Question

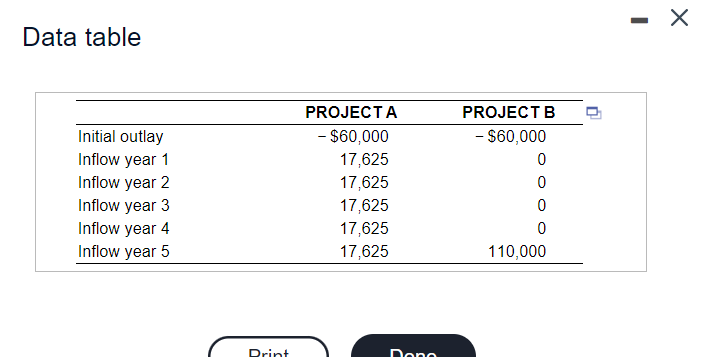

the State Spartan Corporation is considering two mutually exclusive projects. The free cash flows associated with these projects are shown in the popup window. The

the State Spartan Corporation is considering two mutually exclusive projects. The free cash flows associated with these projects are shown in the popup window. The required rate of return on these projects is 7 percent.

a. What is each project's payback period? b. What is each project's NPV? c. What is each project's IRR? d. What has caused the ranking conflict? e. Which project should be accepted? Why?

a. What is the payback period of project A? What is the payback period of project B?

b. What is the NPV of project A? What is the NPV of project B?

c. What is the IRR of project A? What is the IRR of project B?

multiple choice

What has caused the ranking conflict?

a. The free cash flows generated by the projects are different b. the projects evaluated have the same initial cash outlay c. the two projects are independent d. the npv and irr decision criteria have different reinvestment assumptions.

Which project should be accepted? why?

a. Neither project A nor B should be chosen because ranking conflict exists among different decision criteria. Different decision criteria should yield the same result.

b. Project A should be chosen because it has lower payback period. The payback period is preferred because it can be easily computed.

c. Project B should be chosen because it has higher NPV. The NPV criterion is preferred because it makes the most acceptable reinvestment assumption for the wealth-maximizing firm.

d. Project A should be chosen because it has higher IRR. The IRR criterion is preferred because it makes the most acceptable reinvestment assumption for the wealth-maximizing firm.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started