Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Smith Company is considering the purchase of a new machine to replace the old one with which it currently operates. The old machine was

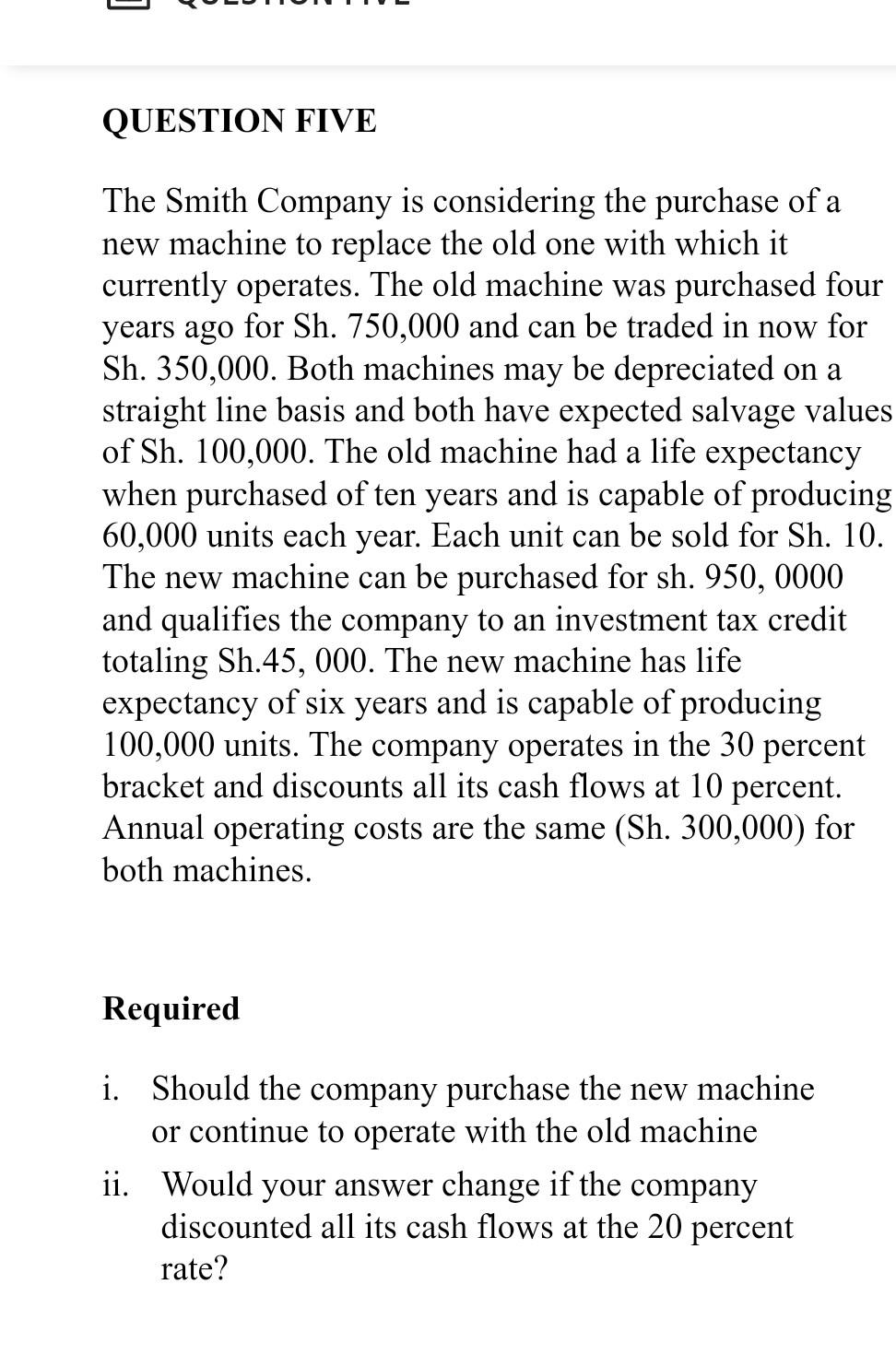

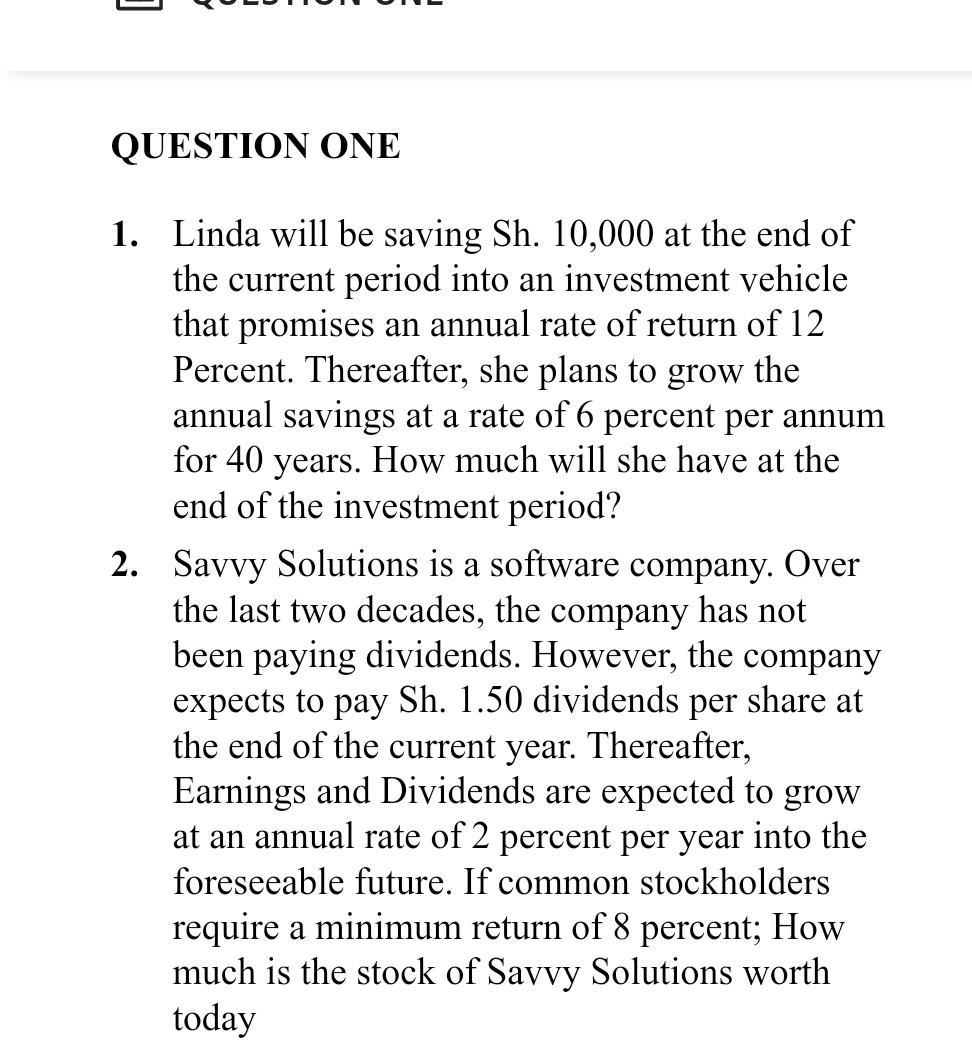

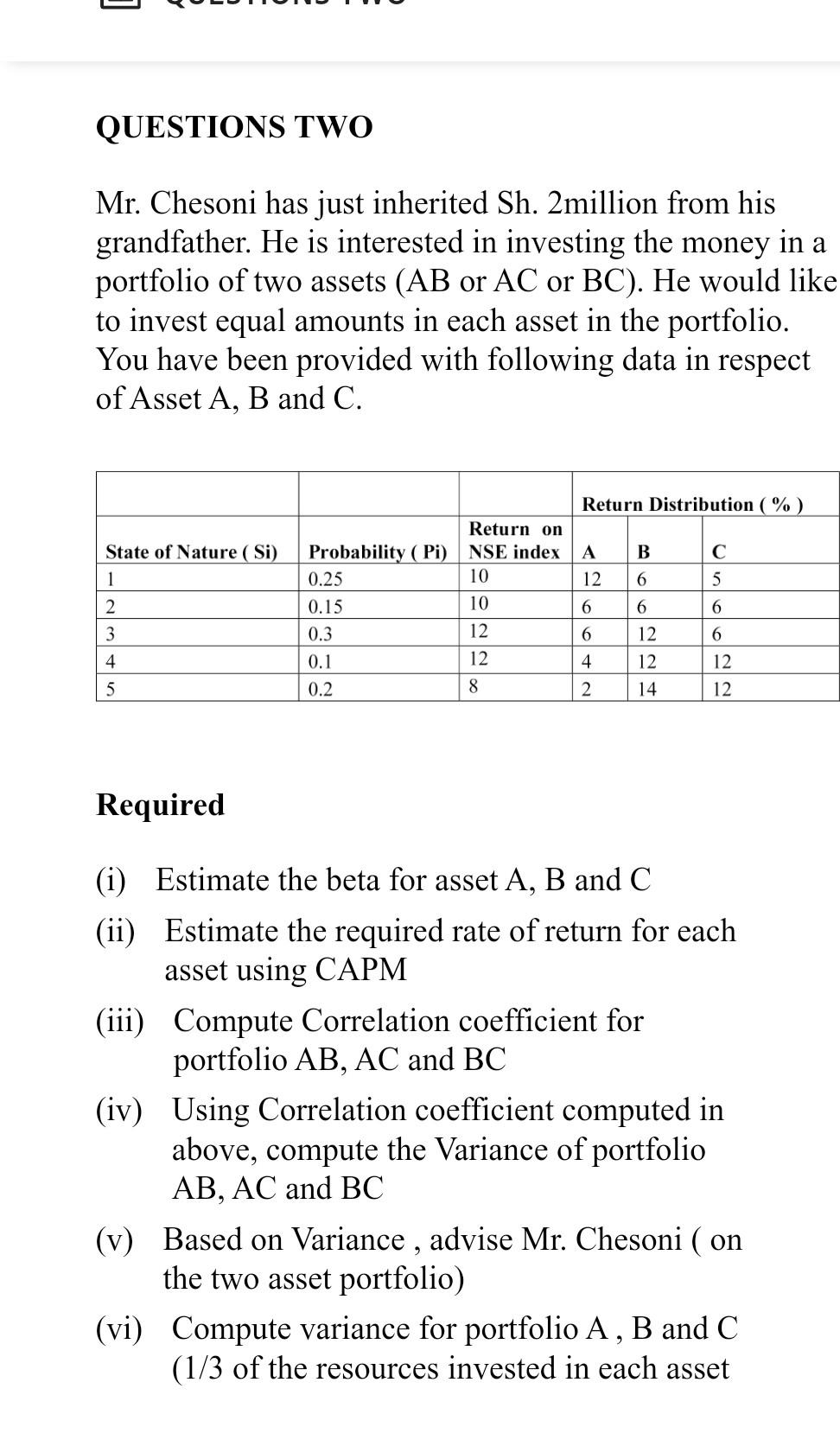

The Smith Company is considering the purchase of a new machine to replace the old one with which it currently operates. The old machine was purchased four years ago for Sh. 750,000 and can be traded in now for Sh. 350,000. Both machines may be depreciated on a straight line basis and both have expected salvage values of Sh. 100,000. The old machine had a life expectancy when purchased of ten years and is capable of producing 60,000 units each year. Each unit can be sold for Sh. 10 . The new machine can be purchased for sh. 950, 0000 and qualifies the company to an investment tax credit totaling Sh.45, 000. The new machine has life expectancy of six years and is capable of producing 100,000 units. The company operates in the 30 percent bracket and discounts all its cash flows at 10 percent. Annual operating costs are the same (Sh. 300,000) for both machines. Required i. Should the company purchase the new machine or continue to operate with the old machine ii. Would your answer change if the company discounted all its cash flows at the 20 percent rate? 1. Linda will be saving Sh. 10,000 at the end of the current period into an investment vehicle that promises an annual rate of return of 12 Percent. Thereafter, she plans to grow the annual savings at a rate of 6 percent per annum for 40 years. How much will she have at the end of the investment period? 2. Savvy Solutions is a software company. Over the last two decades, the company has not been paying dividends. However, the company expects to pay Sh. 1.50 dividends per share at the end of the current year. Thereafter, Earnings and Dividends are expected to grow at an annual rate of 2 percent per year into the foreseeable future. If common stockholders require a minimum return of 8 percent; How much is the stock of Savvy Solutions worth today QUESTIONS TWO Mr. Chesoni has just inherited Sh. 2million from his grandfather. He is interested in investing the money in a portfolio of two assets (AB or AC or BC). He would like to invest equal amounts in each asset in the portfolio. You have been provided with following data in respect of Asset A, B and C. Required (i) Estimate the beta for asset A, B and C (ii) Estimate the required rate of return for each asset using CAPM (iii) Compute Correlation coefficient for portfolio \\( \\mathrm{AB}, \\mathrm{AC} \\) and \\( \\mathrm{BC} \\) (iv) Using Correlation coefficient computed in above, compute the Variance of portfolio \\( \\mathrm{AB}, \\mathrm{AC} \\) and \\( \\mathrm{BC} \\) (v) Based on Variance, advise Mr. Chesoni ( on the two asset portfolio) (vi) Compute variance for portfolio A, B and C \\( (1 / 3 \\) of the resources invested in each asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started