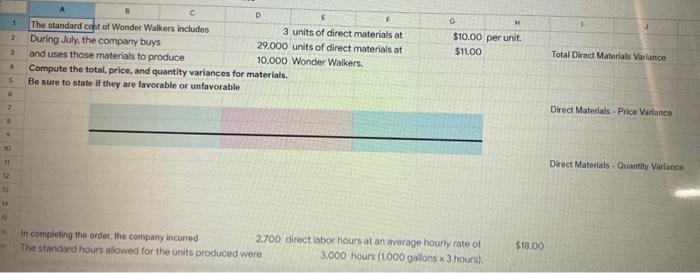

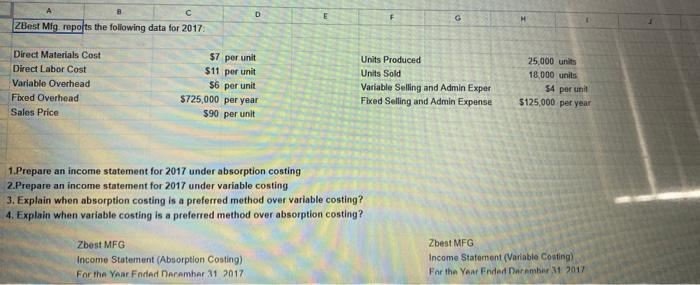

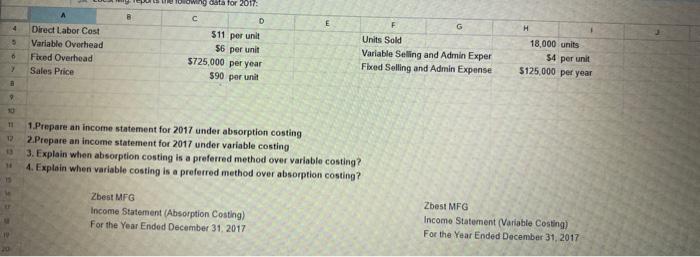

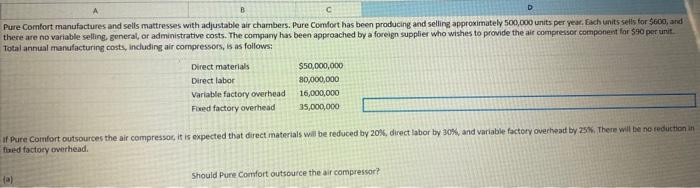

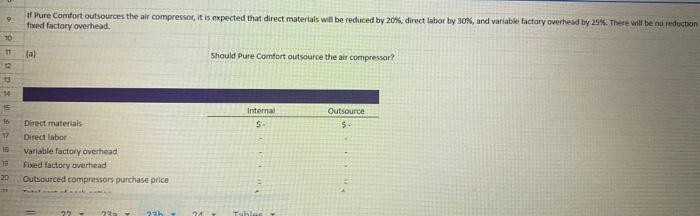

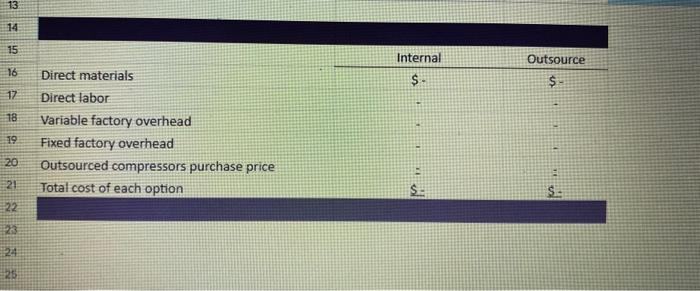

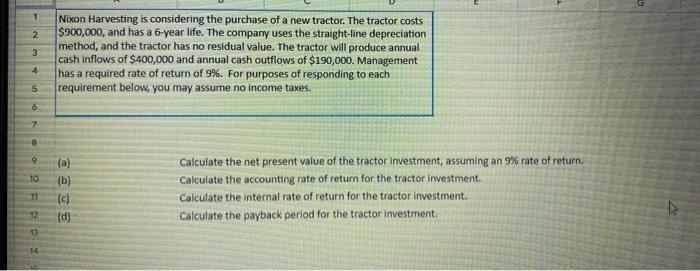

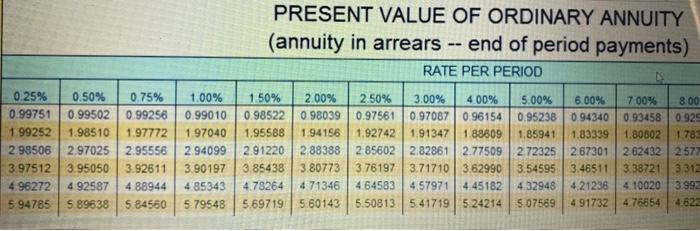

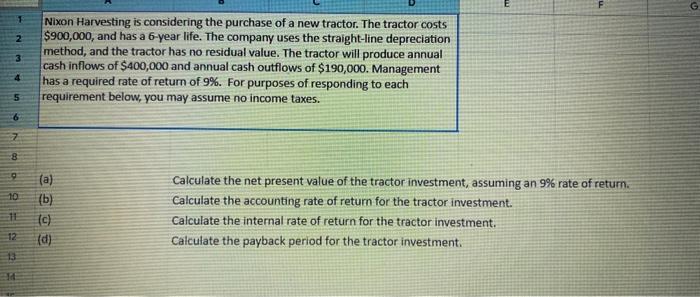

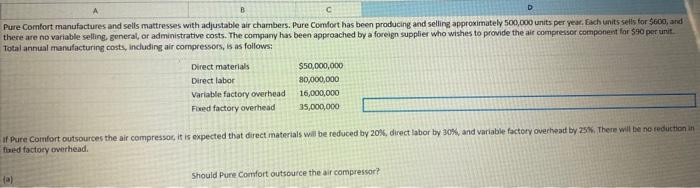

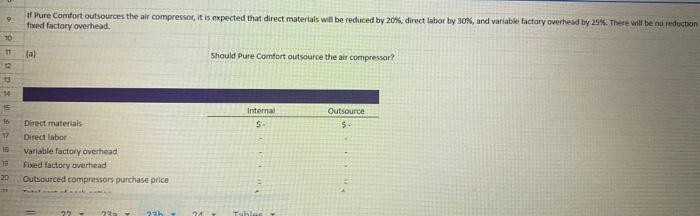

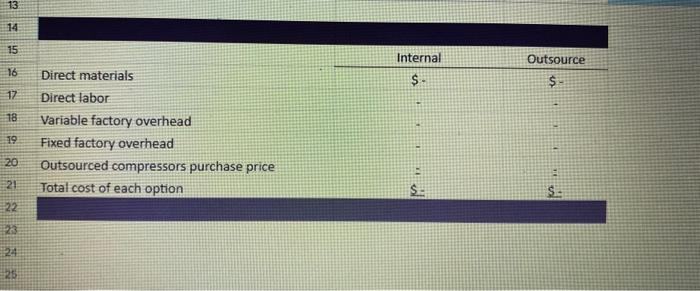

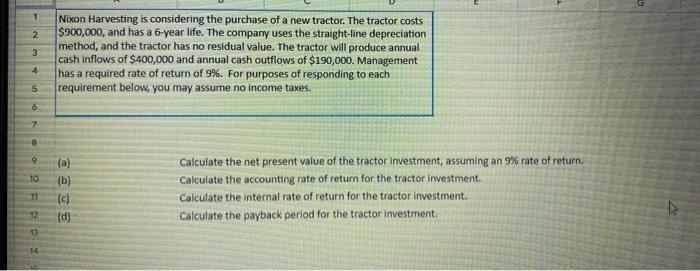

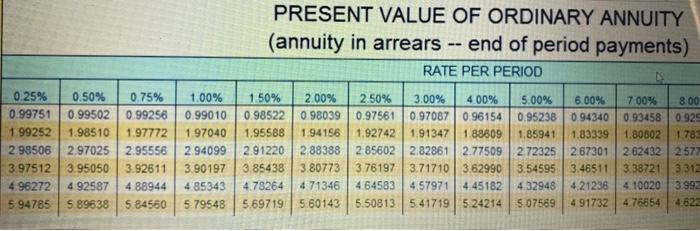

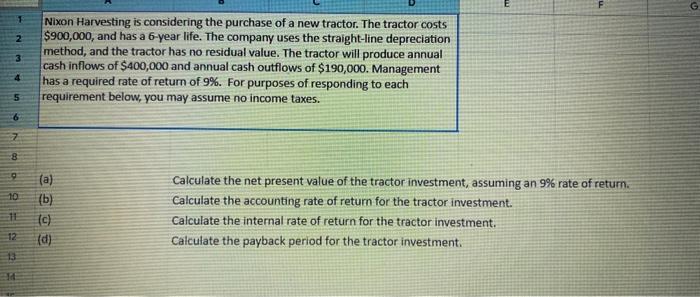

The standard hours aliowed for the units produced were 4.70 airect labor hours at an average hourly rate of 3,000 hours (1,000 gallons 3 hours). 1.Prepare an income statement for 2017 under absorption costing 2.Prepare an income statement for 2017 under variable costing 3. Explain when absorption costing is a preferred method over variable costing? 4. Explain when variable costing is a preferred method over absorption costing? Zbest MFG Zbest MFG Income Statement (Absorption Costing) Income Statement (Variable Costing) For tha Vaar Fonded Deenmhar 317017 Far the Year Fanded Derember M1 ?017 1.Prepare an income statement for 2017 under absorption costing 2. Propare an income statement for 2017 under variable costing 3. Explain when absorption costing is a preferred method over variable costing? 4. Explain when variable costing is a preferred method over absorption costing? \begin{tabular}{|l|l} \hline & A \\ \hline 23 & \\ \hline 22 \\ 23 \\ \hline 24 & \\ \hline 25 & \\ \hline 20 & COGS: \end{tabular} Pure Comfort manufactures and sells mattresses with adjustable air chambers. Pure Comfort has been producing and selling approximately 500,000 units per Yeac, Fach units sells for $600, and there are no variable selling, Beneral, or administrative costs. The company has been approached by a foreign supplier who wishes to provide the air compressor component far $90 per unit. Total annual manefacturing costs, including air compressors, is as follows: If Pure comfort outsources the air compressac, it is expected that direct materials will be reduced by 20 ok, direct labor by 30%, and variable factory overhead by 25 , there will be ne seduction in flaed factory overhead. (a) Should Pure Comfort outsource the air compressor? If Pure Comfort outsources the air compressoc, it is expected that direct materials will be reduced by 20 s. direct labor by 30 s, and variable fictary overhesd by 25%. There mill be no ieduction fixed factory overhead, (a) Should Pure Comtort outsource the air compressor? 13 14 15 16 Direct materials 17. Direct labor 18 Variable factory overhead 19 Fixed factory overhead 20 Outsourced compressors purchase price 21 Total cost of each option S- $ 22 Calculate the net present value of the tractor investment, assuming an 9% rate of return. Calculate the accounting rate of return for the tractor investment. Calculate the internal rate of return for the tractor investment. Calculate the payback period for the tractor investment. PRESENT VALUE OF ORDINARY ANNUITY (annuity in arrears -- end of period payments) Calculate the net present value of the tractor investment, assuming an 9% rate of retum. Calculate the accounting rate of retum for the tractor investment. Calculate the internal rate of return for the tractor investment. Calculate the payback period for the tractor investment. The standard hours aliowed for the units produced were 4.70 airect labor hours at an average hourly rate of 3,000 hours (1,000 gallons 3 hours). 1.Prepare an income statement for 2017 under absorption costing 2.Prepare an income statement for 2017 under variable costing 3. Explain when absorption costing is a preferred method over variable costing? 4. Explain when variable costing is a preferred method over absorption costing? Zbest MFG Zbest MFG Income Statement (Absorption Costing) Income Statement (Variable Costing) For tha Vaar Fonded Deenmhar 317017 Far the Year Fanded Derember M1 ?017 1.Prepare an income statement for 2017 under absorption costing 2. Propare an income statement for 2017 under variable costing 3. Explain when absorption costing is a preferred method over variable costing? 4. Explain when variable costing is a preferred method over absorption costing? \begin{tabular}{|l|l} \hline & A \\ \hline 23 & \\ \hline 22 \\ 23 \\ \hline 24 & \\ \hline 25 & \\ \hline 20 & COGS: \end{tabular} Pure Comfort manufactures and sells mattresses with adjustable air chambers. Pure Comfort has been producing and selling approximately 500,000 units per Yeac, Fach units sells for $600, and there are no variable selling, Beneral, or administrative costs. The company has been approached by a foreign supplier who wishes to provide the air compressor component far $90 per unit. Total annual manefacturing costs, including air compressors, is as follows: If Pure comfort outsources the air compressac, it is expected that direct materials will be reduced by 20 ok, direct labor by 30%, and variable factory overhead by 25 , there will be ne seduction in flaed factory overhead. (a) Should Pure Comfort outsource the air compressor? If Pure Comfort outsources the air compressoc, it is expected that direct materials will be reduced by 20 s. direct labor by 30 s, and variable fictary overhesd by 25%. There mill be no ieduction fixed factory overhead, (a) Should Pure Comtort outsource the air compressor? 13 14 15 16 Direct materials 17. Direct labor 18 Variable factory overhead 19 Fixed factory overhead 20 Outsourced compressors purchase price 21 Total cost of each option S- $ 22 Calculate the net present value of the tractor investment, assuming an 9% rate of return. Calculate the accounting rate of return for the tractor investment. Calculate the internal rate of return for the tractor investment. Calculate the payback period for the tractor investment. PRESENT VALUE OF ORDINARY ANNUITY (annuity in arrears -- end of period payments) Calculate the net present value of the tractor investment, assuming an 9% rate of retum. Calculate the accounting rate of retum for the tractor investment. Calculate the internal rate of return for the tractor investment. Calculate the payback period for the tractor investment