Answered step by step

Verified Expert Solution

Question

1 Approved Answer

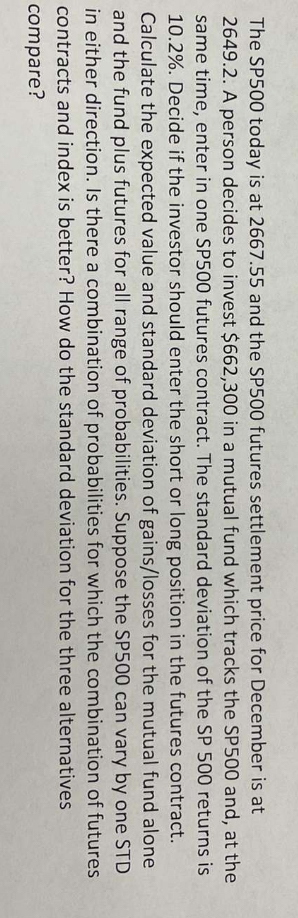

The SP 5 0 0 today is at 2 6 6 7 . 5 5 and the SP 5 0 0 futures settlement price for

The SP today is at and the SP futures settlement price for December is at A person decides to invest $ in a mutual fund which tracks the SP and, at the same time, enter in one SP futures contract. The standard deviation of the SP returns is Decide if the investor should enter the short or long position in the futures contract. Calculate the expected value and standard deviation of gainslosses for the mutual fund alone and the fund plus futures for all range of probabilities. Suppose the SP can vary by one STD in either direction. Is there a combination of probabilities for which the combination of futures contracts and index is better? How do the standard deviation for the three alternatives compare?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started