Answered step by step

Verified Expert Solution

Question

1 Approved Answer

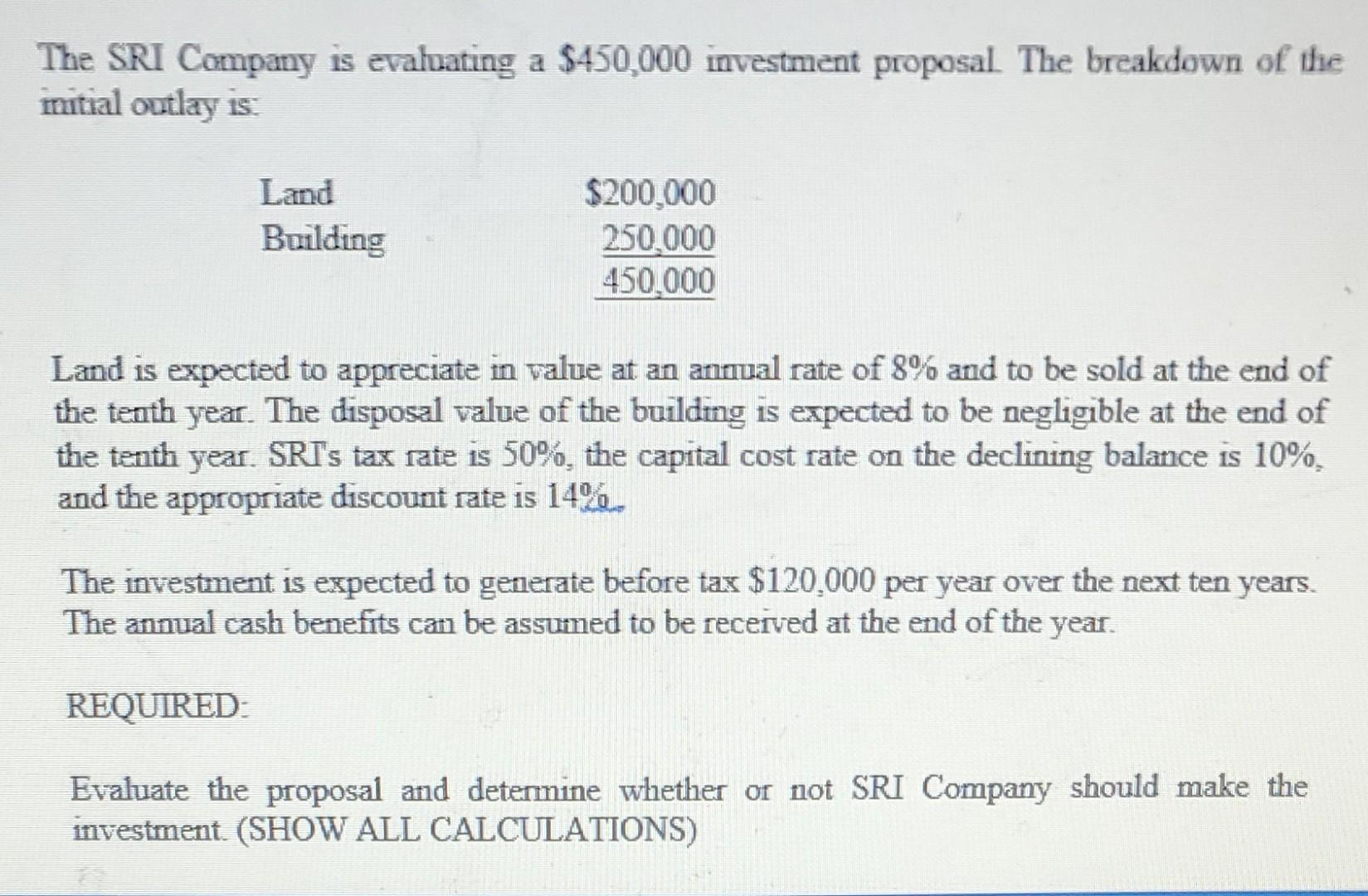

The SRI Company is evaluating a $450,000 investment proposal The breakdown of the mutial outlay is Land Building $200,000 250,000 450.000 Land is expected to

The SRI Company is evaluating a $450,000 investment proposal The breakdown of the mutial outlay is Land Building $200,000 250,000 450.000 Land is expected to appreciate in value at an annual rate of 8% and to be sold at the end of the teath year. The disposal value of the building is expected to be negligible at the end of the tenth year. SRI's tax rate is 50%, the capital cost rate on the declining balance is 10% and the appropriate discount rate is 14%. The investment is expected to generate before tax $120,000 per year over the next ten years. The annual cash benefits can be assumed to be received at the end of the year. REQUIRED Evaluate the proposal and determine whether or not SRI Company should make the investment. (SHOW ALL CALCULATIONS)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started