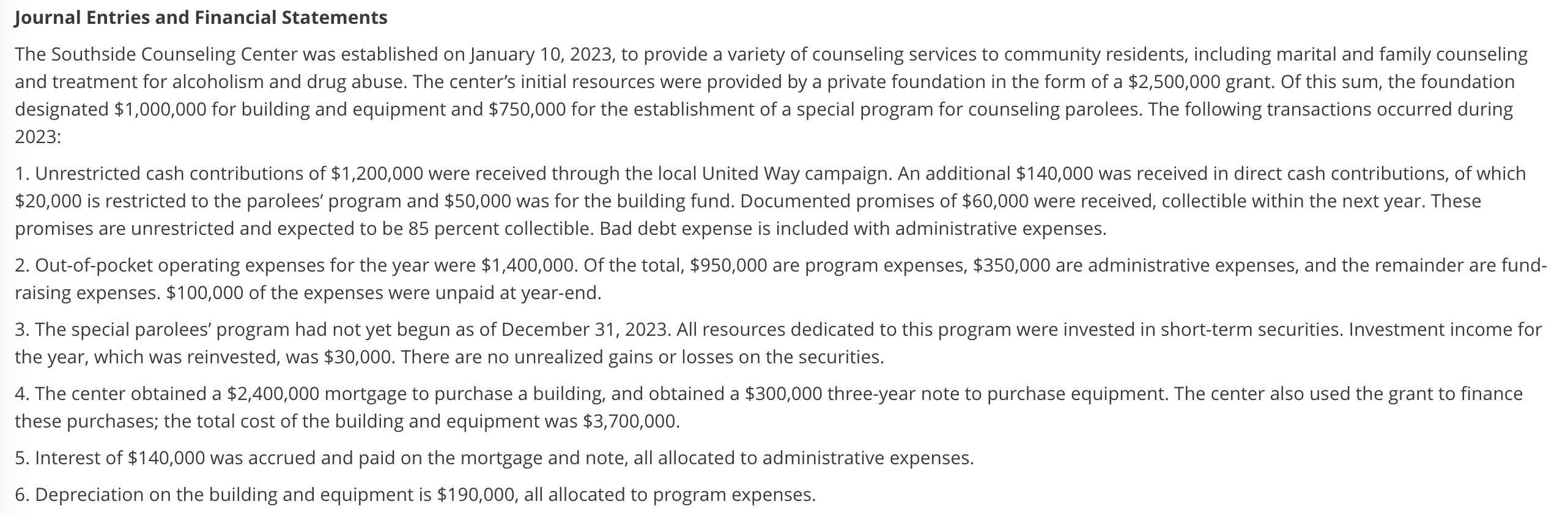

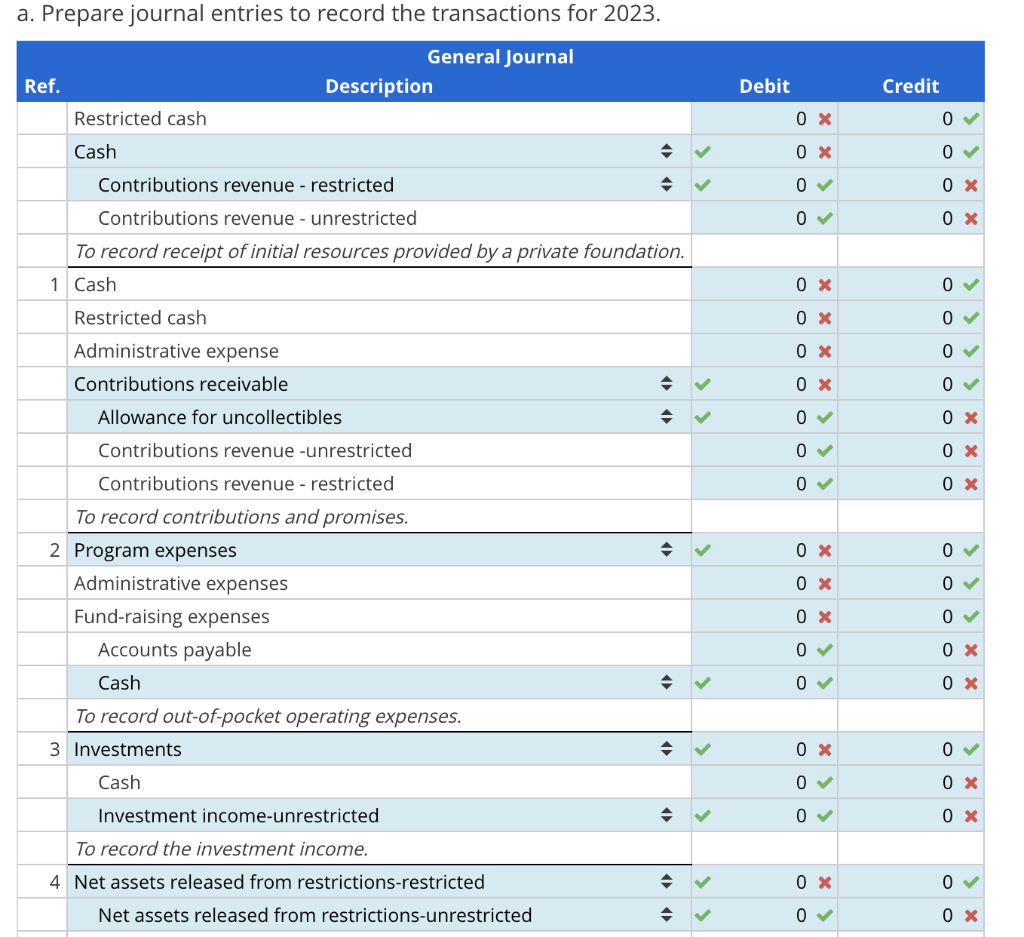

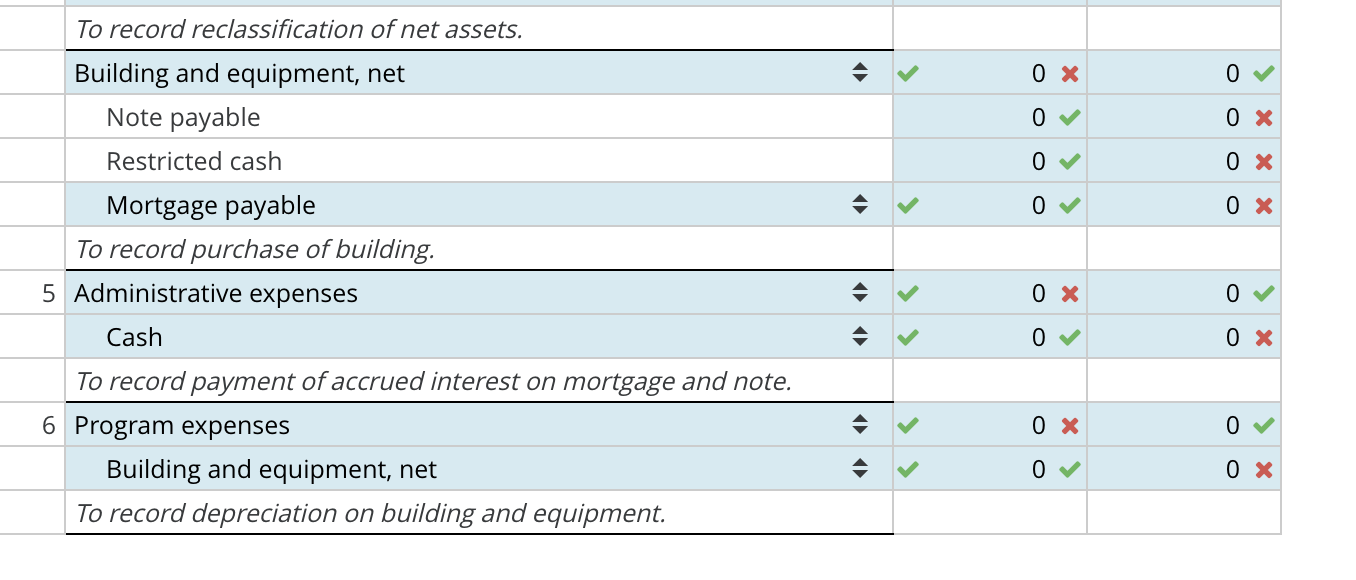

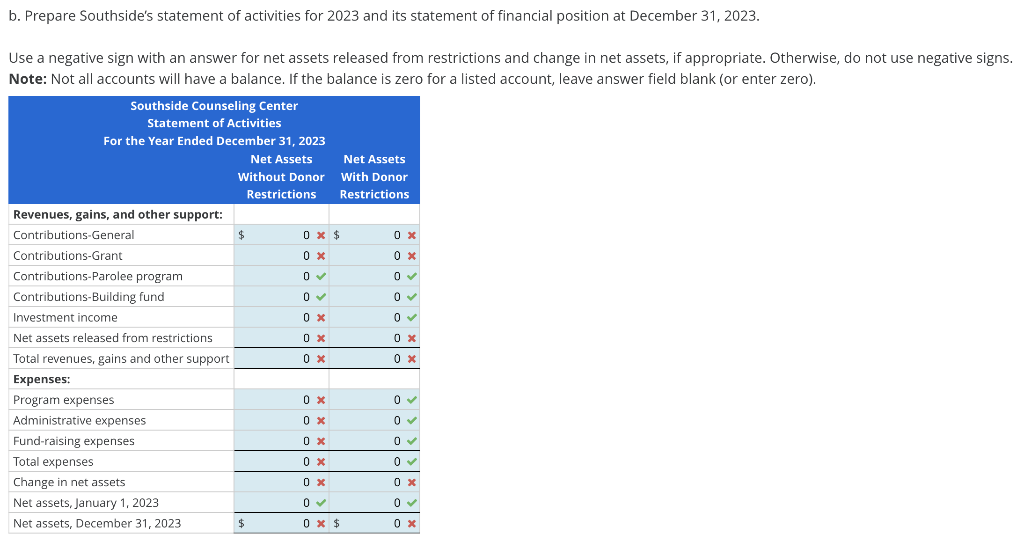

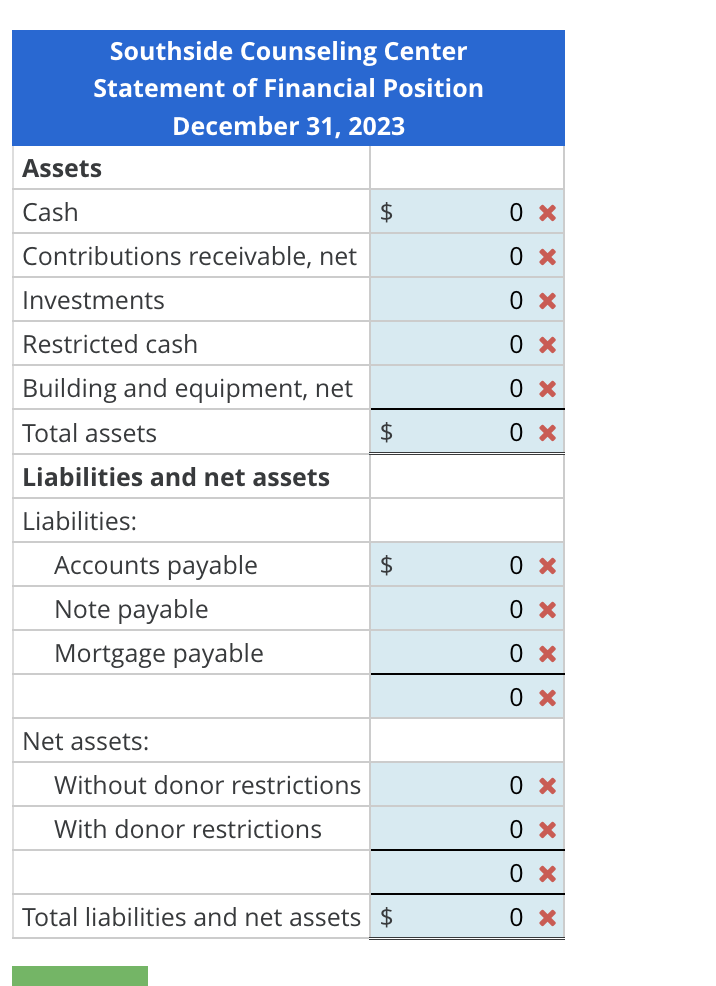

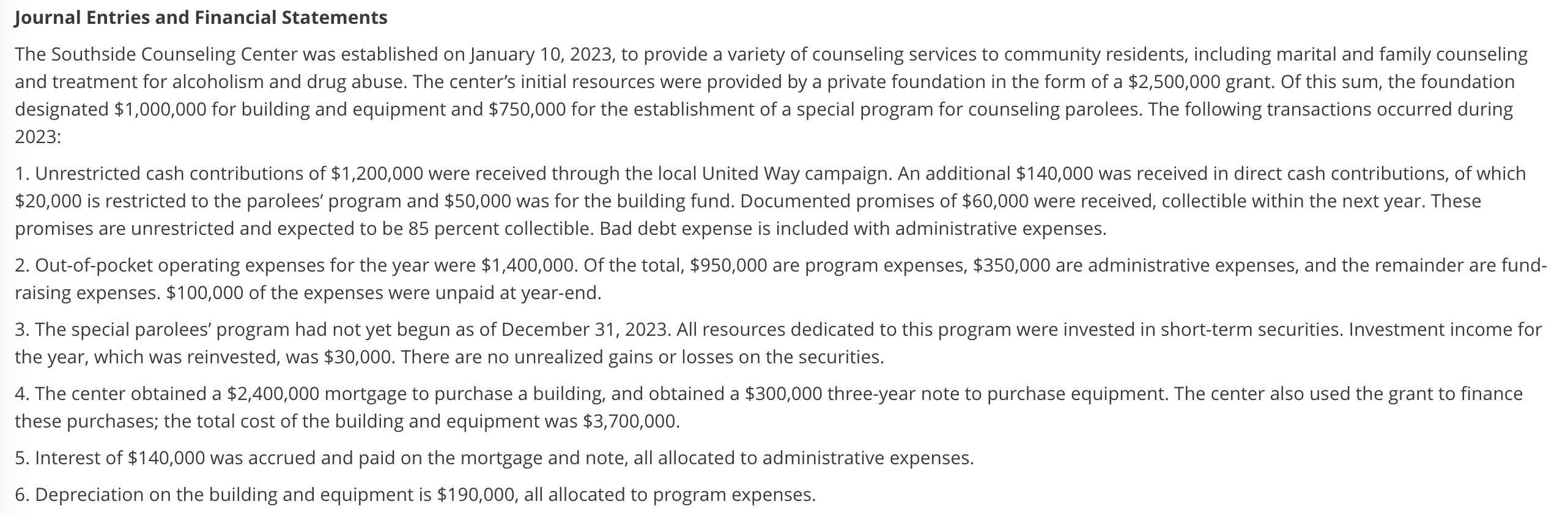

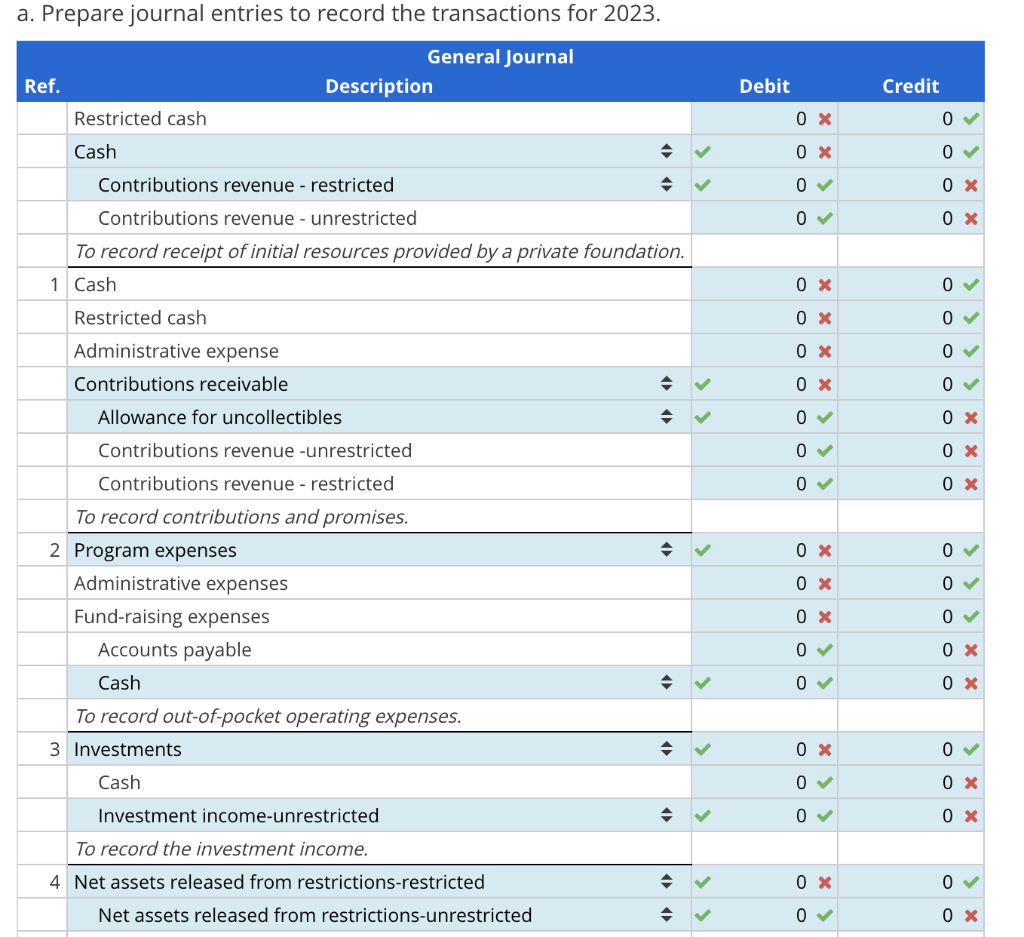

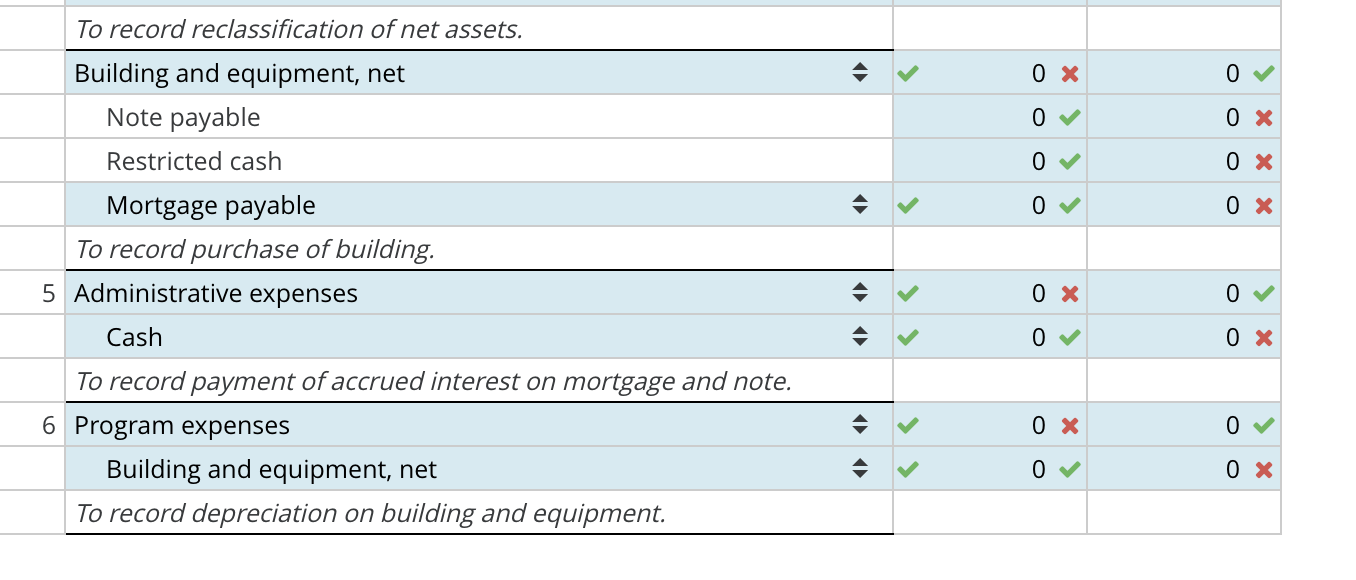

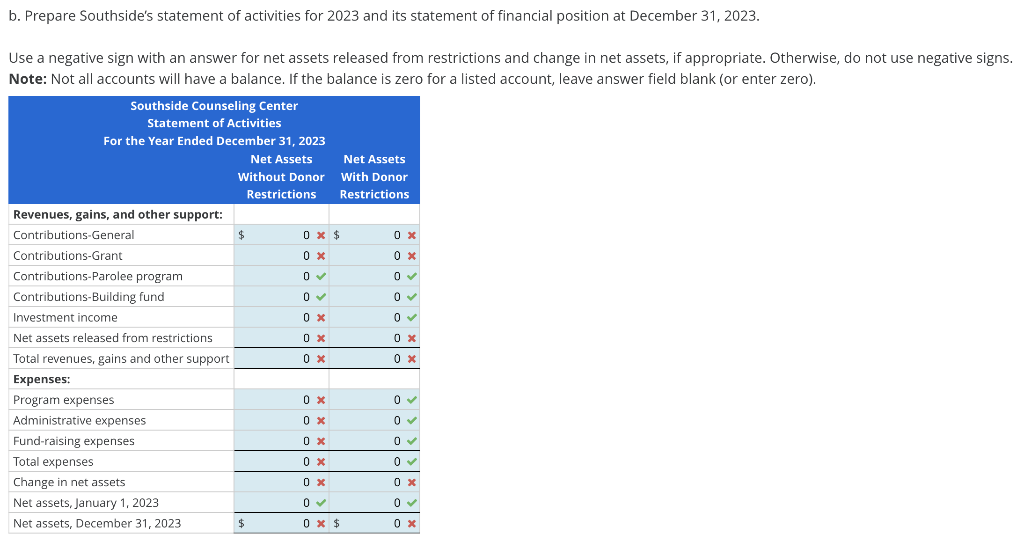

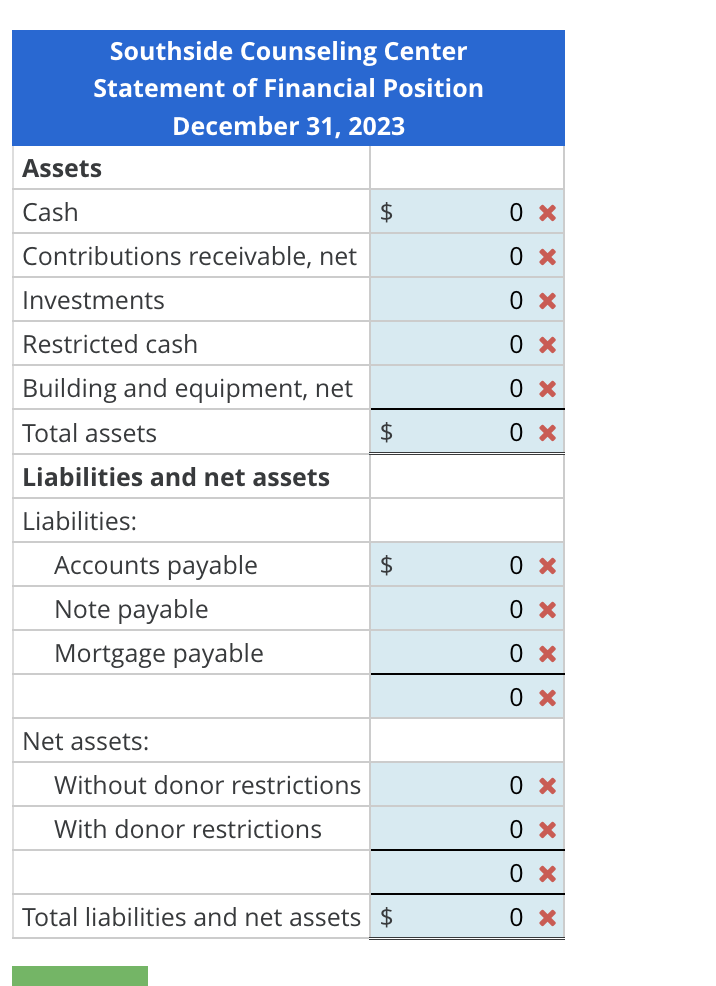

The Southside Counseling Center was established on January 10, 2023, to provide a variety of counseling services to community residents, including marital and family counseling and treatment for alcoholism and drug abuse. The center's initial resources were provided by a private foundation in the form of a $2,500,000 grant. Of this sum, the foundation designated $1,000,000 for building and equipment and $750,000 for the establishment of a special program for counseling parolees. The following transactions occurred during 2023: 1. Unrestricted cash contributions of $1,200,000 were received through the local United Way campaign. An additional $140,000 was received in direct cash contributions, of which $20,000 is restricted to the parolees' program and $50,000 was for the building fund. Documented promises of $60,000 were received, collectible within the next year. These promises are unrestricted and expected to be 85 percent collectible. Bad debt expense is included with administrative expenses. 2. Out-of-pocket operating expenses for the year were $1,400,000. Of the total, $950,000 are program expenses, $350,000 are administrative expenses, and the remainder are fundraising expenses. $100,000 of the expenses were unpaid at year-end. 3. The special parolees' program had not yet begun as of December 31, 2023. All resources dedicated to this program were invested in short-term securities. Investment income for the year, which was reinvested, was $30,000. There are no unrealized gains or losses on the securities. 4. The center obtained a $2,400,000 mortgage to purchase a building, and obtained a $300,000 three-year note to purchase equipment. The center also used the grant to finance these purchases; the total cost of the building and equipment was $3,700,000. 5. Interest of $140,000 was accrued and paid on the mortgage and note, all allocated to administrative expenses. 6. Depreciation on the building and equipment is $190,000, all allocated to program expenses. a. To record reclassification of net assets. Building and equipment, net Note payable Restricted cash Mortgage payable To record purchase of building. 5 Administrative expenses Cash To record payment of accrued interest on mortgage and note. 6 Program expenses Building and equipment, net To record depreciation on building and equipment. b. Prepare Southside's statement of activities for 2023 and its statement of financial position at December 31,2023. Use a negative sign with an answer for net assets released from restrictions and change in net assets, if appropriate. Otherwise, do not use negative signs. Note: Not all accounts will have a balance. If the balance is zero for a listed account, leave answer field blank (or enter zero). Southside Counseling Center Statement of Financial Position December 31, 2023 Assets Net assets