The Southern Textile Company is considering two alternatives: to expand its existing production operation to manufacture a new line of lightweight material, or to purchase

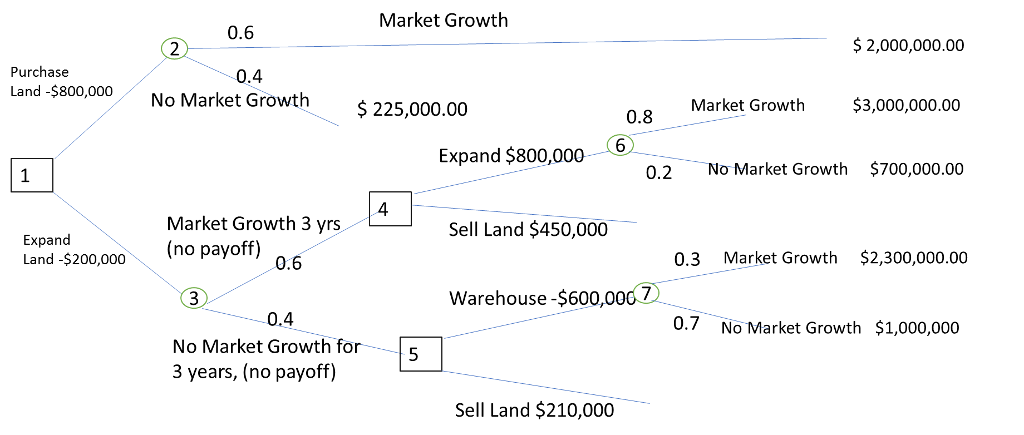

The Southern Textile Company is considering two alternatives: to expand its existing production operation to manufacture a new line of lightweight material, or to purchase land on which to construct a new facility in the future. Each of these decisions has outcomes based on product market growth in the future that result in another set of decisions (during a 10-year planning horizon), as shown in the figure of a sequential decision tree. In this figure, the square nodes represent decisions, and the circle nodes reflect different states of nature and their probabilities. The first decision facing the company is whether to expand or buy land. If the company expands, two states of nature are possible. Either the market will grow (with a probability of 0.60) or it will not grow (with a probability of 0.40). Either state of nature will result in a payoff. On the other hand, if the company chooses to purchase land, three years in the future another decision will have to be made regarding the development of the land. Using decision tree analysis, what is the best option?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started