Answered step by step

Verified Expert Solution

Question

1 Approved Answer

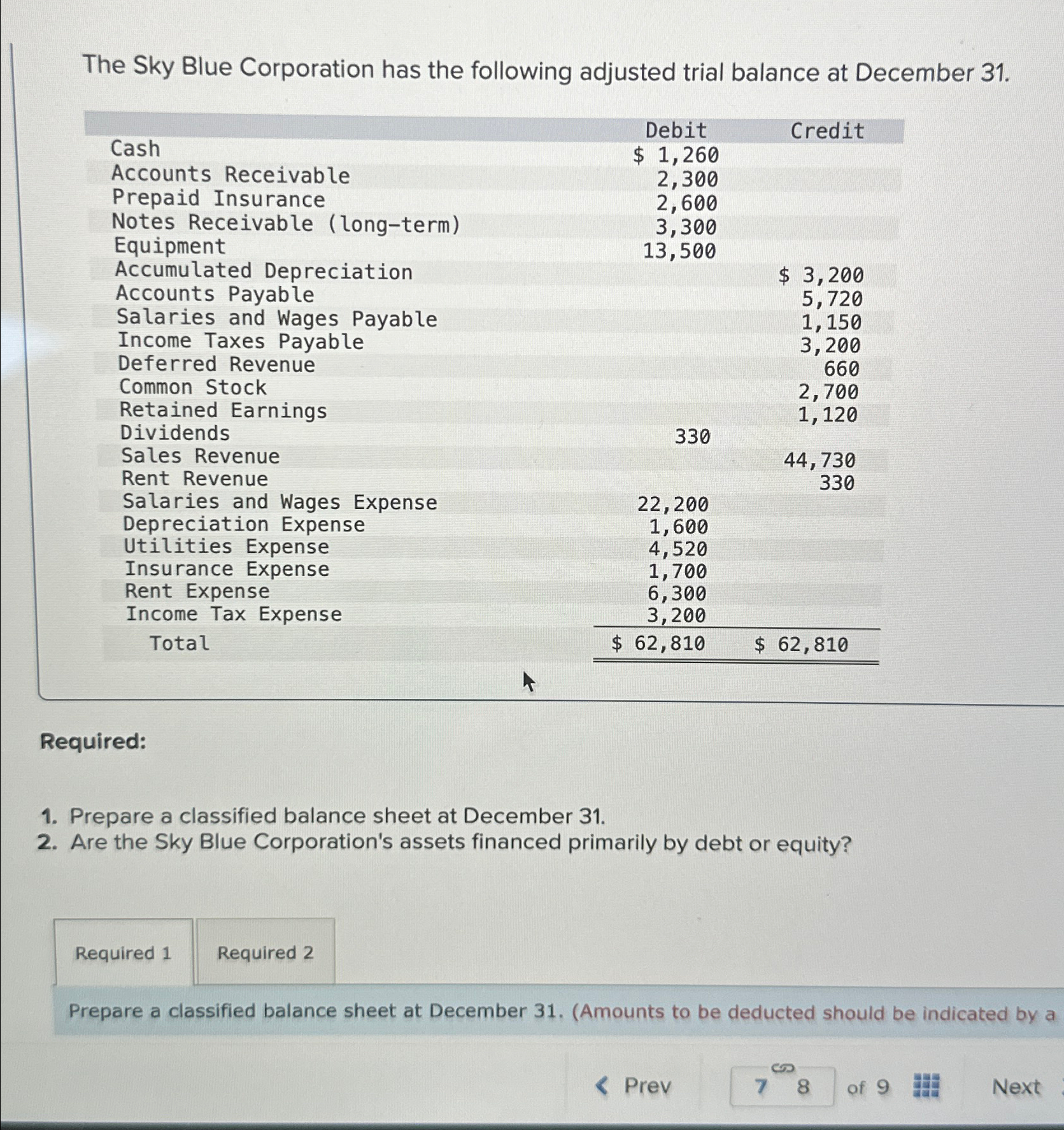

The Sky Blue Corporation has the following adjusted trial balance at December 31. Cash Accounts Receivable Prepaid Insurance Notes Receivable (long-term) Equipment Accumulated Depreciation

The Sky Blue Corporation has the following adjusted trial balance at December 31. Cash Accounts Receivable Prepaid Insurance Notes Receivable (long-term) Equipment Accumulated Depreciation Accounts Payable Salaries and Wages Payable Income Taxes Payable Deferred Revenue Common Stock Retained Earnings Dividends Sales Revenue Rent Revenue Debit $ 1,260 Credit 2,300 2,600 3,300 13,500 $ 3,200 5,720 1,150 3,200 660 2,700 1,120 330 44,730 330 Salaries and Wages Expense 22,200 Depreciation Expense 1,600 Utilities Expense 4,520 Insurance Expense 1,700 Rent Expense Income Tax Expense Total 6,300 3,200 $ 62,810 $ 62,810 Required: 1. Prepare a classified balance sheet at December 31. 2. Are the Sky Blue Corporation's assets financed primarily by debt or equity? Required 1 Required 2 Prepare a classified balance sheet at December 31. (Amounts to be deducted should be indicated by a < Prev 7 8 of 9 Next

Step by Step Solution

★★★★★

3.52 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 Prepare a classified balance sheet at December 31 Sky Blue Corporation Classified Balance Sheet De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started