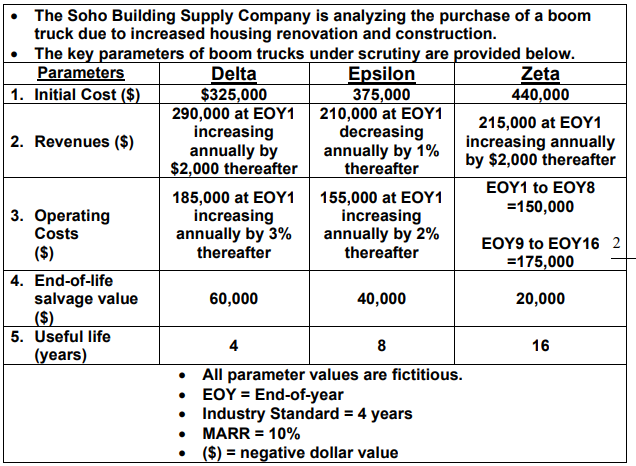

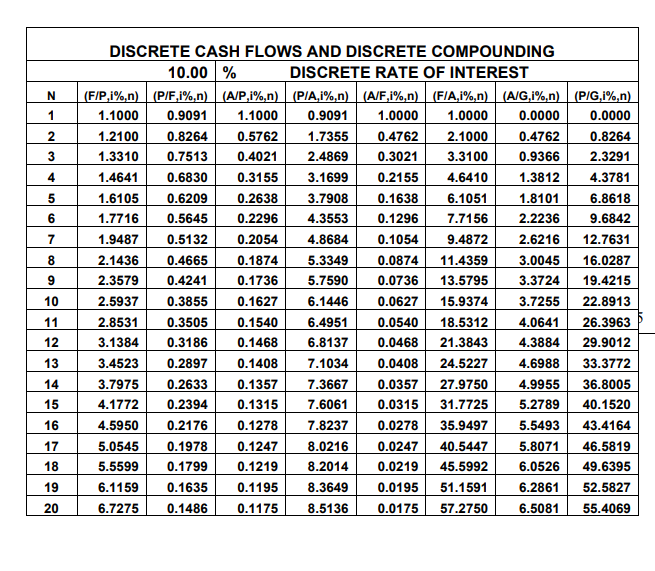

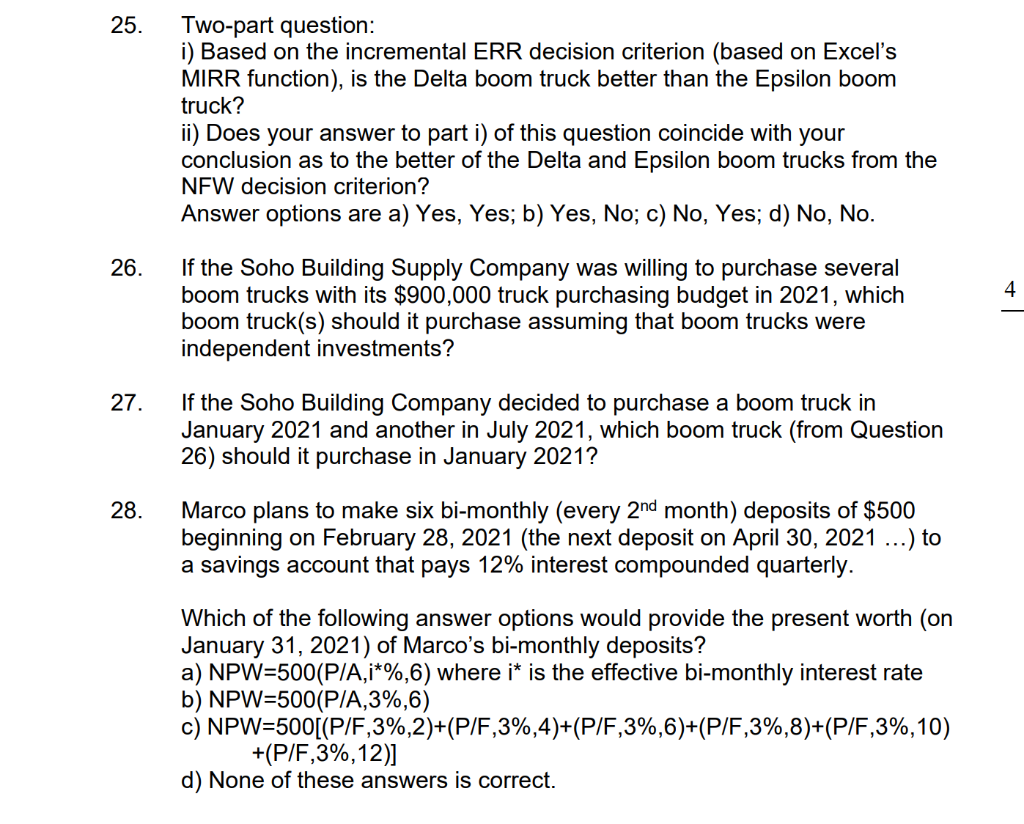

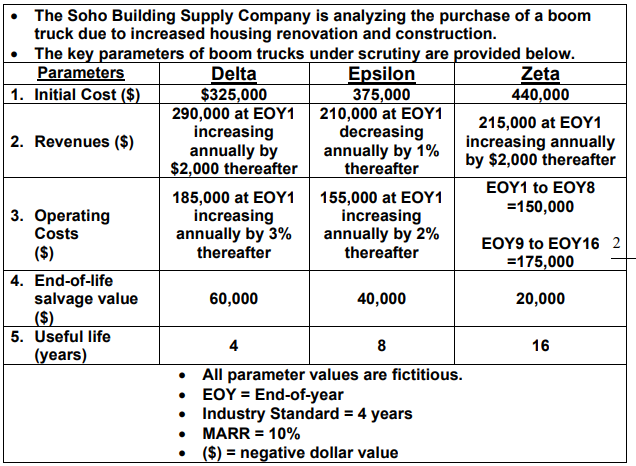

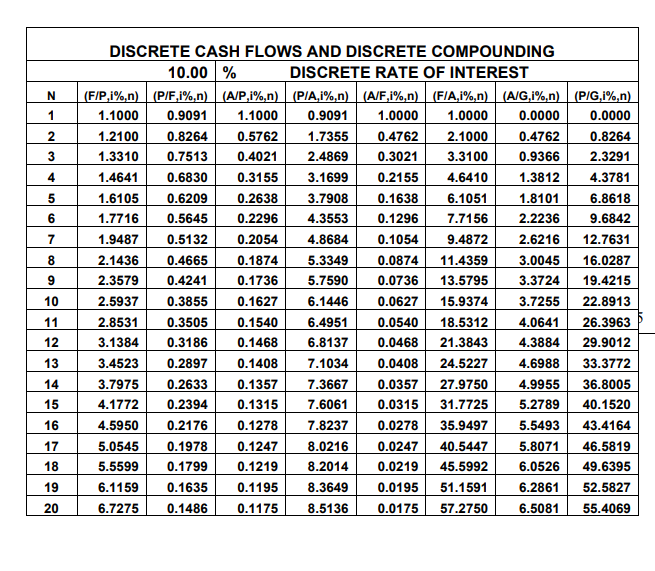

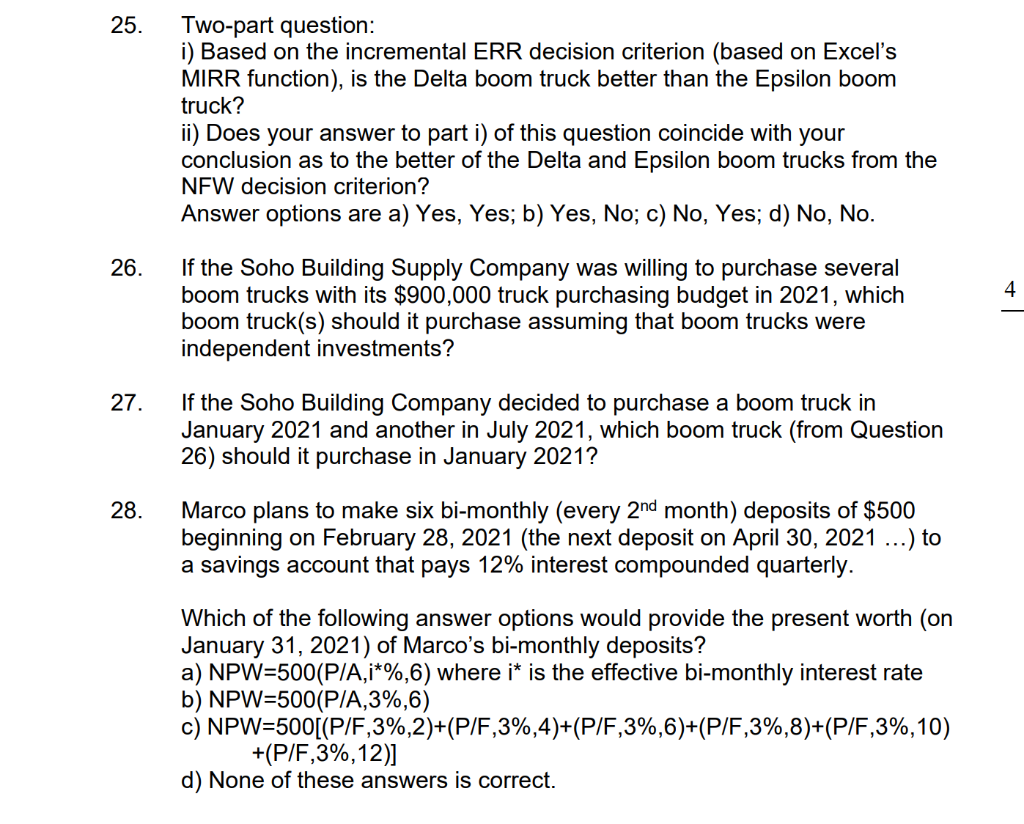

The Soho Building Supply Company is analyzing the purchase of a boom truck due to increased housing renovation and construction. The key parameters of boom trucks under scrutiny are provided below. Parameters Delta Epsilon Zeta 1. Initial Cost ($) $325,000 375,000 440,000 290,000 at EOY1 210,000 at EOY1 215,000 at EOY1 2. Revenues ($) increasing decreasing annually by annually by 1% increasing annually $2,000 thereafter thereafter by $2,000 thereafter 185,000 at EOY1 155,000 at EOY1 EOY1 to EOY8 3. Operating increasing =150,000 increasing Costs annually by 3% annually by 2% EOY9 to EOY16 2 ($) thereafter thereafter =175,000 4. End-of-life salvage value 60,000 40,000 20,000 ($) 5. Useful life (years) 16 4 8 All parameter values are fictitious. EOY = End-of-year Industry Standard = 4 years MARR = 10% ($) = negative dollar value . N 1 2 3 4 56 189 123 DISCRETE CASH FLOWS AND DISCRETE COMPOUNDING 10.00% DISCRETE RATE OF INTEREST (F/P,1%,n) (P/F,i%,n) (A/P,1%,n) (PIA,i%,n) (A/F,i%,n) (FIA,i%,n) (A/G,1%,n) (P/G,1%,n) 1.1000 0.9091 1.1000 0.9091 1.0000 1.0000 0.0000 0.0000 1.2100 0.8264 0.5762 1.7355 0.4762 2.1000 0.4762 0.8264 1.3310 0.7513 0.4021 2.4869 0.3021 3.3100 0.9366 2.3291 1.4641 0.6830 0.3155 3.1699 0.2155 4.6410 1.3812 4.3781 1.6105 0.6209 0.2638 3.7908 0.1638 6.1051 1.8101 6.8618 1.7716 0.5645 0.2296 4.3553 0.1296 7.7156 2.2236 9.6842 1.9487 0.5132 0.2054 4.8684 0.1054 9.4872 2.6216 12.7631 2.1436 0.4665 0.1874 5.3349 0.0874 11.4359 3.0045 16.0287 2.3579 0.4241 0.1736 5.7590 0.0736 13.5795 3.3724 19.4215 2.5937 0.3855 0.1627 6.1446 0.0627 15.9374 3.7255 22.8913 2.8531 0.3505 0.1540 6.4951 0.0540 18.5312 4.0641 26.3963 3.1384 0.3186 0.1468 6.8137 0.0468 21.3843 4.3884 29.9012 3.4523 0.2897 0.1408 7.1034 0.0408 24.5227 4.6988 33.3772 3.7975 0.2633 0.1357 7.3667 0.0357 27.9750 4.9955 36.8005 4.1772 0.2394 0.1315 7.6061 0.0315 31.7725 5.2789 40.1520 4.5950 0.2176 0.1278 7.8237 0.0278 35.9497 5.5493 43.4164 5.0545 0.1978 0.1247 8.0216 0.0247 40.5447 5.8071 46.5819 5.5599 0.1799 0.1219 8.2014 0.0219 45.5992 6.0526 49.6395 6.1159 0.1635 0.1195 8.3649 0.0195 51.1591 6.2861 52.5827 6.7275 0.1486 0.1175 8.5136 0.0175 57.2750 6.5081 55.4069 10 14 15 16 17 18 19 20 25. Two-part question: i) Based on the incremental ERR decision criterion (based on Excel's MIRR function), is the Delta boom truck better than the Epsilon boom truck? ii) Does your answer to part i) of this question coincide with your conclusion as to the better of the Delta and Epsilon boom trucks from the NEW decision criterion? Answer options are a) Yes, Yes; b) Yes, No; c) No, Yes; d) No, No. 26. 4 If the Soho Building Supply Company was willing to purchase several boom trucks with its $900,000 truck purchasing budget in 2021, which boom truck(s) should it purchase assuming that boom trucks were independent investments? 27. If the Soho Building Company decided to purchase a boom truck in January 2021 and another in July 2021, which boom truck (from Question 26) should it purchase in January 2021? 28. Marco plans to make six bi-monthly (every 2nd month) deposits of $500 beginning on February 28, 2021 (the next deposit on April 30, 2021 ...) to a savings account that pays 12% interest compounded quarterly. Which of the following answer options would provide the present worth (on January 31, 2021) of Marco's bi-monthly deposits? a) NPW=500(PIA, i*%,6) where i* is the effective bi-monthly interest rate b) NPW=500(PIA,3%,6) c) NPW=500[(P/F,3%,2)+(P/F,3%,4)+(P/F,3%,6)+(P/F,3%,8)+(P/F,3%,10) +(P/F,3%,12)] d) None of these answers is correct. The Soho Building Supply Company is analyzing the purchase of a boom truck due to increased housing renovation and construction. The key parameters of boom trucks under scrutiny are provided below. Parameters Delta Epsilon Zeta 1. Initial Cost ($) $325,000 375,000 440,000 290,000 at EOY1 210,000 at EOY1 215,000 at EOY1 2. Revenues ($) increasing decreasing annually by annually by 1% increasing annually $2,000 thereafter thereafter by $2,000 thereafter 185,000 at EOY1 155,000 at EOY1 EOY1 to EOY8 3. Operating increasing =150,000 increasing Costs annually by 3% annually by 2% EOY9 to EOY16 2 ($) thereafter thereafter =175,000 4. End-of-life salvage value 60,000 40,000 20,000 ($) 5. Useful life (years) 16 4 8 All parameter values are fictitious. EOY = End-of-year Industry Standard = 4 years MARR = 10% ($) = negative dollar value . N 1 2 3 4 56 189 123 DISCRETE CASH FLOWS AND DISCRETE COMPOUNDING 10.00% DISCRETE RATE OF INTEREST (F/P,1%,n) (P/F,i%,n) (A/P,1%,n) (PIA,i%,n) (A/F,i%,n) (FIA,i%,n) (A/G,1%,n) (P/G,1%,n) 1.1000 0.9091 1.1000 0.9091 1.0000 1.0000 0.0000 0.0000 1.2100 0.8264 0.5762 1.7355 0.4762 2.1000 0.4762 0.8264 1.3310 0.7513 0.4021 2.4869 0.3021 3.3100 0.9366 2.3291 1.4641 0.6830 0.3155 3.1699 0.2155 4.6410 1.3812 4.3781 1.6105 0.6209 0.2638 3.7908 0.1638 6.1051 1.8101 6.8618 1.7716 0.5645 0.2296 4.3553 0.1296 7.7156 2.2236 9.6842 1.9487 0.5132 0.2054 4.8684 0.1054 9.4872 2.6216 12.7631 2.1436 0.4665 0.1874 5.3349 0.0874 11.4359 3.0045 16.0287 2.3579 0.4241 0.1736 5.7590 0.0736 13.5795 3.3724 19.4215 2.5937 0.3855 0.1627 6.1446 0.0627 15.9374 3.7255 22.8913 2.8531 0.3505 0.1540 6.4951 0.0540 18.5312 4.0641 26.3963 3.1384 0.3186 0.1468 6.8137 0.0468 21.3843 4.3884 29.9012 3.4523 0.2897 0.1408 7.1034 0.0408 24.5227 4.6988 33.3772 3.7975 0.2633 0.1357 7.3667 0.0357 27.9750 4.9955 36.8005 4.1772 0.2394 0.1315 7.6061 0.0315 31.7725 5.2789 40.1520 4.5950 0.2176 0.1278 7.8237 0.0278 35.9497 5.5493 43.4164 5.0545 0.1978 0.1247 8.0216 0.0247 40.5447 5.8071 46.5819 5.5599 0.1799 0.1219 8.2014 0.0219 45.5992 6.0526 49.6395 6.1159 0.1635 0.1195 8.3649 0.0195 51.1591 6.2861 52.5827 6.7275 0.1486 0.1175 8.5136 0.0175 57.2750 6.5081 55.4069 10 14 15 16 17 18 19 20 25. Two-part question: i) Based on the incremental ERR decision criterion (based on Excel's MIRR function), is the Delta boom truck better than the Epsilon boom truck? ii) Does your answer to part i) of this question coincide with your conclusion as to the better of the Delta and Epsilon boom trucks from the NEW decision criterion? Answer options are a) Yes, Yes; b) Yes, No; c) No, Yes; d) No, No. 26. 4 If the Soho Building Supply Company was willing to purchase several boom trucks with its $900,000 truck purchasing budget in 2021, which boom truck(s) should it purchase assuming that boom trucks were independent investments? 27. If the Soho Building Company decided to purchase a boom truck in January 2021 and another in July 2021, which boom truck (from Question 26) should it purchase in January 2021? 28. Marco plans to make six bi-monthly (every 2nd month) deposits of $500 beginning on February 28, 2021 (the next deposit on April 30, 2021 ...) to a savings account that pays 12% interest compounded quarterly. Which of the following answer options would provide the present worth (on January 31, 2021) of Marco's bi-monthly deposits? a) NPW=500(PIA, i*%,6) where i* is the effective bi-monthly interest rate b) NPW=500(PIA,3%,6) c) NPW=500[(P/F,3%,2)+(P/F,3%,4)+(P/F,3%,6)+(P/F,3%,8)+(P/F,3%,10) +(P/F,3%,12)] d) None of these answers is correct