Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The spot rate given is AUDUSD Calculate CIA for AUD: Borrowing $100,000 at USD LIBOR for 1-year, Buying AUD at Spot, Buying 1-Year AUD Bond,

The spot rate given is AUDUSD

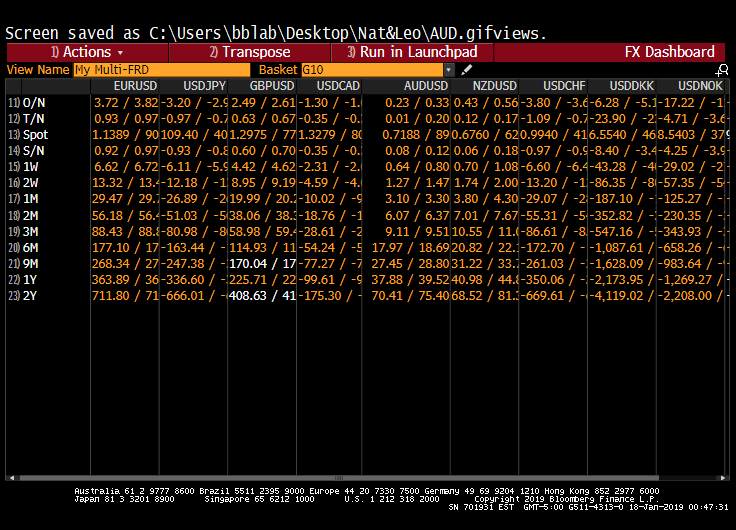

Calculate CIA for AUD: Borrowing $100,000 at USD LIBOR for 1-year, Buying AUD at Spot, Buying 1-Year AUD Bond, and then Selling AUD proceeds at forward price. Can arbitrage profit be made? Provide the solution

Spot rate 1-Yr 0.7188 0.7189 37.88 39.52 Souverign rates : AUD 1.90090 USD 2.569% AUD 1.9730% USD 2.7733% LIBOR rates: Screen saved as C:\Users\bblab\Desktop\Nat&Leo AUD.gifviews 1) Actions 2 Transpose Run in Launchpad FX Dashboard View Name My Multi-FRD Basket 10 EURUSD USDJPY GBPUSD USDCAD 3.72 /3.82-3.20/-2.92.49 2.61-1.30 0.93/0.97-0.97/ -0.70.63/0.67-0.35/ 1.1389 90109.40 401.2975 771.3279/80.7188 890.6760 620.9940 416.5540 468.5403 37 092 / 097-093 / -00.60 / 070-035 / 6.62 6.72-6.11/ -5.9 4.42/4.62-2.31/- 13.32/13-12.18/-1 8.95/9.19-4.59/-4. 1.27 /1.47 1.74 / 2.00-13.20 /-1-86.35/-8-57.35 29.47 29.1-26.89 /-219.99 /20.2-10.02/93.10 3.30 3.80/ 4.30-29.07/-2-187.10/--125.27/ 56.18 56.4-51.03/-538.06 38.3-18.76/-1 6.07/6.37 7.01 7.67-55.31 -5-352.82/--230.35/ 88.43/88.8-80.98-858.98 59.-28.61/-2 9.11/9.5110.55 11.(-86.61 -8-547.16--343.93/ 177.10 17-163.44-114.93/11-54.24/-5 17.97 /18.69 20.82 22.1-172.70-1,087.61/-658.26 268.34/27-247.38-170.04 17-77.27/-7 27.45/28.80 31.22/33.1-261.03/--1,628.09/-983.64/- 363.89 / 36-336.60 /-225.71 / 22-9961 / -9 37.88 / 39.S240.98 / 44,(-350N6 / --2, 73.95 /-126927 711.80 71-666.01-408.63/41-175.30/ 70.41/ 75.4068.52/811-669.61--4,119.02/-2,208.00/ AUDUSD NZDUSD USDCHF USDDKK USDNOK 0.23/0.33 0.43/0.56-3.80-3.6-6.28/-5.1-17.22 /-1 0.01/0.20 0.12/0.17-1.09 -0.7-23.90/-2-4.71/-3 11 0/N 12) T/N 13 Spot 14 S/N 15) 1W 16 2W 17) 1M 18 2M 19) 3M 20) 6M 008 / 0.120.06 / 0.18-0.97 /-os-8A0 /-3A-425 /-3.G 0.64 /0.80 0.70 1.08-6.60-6.4-43.28-4-29.02/ 23) 2Y Aus tralia 61 2 9777 8600 Brazil 5511 2395 9000 Europe 44 20 7330 7500 Germny 49 69 9204 1210 Hong Kong 852 2977 6000 Copyright 2019 Bloomberg Finance L.P Tapan 81 3 3201 8900 Singapore 65 6212 1000 U.S. 1 212 318 2000 SN 701931 EST GMT-5:00 G5 11+313- 18-Jan-2019 00:47:31Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started