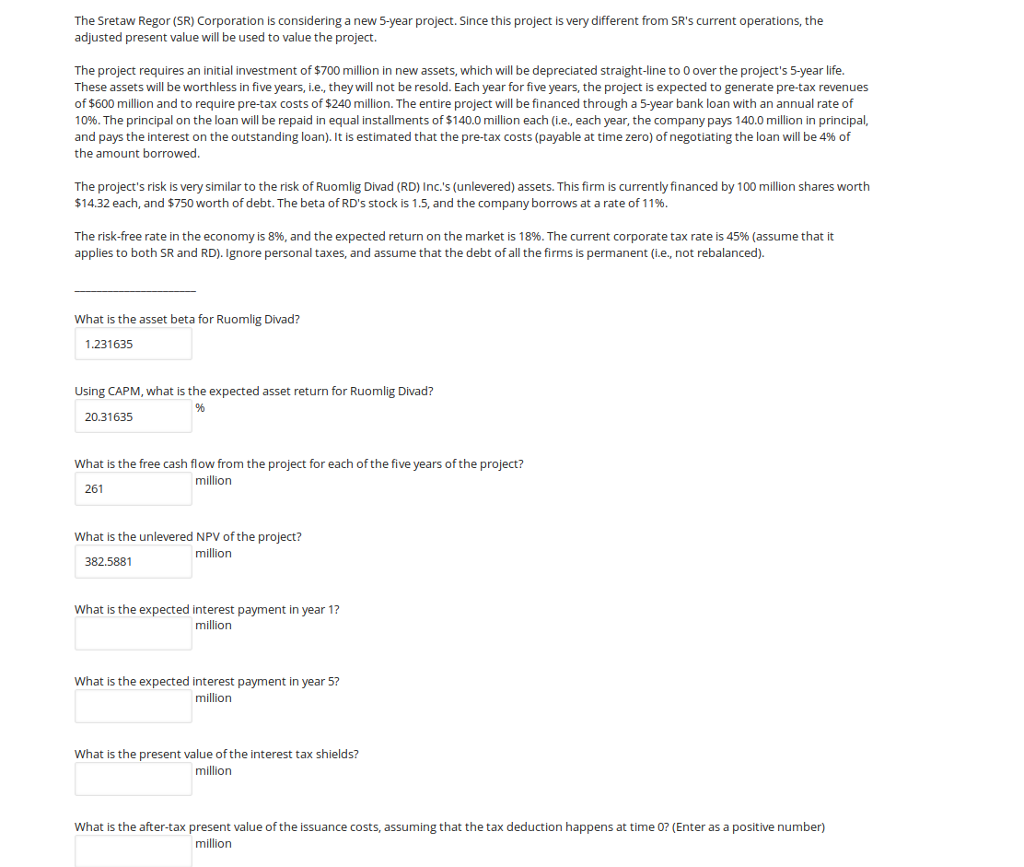

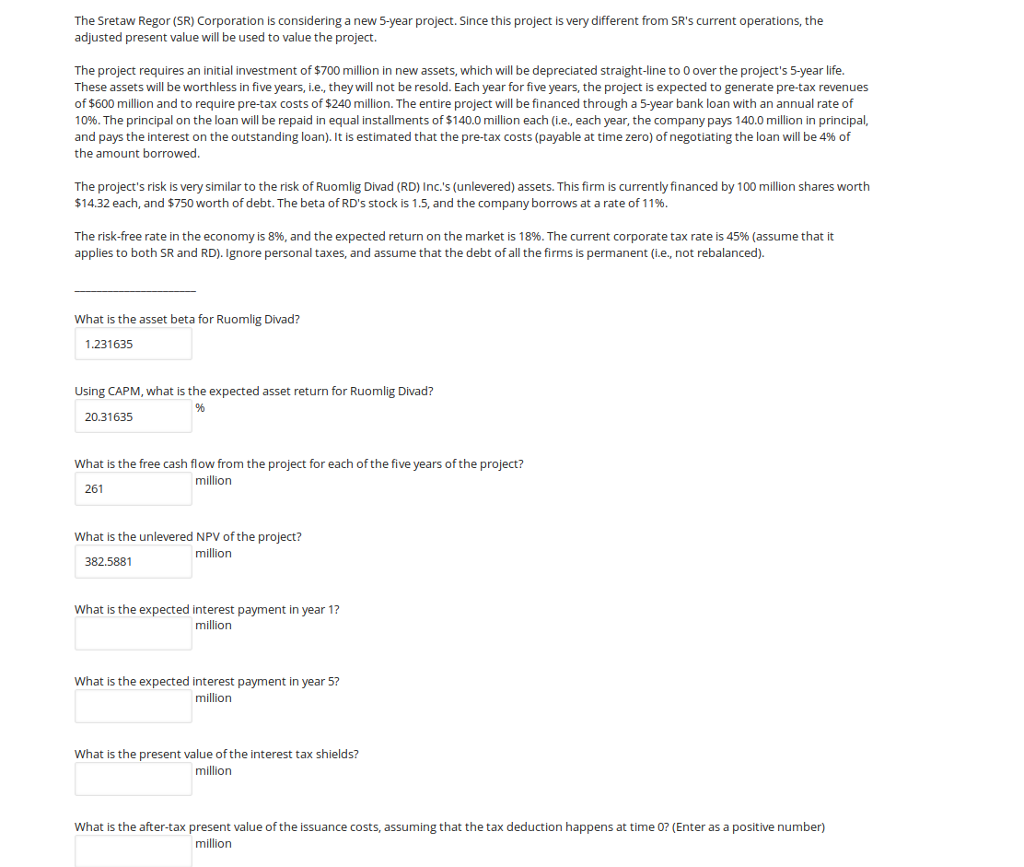

The Sretaw Regor (SR) Corporation is considering a new 5-year project. Since this project is very different from SR's Current operations, the adjusted present value will be used to value the project. The project requires an initial investment of $700 million in new assets, which will be depreciated straight-line to 0 over the project's 5-year life These assets will be worthless in five years, i.e., they will not be resold. Each year for five years, the project is expected to generate pre tax revenues of $600 million and to require pre-tax costs of $240 million. The entire project will be financed through a 5-year bank loan with an annual rate of 10%. The principal on the loan will be repaid in equal installments of $140.0 million each (ie, each year, the company pays 140.0 million in principal, and pays the interest on the outstanding loan, it is estimated that the pre-tax costs (payable at time zero) of negotiating the loan will be 4% of the amount borrowed The project's risk is very similar to the risk of Ruomlig Divad (RD) Inc.'s (unlevered) assets. This firm is currently financed by 100 million shares worth $14.32 each, and $750 worth of debt. The beta of RD's stock is 1.5, and the company borrows at a rate of 11% The risk-free rate in the economy is 896, and the expected return on the market is 18%. The current corporate tax rate is 45% (assume that it applies to both SR and RD). Ignore personal taxes, and assume that the debt of all the firms is permanent (i.e., not rebalanced). What is the asset beta for Ruomlig Divad? 1.231635 Using CAPM, what is the expected asset return for Ruomlig Divad? 20.31635 What is the free cash flow from the project for each of the five years of the project? million 261 What is the unlevered NPV of the project? million 382.5881 What is the expected interest payment in year 1? million What is the expected interest payment in year 5? million What is the present value of the interest tax shields? million What is the after-tax present value of the issuance costs, assuming that the tax deduction happens at time 0? (Enter as a positive number) million