Question

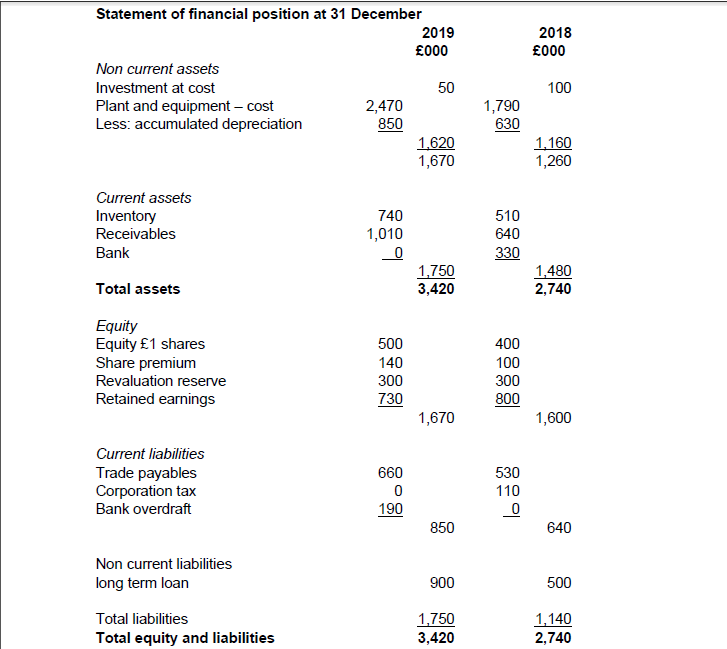

The Statement of financial position of Calvert Ltd at 31 December 2019 is as follows: The following information is available: i)Loss before taxation: 50,000 ii)Plant

The Statement of financial position of Calvert Ltd at 31 December 2019 is as follows:

The following information is available:

i)Loss before taxation: 50,000

ii)Plant and equipment with an original cost of 120,000 and accumulated depreciation of 80,000 was sold in February 2019 for 30,000

iii)Interest paid in the year totalled 70,000

iv)No dividends were paid

v)There is no tax liability for the year to 31 December 2019. The tax liability for the year to 31 December 2018 was underestimated by 20,000.

Required: (a) Prepare a statement of cash flow for Calvert Ltd for the year to 31 December 2019. (b) Illustrate why the Statement of Cash Flow is important for potential investors in their decision making process.

2018 000 Statement of financial position at 31 December 2019 000 Non current assets Investment at cost 50 Plant and equipment -cost 2,470 Less: accumulated depreciation 850 1.620 1,670 100 1,790 630 1.160 1,260 Current assets Inventory Receivables Bank 740 1,010 0 510 640 330 Total assets 1,750 3,420 1,480 2,740 Equity Equity 1 shares Share premium Revaluation reserve Retained earnings 500 140 300 730 400 100 300 800 1,670 1,600 Current liabilities Trade payables Corporation tax Bank overdraft 660 0 190 530 110 0 850 640 Non current liabilities long term loan 900 500 Total liabilities Total equity and liabilities 1.750 3,420 1,140 2,740Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started