The Statement of Cash Flows provides a great deal of information to investors. Please obtain a copy of a Statement of Cash Flows under IFRS and contrast it with another companys under GAAP. What are the major differences that you see?

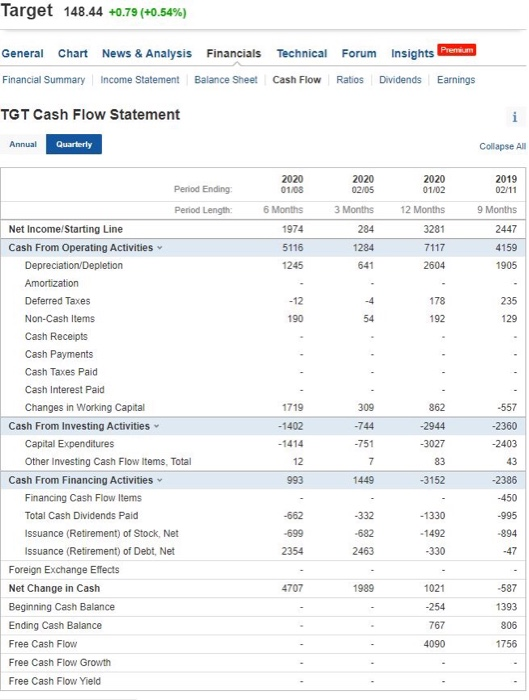

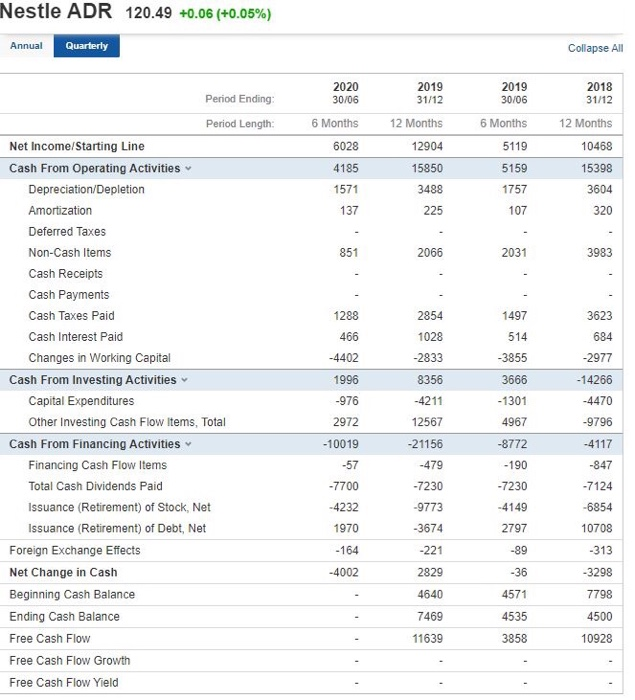

Target GAAP cash flow. Nestle IFRS cash flow

Target 148.44 +0.79 (+0.54%) General Chart News & Analysis Financials Technical Forum Insights Premium Financial Summary Income Statement Balance Sheet Cash Flow Ratios Dividends Earnings TGT Cash Flow Statement Annual Quarterly Collapse All 2020 01/08 2020 01/02 2019 02/11 6 Months 2020 02/05 3 Months 284 12 Months 9 Months 1974 3281 2447 5116 1284 7117 2604 4159 1905 1245 641 178 235 -12 190 192 129 1719 309 862 -744 Period Ending Period Length: Net Income/Starting Line Cash From Operating Activities Depreciation/Depletion Amortization Deferred Taxes Non-Cash Items Cash Receipts Cash Payments Cash Taxes Paid Cash Interest Paid Changes in Working Capital Cash From Investing Activities Capital Expenditures Other Investing Cash Flow Items, Total Cash From Financing Activities Financing Cash Flow Items Total Cash Dividends Paid Issuance (Retirement) of Stock, Net Issuance (Retirement) of Debt, Net Foreign Exchange Effects Net Change in Cash Beginning Cash Balance Ending Cash Balance Free Cash Flow Free Cash Flow Growth Free Cash Flow Yield -1402 -1414 12 -2944 -3027 -557 -2360 -2403 43 -751 7 83 993 1449 -3152 -2386 -450 -332 -995 -662 -699 -682 2463 - 1330 - 1492 -330 -894 -47 2354 4707 1989 1021 -254 -587 1393 767 806 4090 1756 Nestle ADR 120.49 +0.06 (+0.05%) Annual Quarterly Collapse All 2020 30/06 2019 30/06 2018 31/12 12 Months 6 Months 6028 4185 1571 2019 31/12 12 Months 12904 15850 3488 6 Months 5119 5159 1757 10468 15398 3604 137 225 107 320 851 2066 2031 3983 2854 3623 1028 1497 514 -3855 684 -2833 -2977 8356 3666 -14266 Period Ending Period Length: Net Income/Starting Line Cash From Operating Activities Depreciation/Depletion Amortization Deferred Taxes Non-Cash Items Cash Receipts Cash Payments Cash Taxes Paid Cash Interest Paid Changes in Working Capital Cash From Investing Activities Capital Expenditures Other Investing Cash Flow items, Total Cash From Financing Activities Financing Cash Flow Items Total Cash Dividends Paid Issuance (Retirement) of Stock, Net Issuance (Retirement) of Debt, Net Foreign Exchange Effects Net Change in Cash Beginning Cash Balance Ending Cash Balance Free Cash Flow Free Cash Flow Growth Free Cash Flow Yield -4211 -1301 -4470 1288 466 -4402 1996 -976 2972 -10019 -57 -7700 -4232 1970 4967 -9796 12567 -21156 -479 -4117 -8772 -190 -847 -7230 -7230 -7124 -9773 -4149 -6854 -3674 2797 10708 - 164 -221 -89 -313 -4002 2829 -36 -3298 4640 7798 4571 4535 7469 4500 11639 3858 10928