Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Solar Energy Company is producing electricity directly from a solar source by using a large array of solar cells and selling the power to

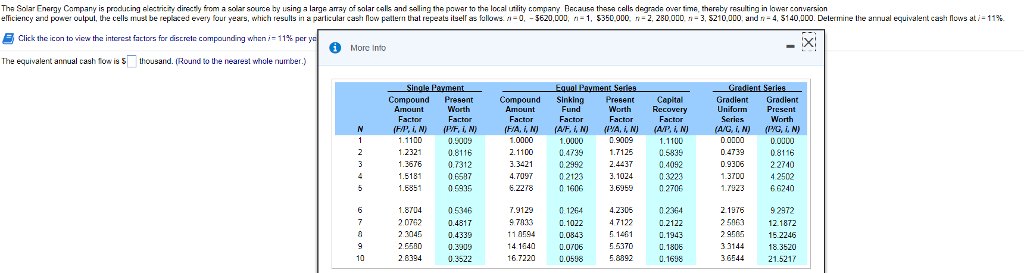

The Solar Energy Company is producing electricity directly from a solar source by using a large array of solar cells and selling the power to the local utility company. Because these cells degrade over time, thereby resulting in lower conversion

efficiency and power output, the cells must be replaced every four years, which results in a particular cash flow pattern that repeats itself as follows: n=0, $620,000; n=1, $350,000; n=2, $280,000; n=3, $210,000; and n=4, $140,000. Determine the annual equivalent cash flows at i=11%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started