Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the solution should be as the photo attached A large manufacturing company in Jubail is considering an electric power plant project in order to save

the solution should be as the photo attached

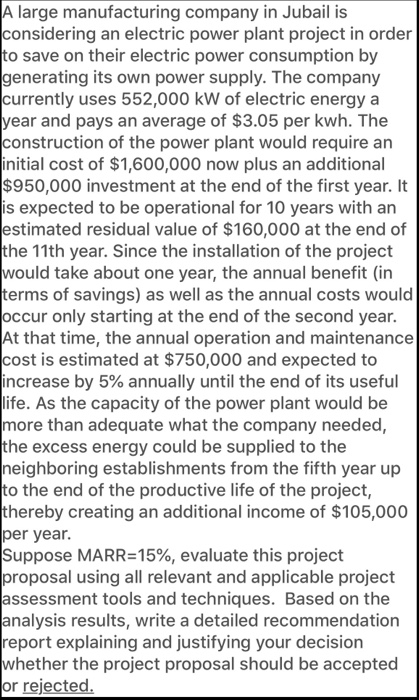

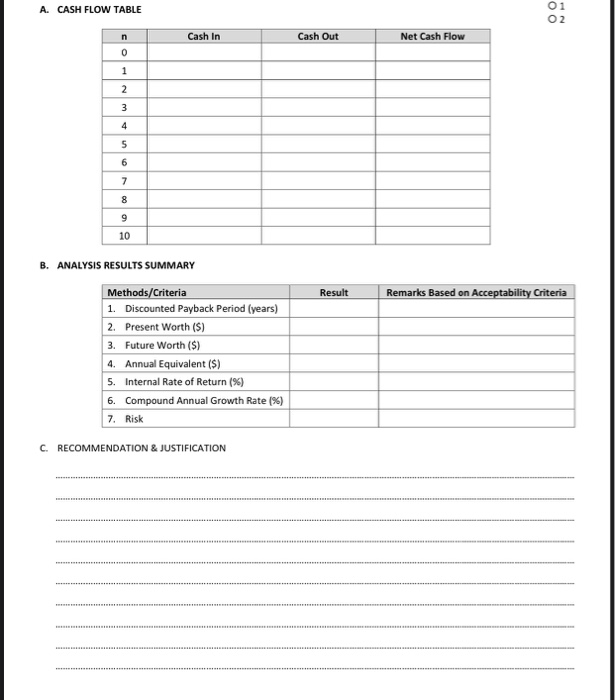

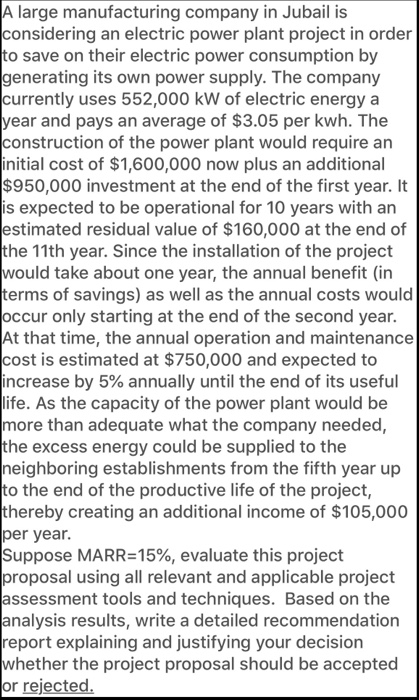

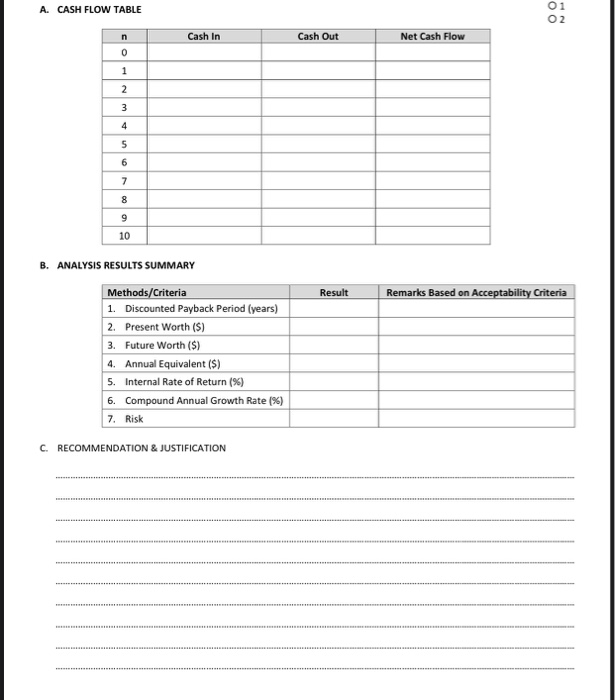

A large manufacturing company in Jubail is considering an electric power plant project in order to save on their electric power consumption by generating its own power supply. The company currently uses 552,000 kW of electric energy a year and pays an average of $3.05 per kwh. The construction of the power plant would require an initial cost of $1,600,000 now plus an additional $950,000 investment at the end of the first year. It is expected to be operational for 10 years with an estimated residual value of $160,000 at the end of the 11th year. Since the installation of the project would take about one year, the annual benefit (in terms of savings) as well as the annual costs would occur only starting at the end of the second year. At that time, the annual operation and maintenance cost is estimated at $750,000 and expected to increase by 5% annually until the end of its useful life. As the capacity of the power plant would be more than adequate what the company needed, the excess energy could be supplied to the Ineighboring establishments from the fifth year up to the end of the productive life of the project, thereby creating an additional income of $105,000 per year. Suppose MARR=15%, evaluate this project proposal using all relevant and applicable project Jassessment tools and techniques. Based on the Janalysis results, write a detailed recommendation report explaining and justifying your decision whether the project proposal should be accepted or rejected. A. CASH FLOW TABLE 06 Cash In Cash Out Net Cash Flow B. ANALYSIS RESULTS SUMMARY Result Remarks Based on Acceptability Criteria Methods/Criteria 1. Discounted Payback Period (years) 2. Present Worth (5) 3. Future Worth ($) 4. Annual Equivalent ($) 5. Internal Rate of Return (%) 6. Compound Annual Growth Rate (%) 7. Risk C. RECOMMENDATION & JUSTIFICATION

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started