Answered step by step

Verified Expert Solution

Question

1 Approved Answer

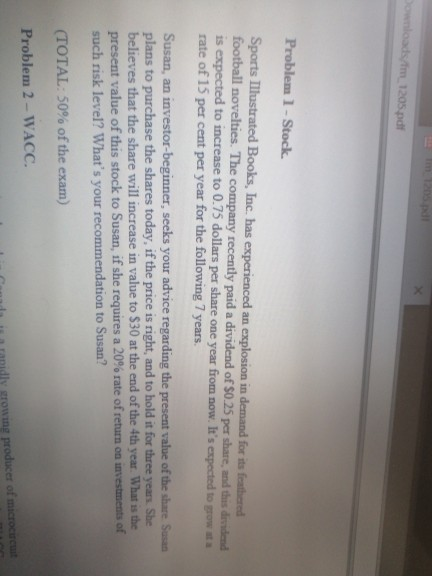

The sports illustrated books Inc. has experienced an explosion in demand for its further football novelties loads/im1205.pdf Problem 1 - Stock Sports Illustrated Books, Inc.

The sports illustrated books Inc. has experienced an explosion in demand for its further football novelties

loads/im1205.pdf Problem 1 - Stock Sports Illustrated Books, Inc. has experienced an explosion in demand for its feathered football novelties. The company recently paid a dividend of $0.25 per share, and this dividend is expected to increase to 0.75 dollars per share one year from now. It's expected to grow at rate of 15 per cent per year for the following 7 years. Susan, an investor beginner, seeks your advice regarding the present value of the share. Susan plans to purchase the shares today, if the price is right, and to hold it for three years. She believes that the share will increase in value to $30 at the end of the 4th year. What is the present value of this stock to Susan, if she requires a 20% rate of return on investments of such risk level? What's your recommendation to Susan? (TOTAL: 50% of the exam) Problem 2 - WACC. Canada and strong producer of microcus loads/im1205.pdf Problem 1 - Stock Sports Illustrated Books, Inc. has experienced an explosion in demand for its feathered football novelties. The company recently paid a dividend of $0.25 per share, and this dividend is expected to increase to 0.75 dollars per share one year from now. It's expected to grow at rate of 15 per cent per year for the following 7 years. Susan, an investor beginner, seeks your advice regarding the present value of the share. Susan plans to purchase the shares today, if the price is right, and to hold it for three years. She believes that the share will increase in value to $30 at the end of the 4th year. What is the present value of this stock to Susan, if she requires a 20% rate of return on investments of such risk level? What's your recommendation to Susan? (TOTAL: 50% of the exam) Problem 2 - WACC. Canada and strong producer of microcus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started