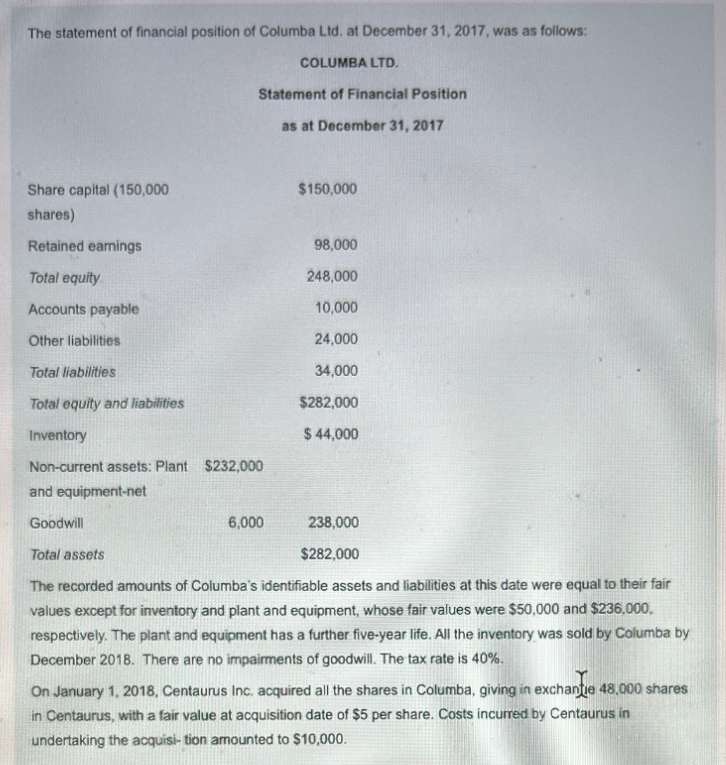

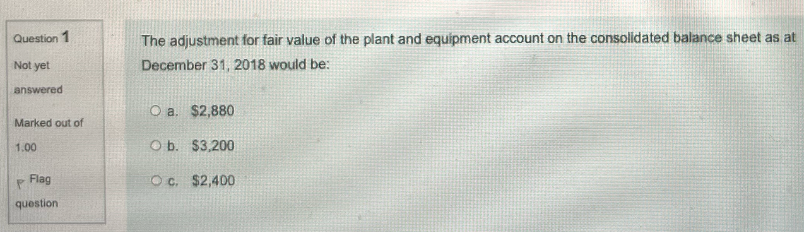

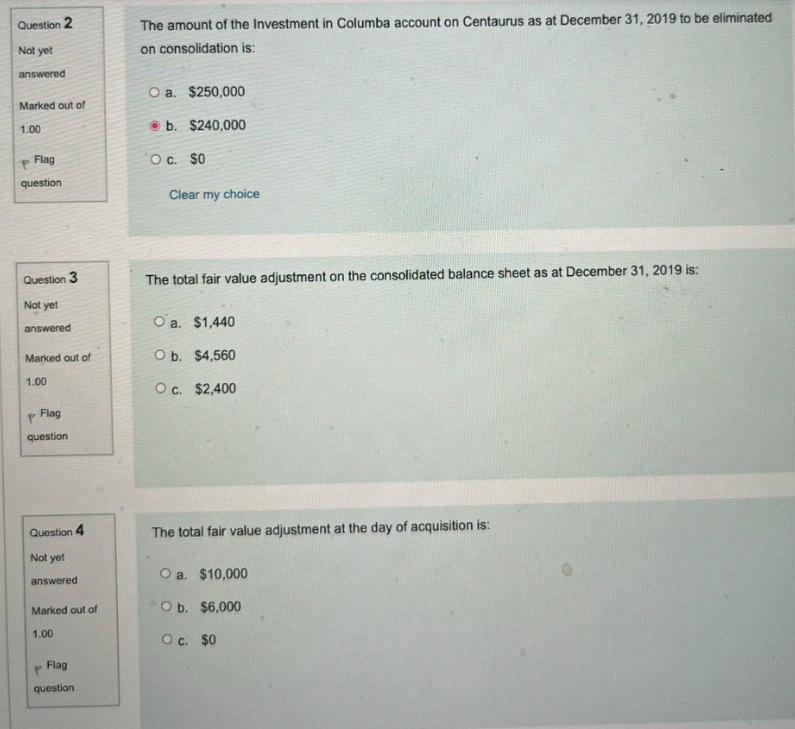

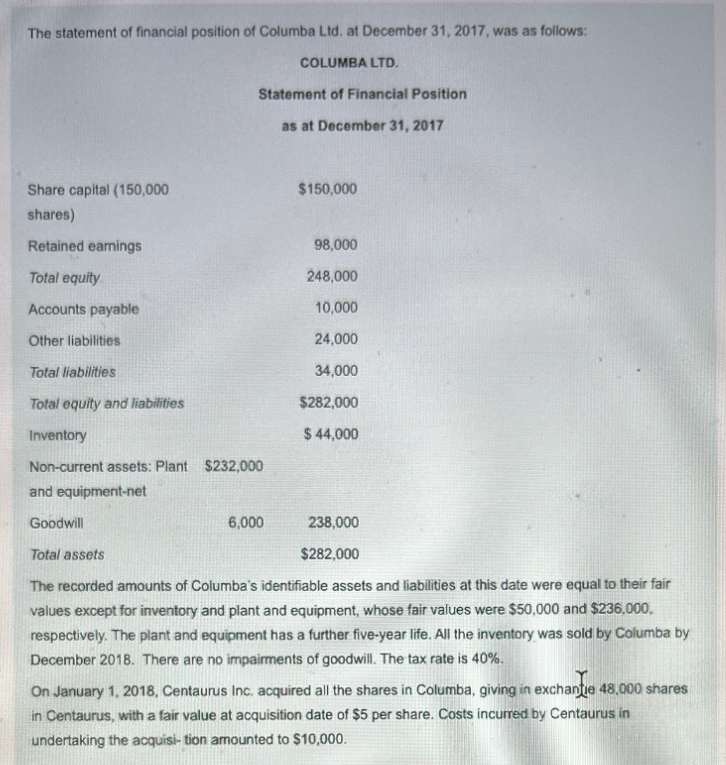

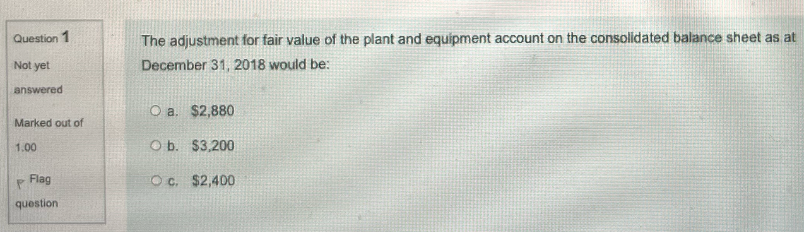

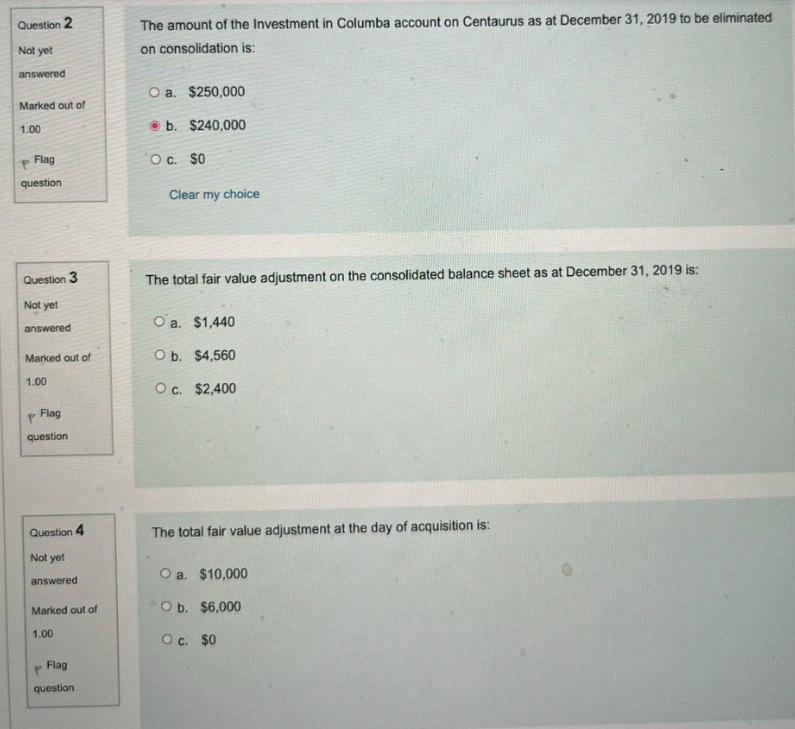

The statement of financial position of Columba Ltd. at December 31, 2017, was as follows: COLUMBA LTD. Position 2017 The recorded amounts of Columba's identifiable assets and liabilities at this date were equal to their fair values except for inventory and plant and equipment, whose fair values were $50,000 and $236,000, respectively. The plant and equipment has a further five-year life. All the inventory was sold by Columba by December 2018. There are no impairments of goodwill. The tax rate is 40%. On January 1, 2018, Centaurus Inc. acquired all the shares in Columba, giving in exchantee 48,000 shares in Centaurus, with a fair value at acquisition date of $5 per share. Costs incurred by Centaurus in undertaking the acquisi- tion amounted to $10,000. Question 1 The adjustment for fair value of the plant and equipment account on the consolidated balance sheet as at Not yet December 31,2018 would be: answered Marked out of a. $2,880 1.00 b. $3,200 Flag c. $2,400 The amount of the Investment in Columba account on Centaurus as at December 31,2019 to be eliminated on consolidation is: a. $250,000 b. $240,000 c. $0 Clear my choice The total fair value adjustment on the consolidated balance sheet as at December 31, 2019 is: a. $1,440 b. $4,560 c. $2,400 The total fair value adjustment at the day of acquisition is: a. $10,000 b. $6,000 c. $0 The statement of financial position of Columba Ltd. at December 31, 2017, was as follows: COLUMBA LTD. Position 2017 The recorded amounts of Columba's identifiable assets and liabilities at this date were equal to their fair values except for inventory and plant and equipment, whose fair values were $50,000 and $236,000, respectively. The plant and equipment has a further five-year life. All the inventory was sold by Columba by December 2018. There are no impairments of goodwill. The tax rate is 40%. On January 1, 2018, Centaurus Inc. acquired all the shares in Columba, giving in exchantee 48,000 shares in Centaurus, with a fair value at acquisition date of $5 per share. Costs incurred by Centaurus in undertaking the acquisi- tion amounted to $10,000. Question 1 The adjustment for fair value of the plant and equipment account on the consolidated balance sheet as at Not yet December 31,2018 would be: answered Marked out of a. $2,880 1.00 b. $3,200 Flag c. $2,400 The amount of the Investment in Columba account on Centaurus as at December 31,2019 to be eliminated on consolidation is: a. $250,000 b. $240,000 c. $0 Clear my choice The total fair value adjustment on the consolidated balance sheet as at December 31, 2019 is: a. $1,440 b. $4,560 c. $2,400 The total fair value adjustment at the day of acquisition is: a. $10,000 b. $6,000 c. $0