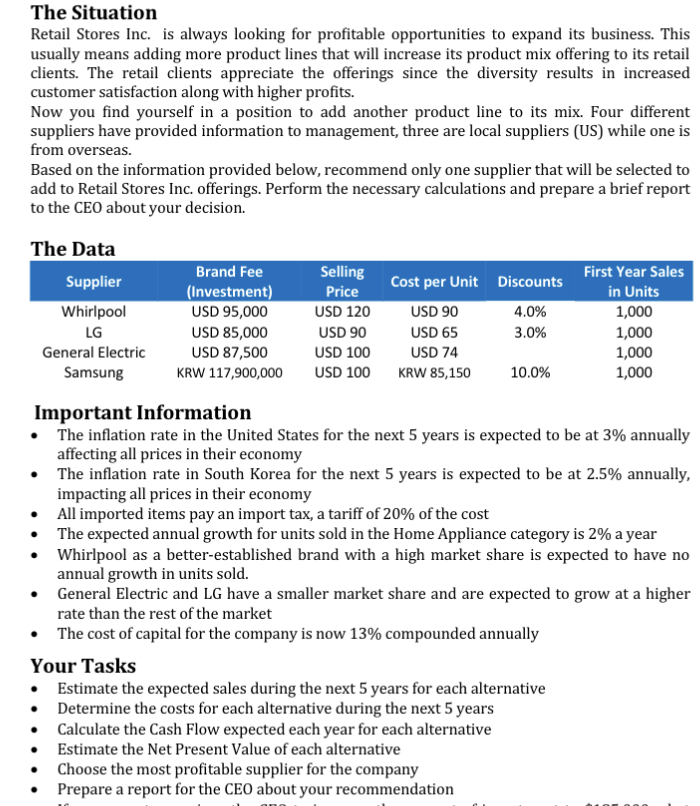

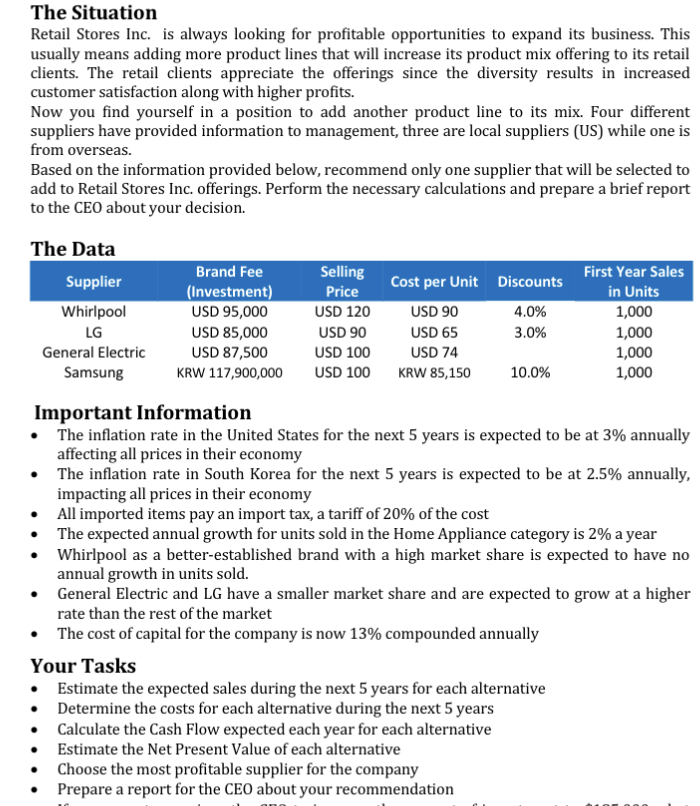

The Situation Retail Stores Inc. is always looking for profitable opportunities to expand its business. This usually means adding more product lines that will increase its product mix offering to its retail clients. The retail clients appreciate the offerings since the diversity results in increased customer satisfaction along with higher profits. Now you find yourself in a position to add another product line to its mix. Four different suppliers have provided information to management, three are local suppliers (US) while one is from overseas. Based on the information provided below, recommend only one supplier that will be selected to add to Retail Stores Inc. offerings. Perform the necessary calculations and prepare a brief report to the CEO about your decision. The Data Important Information - The inflation rate in the United States for the next 5 years is expected to be at 3% annually affecting all prices in their economy - The inflation rate in South Korea for the next 5 years is expected to be at 2.5% annually, impacting all prices in their economy - All imported items pay an import tax, a tariff of 20% of the cost - The expected annual growth for units sold in the Home Appliance category is 2% a year - Whirlpool as a better-established brand with a high market share is expected to have no annual growth in units sold. - General Electric and LG have a smaller market share and are expected to grow at a higher rate than the rest of the market - The cost of capital for the company is now 13% compounded annually Your Tasks - Estimate the expected sales during the next 5 years for each alternative - Determine the costs for each alternative during the next 5 years - Calculate the Cash Flow expected each year for each alternative - Estimate the Net Present Value of each alternative - Choose the most profitable supplier for the company - Prepare a report for the CEO about your recommendation The Situation Retail Stores Inc. is always looking for profitable opportunities to expand its business. This usually means adding more product lines that will increase its product mix offering to its retail clients. The retail clients appreciate the offerings since the diversity results in increased customer satisfaction along with higher profits. Now you find yourself in a position to add another product line to its mix. Four different suppliers have provided information to management, three are local suppliers (US) while one is from overseas. Based on the information provided below, recommend only one supplier that will be selected to add to Retail Stores Inc. offerings. Perform the necessary calculations and prepare a brief report to the CEO about your decision. The Data Important Information - The inflation rate in the United States for the next 5 years is expected to be at 3% annually affecting all prices in their economy - The inflation rate in South Korea for the next 5 years is expected to be at 2.5% annually, impacting all prices in their economy - All imported items pay an import tax, a tariff of 20% of the cost - The expected annual growth for units sold in the Home Appliance category is 2% a year - Whirlpool as a better-established brand with a high market share is expected to have no annual growth in units sold. - General Electric and LG have a smaller market share and are expected to grow at a higher rate than the rest of the market - The cost of capital for the company is now 13% compounded annually Your Tasks - Estimate the expected sales during the next 5 years for each alternative - Determine the costs for each alternative during the next 5 years - Calculate the Cash Flow expected each year for each alternative - Estimate the Net Present Value of each alternative - Choose the most profitable supplier for the company - Prepare a report for the CEO about your recommendation