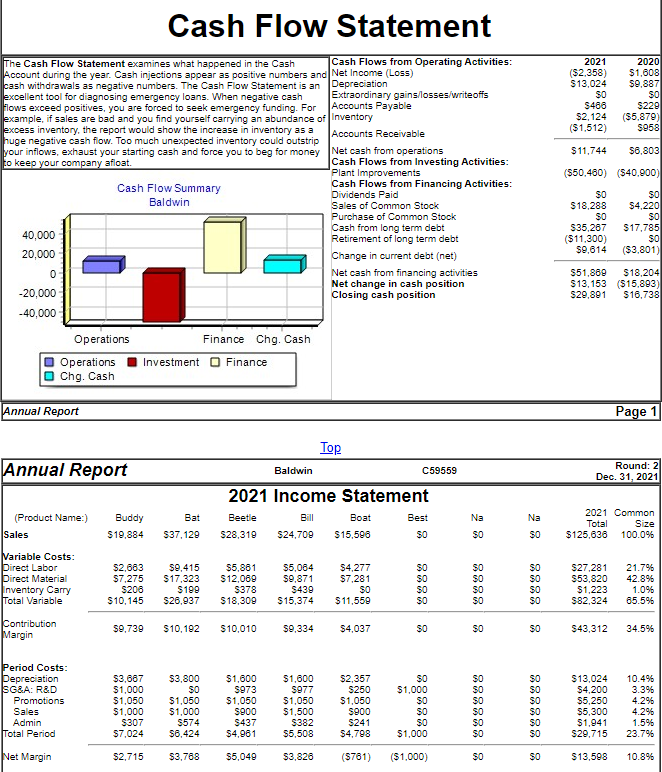

| The statement of cash flows for Baldwin Company shows what happens in the Cash account during the year. It can be seen as a summary of the sources and uses of cash (sources of cash are added, uses of cash are subtracted). Please answer which of the following is true if Baldwin's inventory goes up: |

| Select: 1 |

| | It is a source of cash, and will be shown in the investing section as an addition. | | | It is a source of cash and will be shown in the operating section as an addition. | | | It is a use of cash, and will be shown in the operating section as a subtraction. | | | It is a use of cash, and will be shown in the investing section as a subtraction. | |

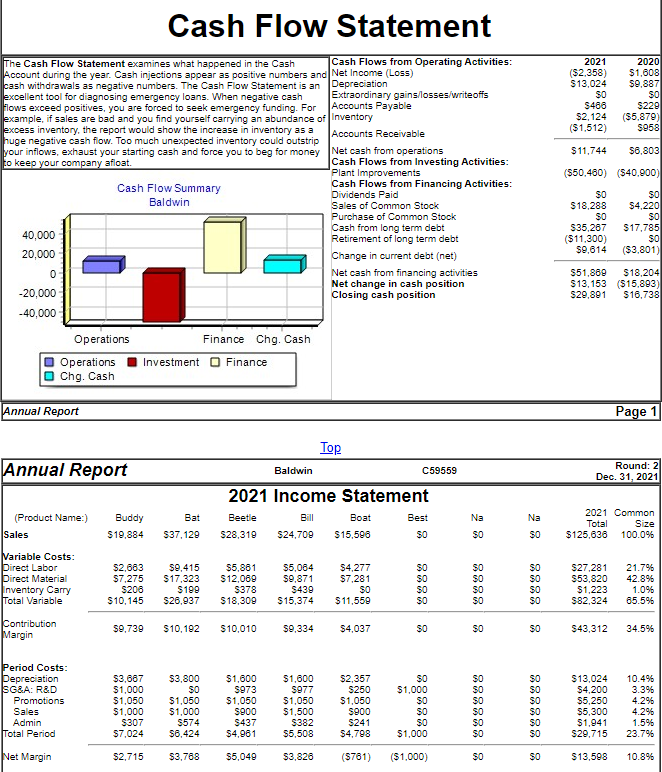

Cash Flow Statement 2021 ($2.358) $13,024 2020 $1,608 $9,887 SO S466 $2,124 ($1.512) 229 ($5.879) 5958 $11,744 $8,803 (550.480) (540,900) The Cash Flow Statement examines what happened in the Cash Cash Flows from Operating Activities: Account during the year. Cash injections appear as positive numbers and Net Income (Loss) cash withdrawals as negative numbers. The Cash Flow Statement is an Depreciation excellent tool for diagnosing emergency loans. When negative cash Extraordinary gains/losses/writeoffs Flows exceed positives, you are forced to seek emergency funding. For Accounts Payable example, if sales are bad and you find yourself carrying an abundance of Inventory excess inventory, the report would show the increase in inventory as a Accounts Receivable huge negative cash flow. Too much unexpected inventory could outstrip your inflows, exhaust your starting cash and force you to beg for money Net cash from operations to keep your company afloat. Cash Flows from Investing Activities: Plant Improvements Cash Flow Summary Cash Flows from Financing Activities: Dividends Paid Baldwin Sales of Common Stock Purchase of Common Stock Cash from long term debt 40,000 Retirement of long term debt 20,000 Change in current debt (net) 0 Net cash from financing activities Net change in cash position -20,000 Closing cash position -40,000 SO $4,220 $18,288 SO S35,287 ($11.300) 59,614 $17,785 SO (53.801) $51,869 $13,153 $29,891 $18,204 ($15.893) S16,738 Operations Operations Chg. Cash Finance Chg. Cash Investment Finance Annual Report Page 1 Annual Report Round: 2 Dec. 31, 2021 Top Baldwin C59559 2021 Income Statement Beetle Bill Boat Best $28,319 324,709 $15,598 (Product Name:) Sales Buddy $19,884 Bat $37,129 2021 Common Total Size $125,636 100.0% $0 Variable Costs: Direct Labor Pirect Material Inventory Carry Total Variable $2,683 $7.275 $206 $10,145 59,415 $17,323 $199 26,937 $5,861 $12,069 $378 $18,309 $5,064 $9,871 S439 S15,374 $4,277 $7.281 $0 $27,281 $53,820 $1,223 $82,324 21.796 42.896 1.096 65.5% $11,559 Contribution Margin $9,739 $10,192 $10,010 $9,334 $4,037 S43,312 34.5% $1.000 Period Costs: Depreciation SG&A: R&D Promotions Sales Admin Total Period $3,687 $1,000 $1,050 $1,000 S307 $7,024 $3,800 SO $1,050 $1,000 S574 $8,424 $1,600 S973 $1,050 8900 S437 $4.081 $1,600 S977 $1,050 $1,500 $382 $5,508 $2,357 $250 $1,050 S000 S241 $4.708 $13,024 $4,200 $5,250 $5,300 $1,941 $29,715 10.496 3.39% 4.2% 4.2% 1.5% 23.796 $1,000 Net Margin $2,715 $3,788 $5,049 $3,826 (5761) ($1.000) $13,598 10.89