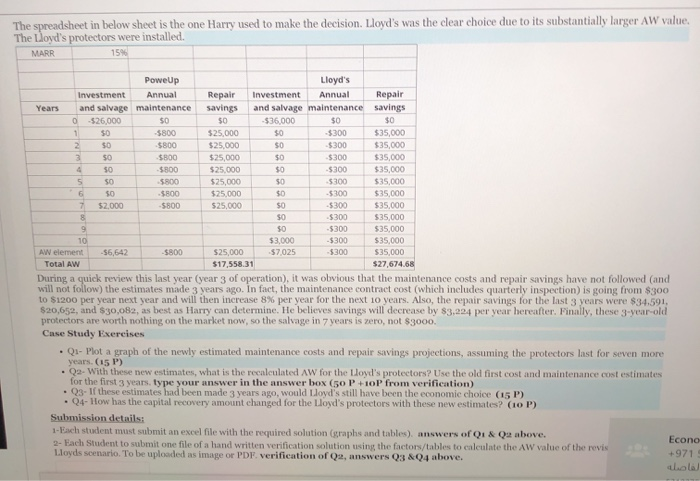

The spreadsheet in below sheet is the one Harry used to make the decision. Lloyd's was the clear choice due to its substantially larger AW value. The Lloyd's protectors were installed. 159 MARR 1 $300 $0 $0 30 -5300 $0 SO SO 50 -$300 PoweUp Lloyd's Investment Annual Repair Investment Annual Repair Years and salvage maintenance savings and salvage maintenance savings 0 - 526,000 $0 50 -$36.000 $0 $0 50 -$800 $25,000 $0 -$300 $35,000 2 SO $800 $25,000 $0 $300 $35,000 3 $0 $800 $25,000 $35,000 4 50 $800 $25,000 -$300 $35,000 5 50 $800 $25,000 $35,000 6 50 $800 $25,000 -5300 $35,000 7 $2,000 5800 $25,000 -$300 $35.000 8 -$300 $35,000 9 $35,000 10 $3,000 -$300 $35.000 AW element -56,642 -$800 $25,000 57,025 -$300 $35,000 Total Aw $17,558.31 $27,674.68 During a quick review this last year (year 3 of operation), it was obvious that the maintenance costs and repair savings have not followed (and will not follow) the estimates made 3 years ago. In fact, the maintenance contract cost (which ineludes quarterly inspection) is going from $300 to $1200 per year next year and will then increase 8% per year for the next 10 years. Also, the repair savings for the last 3 years were $34.591, $20,652, and $30,082, as best as Harry can determine. He believes savings will decrease by $3,224 per year hereafter. Finally, these 3-year-old protectors are worth nothing on the market now, so the salvage in 7 years is zero, not $3000. Case Study Exercises Q1- Plot a graph of the newly estimated maintenance costs and repair savings projections, assuming the protectors last for seven more years. (15 P) . Qe- With these new estimates, what is the recalculated AW for the Lloyd's protectors? Use the old first cost and maintenance cost estimates for the first 3 years. Type your answer in the answer box (50 P +10P from verification) Q3. If these estimates had been made 3 years ago, would Lloyd's still have been the economic choice (15) Q4- How has the capital recovery amount changed for the Lloyd's protectors with these new estimates? (10 P) Submission details: 1-Each student must submit an excel file with the required solution (graphs and tables) answers of Qi & Q above. 2- Each student to submit one file of a hand written verification solution using the factors/tables to calculate the AW value of the revis Econo Lloyds scenario. To be uploaded as image or PDF verification of Qa, answers Q3 &04 above. +971 ahalal The spreadsheet in below sheet is the one Harry used to make the decision. Lloyd's was the clear choice due to its substantially larger AW value. The Lloyd's protectors were installed. 159 MARR 1 $300 $0 $0 30 -5300 $0 SO SO 50 -$300 PoweUp Lloyd's Investment Annual Repair Investment Annual Repair Years and salvage maintenance savings and salvage maintenance savings 0 - 526,000 $0 50 -$36.000 $0 $0 50 -$800 $25,000 $0 -$300 $35,000 2 SO $800 $25,000 $0 $300 $35,000 3 $0 $800 $25,000 $35,000 4 50 $800 $25,000 -$300 $35,000 5 50 $800 $25,000 $35,000 6 50 $800 $25,000 -5300 $35,000 7 $2,000 5800 $25,000 -$300 $35.000 8 -$300 $35,000 9 $35,000 10 $3,000 -$300 $35.000 AW element -56,642 -$800 $25,000 57,025 -$300 $35,000 Total Aw $17,558.31 $27,674.68 During a quick review this last year (year 3 of operation), it was obvious that the maintenance costs and repair savings have not followed (and will not follow) the estimates made 3 years ago. In fact, the maintenance contract cost (which ineludes quarterly inspection) is going from $300 to $1200 per year next year and will then increase 8% per year for the next 10 years. Also, the repair savings for the last 3 years were $34.591, $20,652, and $30,082, as best as Harry can determine. He believes savings will decrease by $3,224 per year hereafter. Finally, these 3-year-old protectors are worth nothing on the market now, so the salvage in 7 years is zero, not $3000. Case Study Exercises Q1- Plot a graph of the newly estimated maintenance costs and repair savings projections, assuming the protectors last for seven more years. (15 P) . Qe- With these new estimates, what is the recalculated AW for the Lloyd's protectors? Use the old first cost and maintenance cost estimates for the first 3 years. Type your answer in the answer box (50 P +10P from verification) Q3. If these estimates had been made 3 years ago, would Lloyd's still have been the economic choice (15) Q4- How has the capital recovery amount changed for the Lloyd's protectors with these new estimates? (10 P) Submission details: 1-Each student must submit an excel file with the required solution (graphs and tables) answers of Qi & Q above. 2- Each student to submit one file of a hand written verification solution using the factors/tables to calculate the AW value of the revis Econo Lloyds scenario. To be uploaded as image or PDF verification of Qa, answers Q3 &04 above. +971 ahalal