Question

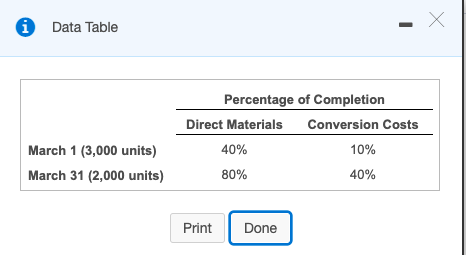

The Stanton Processing Company had work in process at the beginning and end of March 2017 in its Painting Department as follows: The company completed

The Stanton Processing Company had work in process at the beginning and end of March 2017 in its Painting Department as follows:

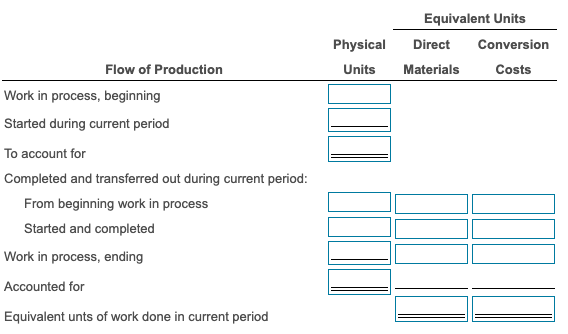

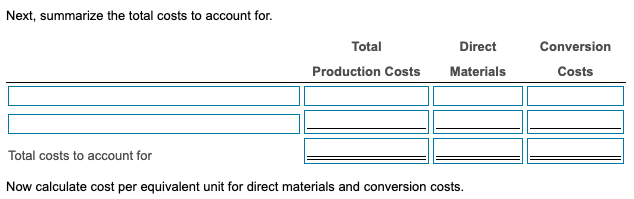

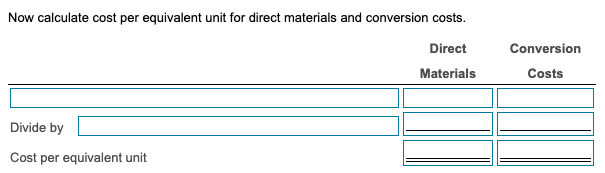

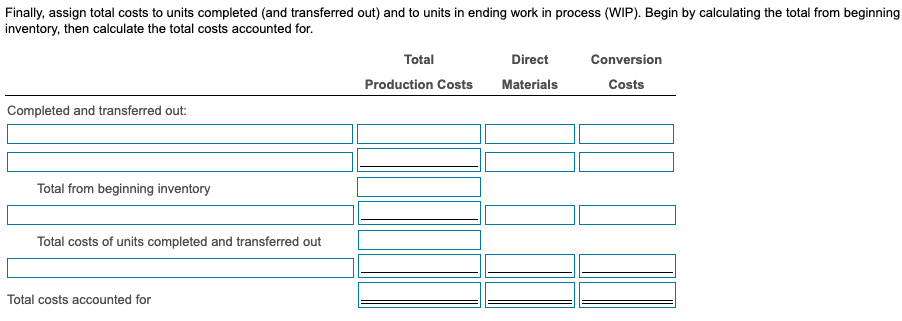

The company completed 30,000 units during March. Manufacturing costs incurred during March were direct materials costs of $176,320 and conversion costs of $312,625. Inventory at March 1 was carried at a cost of $16,155 (direct materials$5,380 and conversion costs$10,775). Assuming Stanton uses FIFO costing, determine the equivalent units of work done in March, and calculate the cost of units completed and the cost of units in ending inventory.

If possible, can a break down of the calculations be made? As I have been stuck on this problem for a while. Thank you for your help in advance :)

Begin by entering the physical units in first, then calculate the equivalent units.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started