Question

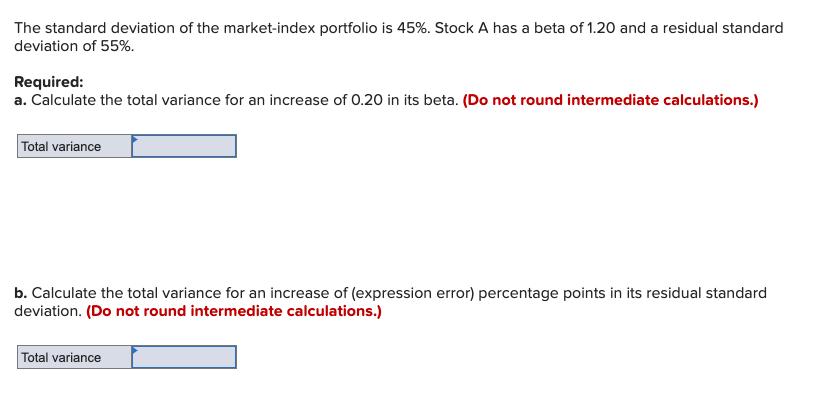

The standard deviation of the market-index portfolio is 45%. Stock A has a beta of 1.20 and a residual standard deviation of 55%. Required:

The standard deviation of the market-index portfolio is 45%. Stock A has a beta of 1.20 and a residual standard deviation of 55%. Required: a. Calculate the total variance for an increase of 0.20 in its beta. (Do not round intermediate calculations.) Total variance b. Calculate the total variance for an increase of (expression error) percentage points in its residual standard deviation. (Do not round intermediate calculations.) Total variance

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

3431C File Paste 1 2 3 4 a 5 6 7 b 8 9 10 11 12 13 14 15 16 17 18 Rea Clipboard VN11 H Home insert P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles of Finance

Authors: Scott Besley, Eugene F. Brigham

6th edition

9781305178045, 1285429648, 1305178041, 978-1285429649

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App