appointment with you today they have found a property valued at $499.000. This is the information the you know about the Singhs from your conversation: - Toial Income S82,500 annually for Jasminder, who has been a Operatons Oistributor for Nova. Cannabis for 2 years. Prior of that Jasminder worked in a similar rale with the Afeerta Liquer and Gaming for 5 years. Jastinder earned his BBA in Manegement from NAIT. Bnda has an income of $65,000 she is a retail manager for Peebolc. Beda has her Management Diploma and has worked at Aberta Liquor and Gaming for 4 years. Bolh hieve brought paystubn in to venty this information. - Credit card debi \$7850 balance, carried over each month as they are making the minimum payment only. - Car Loan payment al \$575/month and a vehicie lease payment of $425 monthly. - Combined they have $11,250 in TFSA s. (They plan to use for their downpayment) - Beda and Jasminder currently rent an apartment where they have lived for the last 3 yeara. They pay S1950imonth for rent. - They plan to make a 5% down payment on a home, using hoping to use their funds in their TFSA, but have said it they require more of a down payment that their parents said they will give them the money - Heat is $300 and Tax is $360 1. Use this CMHCTABLE 2022 for the following question Calculate CMHC premium using their down payment: 19862 19960 Not enough information to determine 18962 2.Calculate their mortgage with the CMHC premium you caleulated. 5.00% for 5 yeare with a 25 year amortizatlon. Be sure to use the atress test: 395.07 3459.13 2867.38 3920=12 3320.32 3. Calculate the Clients GDS and TDS for their mortgage use stress tested monthly payment(5 MARKS) Calculating Maximum High ratio mortgage Monthly Housing Costs (including taxes \& heating) ALL. Other Applicable Consumer Debt DIVIDED BY Gross Monthly income 4. What documentation do you require as the lender( 4 marks )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started