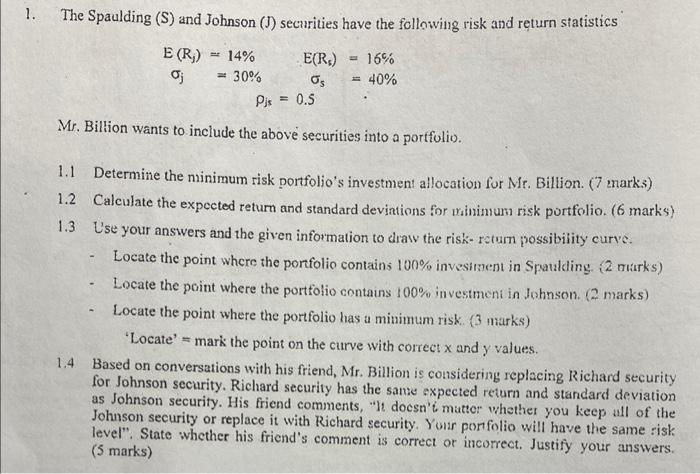

The Spaulding (S) and Johnson (J) securities have the following risk and return statistics E(Rj)=14%E(R5)=16% j=30%s=40% js=0.5 Mr. Biltion wants to include the above securities into a portfolio. 1.1 Determine the nuinimum risk portfolio's investment allocation for Mr. Billion. (7 marks) 1.2 Calculate the expected return and standard devintions for ysinimun risk portfolio. ( 6 marks) 1.3 Use your answers and the given information to draw the risk- rcturn possibility curve. - Locate the point where the porfolio contains 100% invesiment in Spaulding (2 mutrks) - Locate the point where the portfolio contains 100% investment in Johnson. (2 marks) - Locate the point where the portfolio has a minimum risk. (3 marks) 'Locate' = mark the point on the curve with correct x and y values. 1.4 Based on conversations with his friend, Mr. Billion is considering replacing Richard security for Johnson security. Richard security has the sane expected return and standard deviation as Johnson security. His friend comments, "It docsn't mutter whether you keep wll of the Johnson security or replace it with Richard security. Your porfolio will have the same risk level". State whether his friend's comment is correct or incorrect. Justify your answers. (5 marks) The Spaulding (S) and Johnson (J) securities have the following risk and return statistics E(Rj)=14%E(R5)=16% j=30%s=40% js=0.5 Mr. Biltion wants to include the above securities into a portfolio. 1.1 Determine the nuinimum risk portfolio's investment allocation for Mr. Billion. (7 marks) 1.2 Calculate the expected return and standard devintions for ysinimun risk portfolio. ( 6 marks) 1.3 Use your answers and the given information to draw the risk- rcturn possibility curve. - Locate the point where the porfolio contains 100% invesiment in Spaulding (2 mutrks) - Locate the point where the portfolio contains 100% investment in Johnson. (2 marks) - Locate the point where the portfolio has a minimum risk. (3 marks) 'Locate' = mark the point on the curve with correct x and y values. 1.4 Based on conversations with his friend, Mr. Billion is considering replacing Richard security for Johnson security. Richard security has the sane expected return and standard deviation as Johnson security. His friend comments, "It docsn't mutter whether you keep wll of the Johnson security or replace it with Richard security. Your porfolio will have the same risk level". State whether his friend's comment is correct or incorrect. Justify your answers