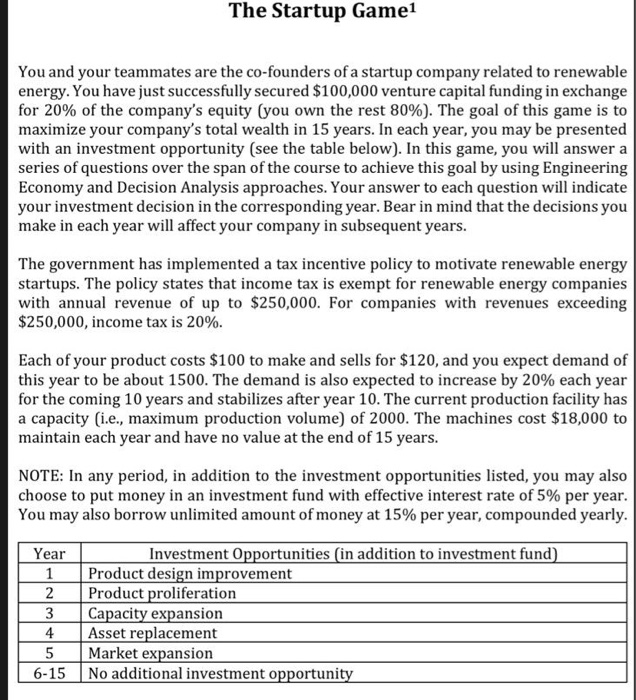

The Startup Game1 You and your teammates are the co-founders of a startup company related to renewable energy. You have just successfully secured $100,000 venture capital funding in exchange for 20% of the company's equity (you own the rest 80 %). The goal of this game is to maximize your company's total wealth in 15 years. In each year, you may be presented with an investment opportunity (see the table below). In this game, you will answer a series of questions over the span of the course to achieve this goal by using Engineering Economy and Decision Analysis approaches. Your answer to each question will indicate your investment decision in the corresponding year. Bear in mind that the decisions you make in each year will affect your company in subsequent years. The government has implemented a tax incentive policy to motivate renewable energy startups. The policy states that income tax is exempt for renewable energy companies with annual revenue of up to $250,000. For companies with revenues exceeding $250,000, income tax is 20%. Each of your product costs $100 to make and sells for $120, and you expect demand of this year to be about 1500. The demand is also expected to increase by 20 % each year for the coming 10 years and stabilizes after year 10. The current production facility has a capacity (i.e., maximum production volume) of 2000. The machines cost $18,000 to maintain each year and have no value at the end of 15 years. NOTE: In any period, in addition to the investment opportunities listed, you may also choose to put money in an investment fund with effective interest rate of 5% per year. You may also borrow unlimited amount of money at 15% per year, compounded yearly. Investment Opportunities (in addition to investment fund) Year Product design improvement Product proliferation Capacity expansion Asset replacement Market expansion No additional investment opportunity 1 3 5 6-15 The Startup Game1 You and your teammates are the co-founders of a startup company related to renewable energy. You have just successfully secured $100,000 venture capital funding in exchange for 20% of the company's equity (you own the rest 80 %). The goal of this game is to maximize your company's total wealth in 15 years. In each year, you may be presented with an investment opportunity (see the table below). In this game, you will answer a series of questions over the span of the course to achieve this goal by using Engineering Economy and Decision Analysis approaches. Your answer to each question will indicate your investment decision in the corresponding year. Bear in mind that the decisions you make in each year will affect your company in subsequent years. The government has implemented a tax incentive policy to motivate renewable energy startups. The policy states that income tax is exempt for renewable energy companies with annual revenue of up to $250,000. For companies with revenues exceeding $250,000, income tax is 20%. Each of your product costs $100 to make and sells for $120, and you expect demand of this year to be about 1500. The demand is also expected to increase by 20 % each year for the coming 10 years and stabilizes after year 10. The current production facility has a capacity (i.e., maximum production volume) of 2000. The machines cost $18,000 to maintain each year and have no value at the end of 15 years. NOTE: In any period, in addition to the investment opportunities listed, you may also choose to put money in an investment fund with effective interest rate of 5% per year. You may also borrow unlimited amount of money at 15% per year, compounded yearly. Investment Opportunities (in addition to investment fund) Year Product design improvement Product proliferation Capacity expansion Asset replacement Market expansion No additional investment opportunity 1 3 5 6-15