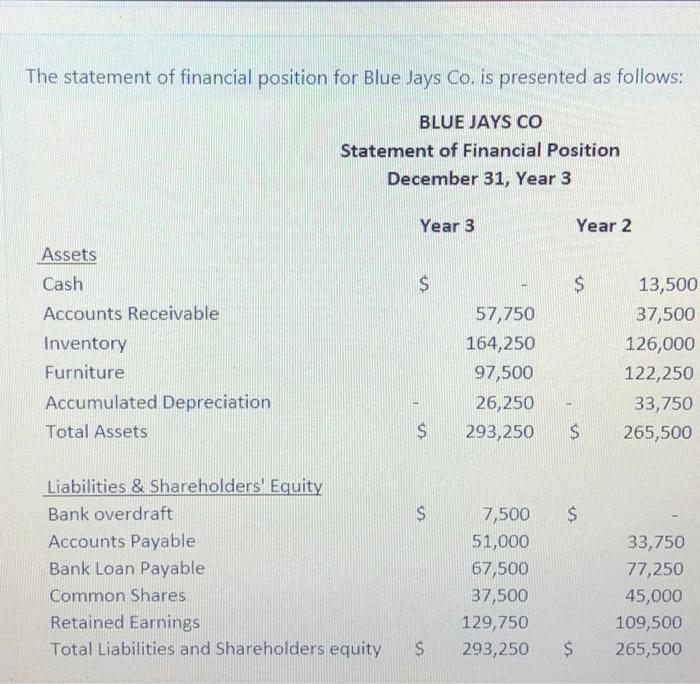

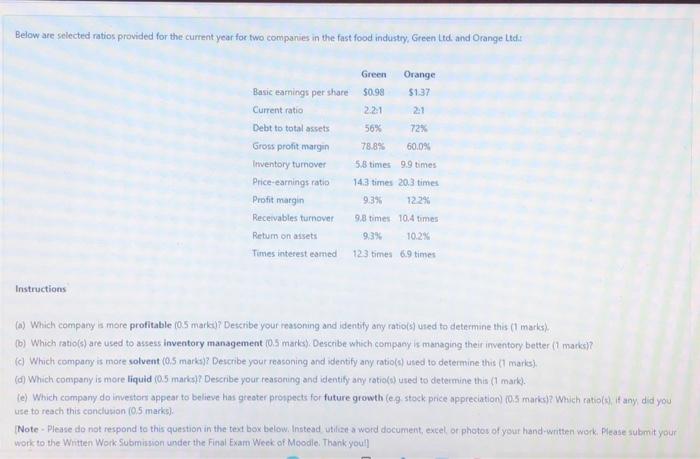

The statement of financial position for Blue Jays Co. is presented as follows: BLUE JAYS CO Statement of Financial Position December 31, Year 3 Year 3 Year 2 $ $ Assets Cash Accounts Receivable Inventory Furniture Accumulated Depreciation Total Assets 57,750 164,250 97,500 26,250 293,250 13,500 37,500 126,000 122,250 33,750 265,500 S $ $ $ Liabilities & Shareholders' Equity Bank overdraft Accounts Payable Bank Loan Payable Common Shares Retained Earnings Total Liabilities and Shareholders equity 7,500 51,000 67,500 37,500 129,750 293,250 33,750 77,250 45,000 109,500 265,500 $ $ Below are selected ratios provided for the current year for two companies in the fast food industry, Green Ltd and Orange Ltd Green 50.98 2.2.1 Orange $1.37 2.1 Basic earnings per share Current ratio Debt to total assets Gross profit margin Inventory turnover Price-earnings ratio 56% 72% 78.8% 60.0% 5.8 times 9.9 times 143 times 20.3 times 9.3% 12.2% Profit margin Receivables turnover Retum on assets Times interesteamed 9.8 times 10,4 times 93% 10.2% 123 times 6.9 times Instructions (b) Which company is more profitable (0.5 marki)? Describe your reasoning and identify any ratio(s) used to determine this (1 marks) (b) Which ratios) are used to assess inventory management 0.5 marks) Describe which company is managing their inventory better marks)? (e) Which company is more solvent (0,5 marks)? Describe your reasoning and identify any ratio(s) used to determine this (1 marks). (d) Which company is more liquid (0.5 maris)? Describe your reasoning and identify any ratio) used to determine this (1 mark). le) Which company do investors appear to believe has greater prospects for future growth (eg stock price appreciation (05 marks)? Which ratio) it any did you use to reach this conclusion (0.5 marks) Note - Please do not respond to this question in the text box below. Instead utilize a word document, excel or photos of your hand-written work. Please submit your work to the Written Work Submission under the Final Exam Week of Moodle: Thank you