Answered step by step

Verified Expert Solution

Question

1 Approved Answer

**The solution should be in Excel** CASE I: Testing market efficiency using event study methodology Instructions: Form a group of 5 students and submit your

**The solution should be in Excel**

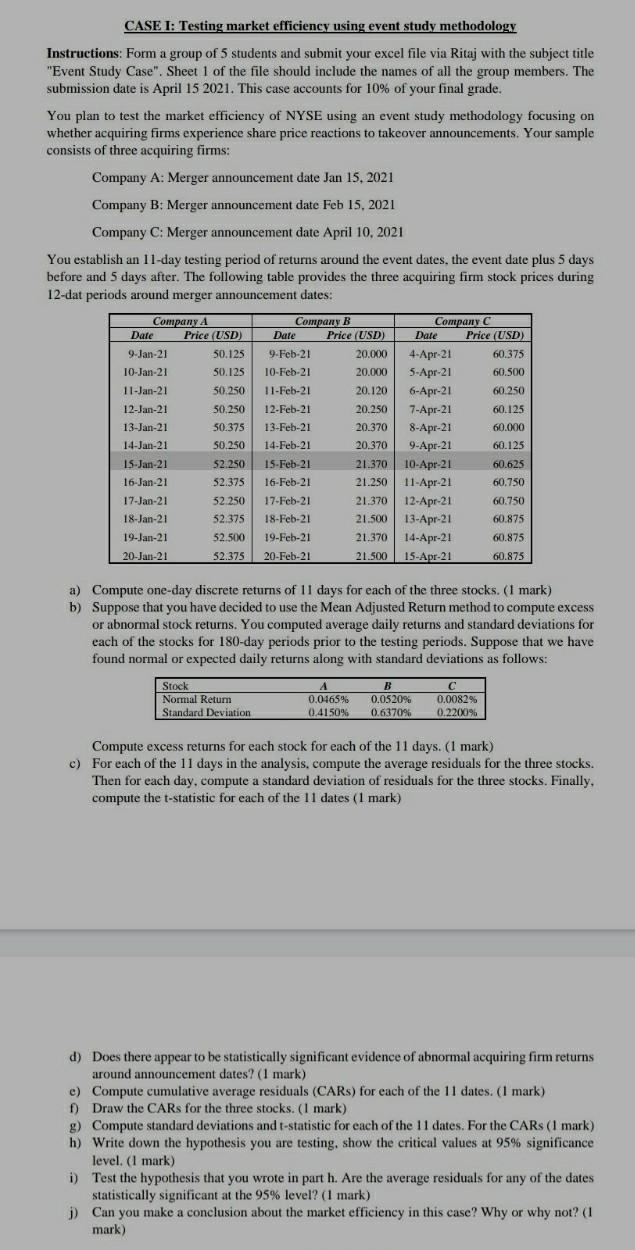

CASE I: Testing market efficiency using event study methodology Instructions: Form a group of 5 students and submit your excel file via Ritaj with the subject title "Event Study Case". Sheet 1 of the file should include the names of all the group members. The submission date is April 15 2021. This case accounts for 10% of your final grade. You plan to test the market efficiency of NYSE using an event study methodology focusing on whether acquiring firms experience share price reactions to takeover announcements. Your sample consists of three acquiring firms: Company A: Merger announcement date Jan 15, 2021 Company B: Merger announcement date Feb 15, 2021 Company C: Merger announcement date April 10, 2021 You establish an 11-day testing period of returns around the event dates, the event date plus 5 days before and 5 days after. The following table provides the three acquiring firm stock prices during 12-dat periods around merger announcement dates: Company Company B Company Date Price (USD) Date Price (USD) Dale Price (USD) 9-Jan-21 50.125 9-Feb-21 20.000 4-Apr-21 60.375 10-Jan-21 50.125 10-Feb-21 20.000 5-Apr-21 60.500 11-Jan-21 50.250 11-Feb-21 20.120 6-Apr-21 60.250 12-Jan-21 50,250 12-Feb-21 20.250 7-Apr-21 60.125 13-Jan-21 50.375 13-Feb-21 20.370 8-Apr-21 60.000 14-Jan-21 50.250 14-Feb-21 20.370 9-Apr-21 60.125 IS-Jan-21 52.250 15-Feb-21 21.370 10-Apr-21 60.625 16-Jan-21 52.375 16-Feb-21 21.250 11-Apr-21 60,750 17-Jan-21 52.250 17-Feb-21 21.370 12-Apr-21 60.750 18-Jan-21 52.375 18-Feb-21 21.500 13-Apr-21 60.875 19-Jan-21 52 500 19-Feb-21 21.370 14-Apr-21 60.875 20-Jan-21 52.375 20-Feb-21 21.500 15-Apr-21 60.875 a) Compute one-day discrete returns of 11 days for each of the three stocks. (1 mark) b) Suppose that you have decided to use the Mean Adjusted Return method to compute excess or abnormal stock returns. You computed average daily returns and standard deviations for each of the stocks for 180-day periods prior to the testing periods. Suppose that we have found normal or expected daily returns along with standard deviations as follows: Stock A 0.0465% 0.0082% Standard Deviation 0.4150% 0.2200% Normal Retum B 0.0520% 0.637096 Compute excess returns for each stock for each of the 11 days. (1 mark) c) For each of the 11 days in the analysis, compute the average residuals for the three stocks. Then for each day, compute a standard deviation of residuals for the three stocks. Finally, compute the t-statistic for each of the 11 dates (1 mark) d) Does there appear to be statistically significant evidence of abnormal acquiring firm returns around announcement dates? (1 mark) e) Compute cumulative average residuals (CARS) for each of the 11 dates. (1 mark) f) Draw the CARs for the three stocks. (1 mark) g) Compute standard deviations and t-statistic for each of the 11 dates. For the CARs (1 mark) h) Write down the hypothesis you are testing, show the critical values at 95% significance level. (1 mark) i) Test the hypothesis that you wrote in part h. Are the average residuals for any of the dates statistically significant at the 95% level? (1 mark) j) Can you make a conclusion about the market efficiency in this case? Why or why not? (1 mark) CASE I: Testing market efficiency using event study methodology Instructions: Form a group of 5 students and submit your excel file via Ritaj with the subject title "Event Study Case". Sheet 1 of the file should include the names of all the group members. The submission date is April 15 2021. This case accounts for 10% of your final grade. You plan to test the market efficiency of NYSE using an event study methodology focusing on whether acquiring firms experience share price reactions to takeover announcements. Your sample consists of three acquiring firms: Company A: Merger announcement date Jan 15, 2021 Company B: Merger announcement date Feb 15, 2021 Company C: Merger announcement date April 10, 2021 You establish an 11-day testing period of returns around the event dates, the event date plus 5 days before and 5 days after. The following table provides the three acquiring firm stock prices during 12-dat periods around merger announcement dates: Company Company B Company Date Price (USD) Date Price (USD) Dale Price (USD) 9-Jan-21 50.125 9-Feb-21 20.000 4-Apr-21 60.375 10-Jan-21 50.125 10-Feb-21 20.000 5-Apr-21 60.500 11-Jan-21 50.250 11-Feb-21 20.120 6-Apr-21 60.250 12-Jan-21 50,250 12-Feb-21 20.250 7-Apr-21 60.125 13-Jan-21 50.375 13-Feb-21 20.370 8-Apr-21 60.000 14-Jan-21 50.250 14-Feb-21 20.370 9-Apr-21 60.125 IS-Jan-21 52.250 15-Feb-21 21.370 10-Apr-21 60.625 16-Jan-21 52.375 16-Feb-21 21.250 11-Apr-21 60,750 17-Jan-21 52.250 17-Feb-21 21.370 12-Apr-21 60.750 18-Jan-21 52.375 18-Feb-21 21.500 13-Apr-21 60.875 19-Jan-21 52 500 19-Feb-21 21.370 14-Apr-21 60.875 20-Jan-21 52.375 20-Feb-21 21.500 15-Apr-21 60.875 a) Compute one-day discrete returns of 11 days for each of the three stocks. (1 mark) b) Suppose that you have decided to use the Mean Adjusted Return method to compute excess or abnormal stock returns. You computed average daily returns and standard deviations for each of the stocks for 180-day periods prior to the testing periods. Suppose that we have found normal or expected daily returns along with standard deviations as follows: Stock A 0.0465% 0.0082% Standard Deviation 0.4150% 0.2200% Normal Retum B 0.0520% 0.637096 Compute excess returns for each stock for each of the 11 days. (1 mark) c) For each of the 11 days in the analysis, compute the average residuals for the three stocks. Then for each day, compute a standard deviation of residuals for the three stocks. Finally, compute the t-statistic for each of the 11 dates (1 mark) d) Does there appear to be statistically significant evidence of abnormal acquiring firm returns around announcement dates? (1 mark) e) Compute cumulative average residuals (CARS) for each of the 11 dates. (1 mark) f) Draw the CARs for the three stocks. (1 mark) g) Compute standard deviations and t-statistic for each of the 11 dates. For the CARs (1 mark) h) Write down the hypothesis you are testing, show the critical values at 95% significance level. (1 mark) i) Test the hypothesis that you wrote in part h. Are the average residuals for any of the dates statistically significant at the 95% level? (1 mark) j) Can you make a conclusion about the market efficiency in this case? Why or why not? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started