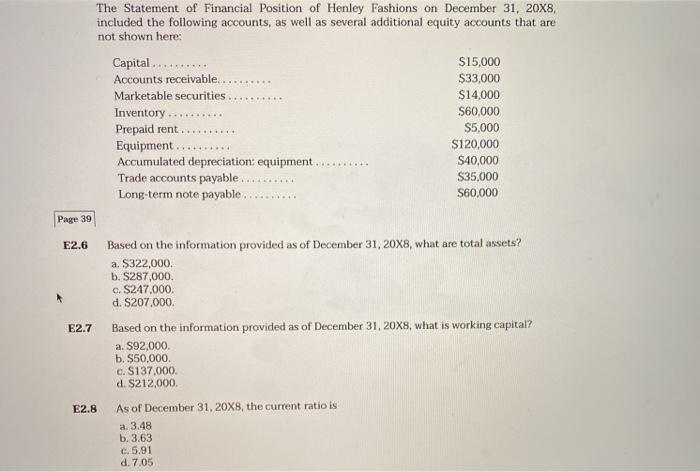

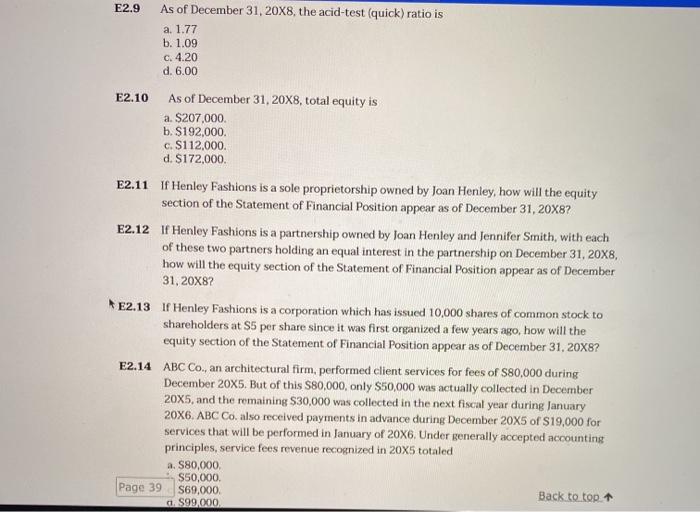

The Statement of Financial Position of Henley Fashions on December 31, 20x8, included the following accounts, as well as several additional equity accounts that are not shown here: Capital ......... $15,000 Accounts receivable.... $33,000 Marketable securities $14,000 Inventory S60,000 Prepaid rent $5,000 Equipment. $120,000 Accumulated depreciation equipment. $40,000 Trade accounts payable. $35,000 Long-term note payable S60,000 Page 39 E2.6 E2.7 Based on the information provided as of December 31, 20x8, what are total assets? a. S322,000. b. $287,000. c. $247.000 d. $207,000. Based on the information provided as of December 31, 20x8, what is working capital? a. $92,000 b. $50,000 c. $137,000. d. S212,000 As of December 31, 20X8, the current ratio is a 3.48 b. 3.63 c. 5.91 d. 7.05 E2.8 E2.9 As of December 31, 20X8, the acid-test (quick) ratio is a. 1.77 b. 1.09 C. 4.20 d. 6.00 E2.10 As of December 31, 20X8, total equity is a $207,000 b. $192,000 c. $112.000. d. $172,000 E2.11 If Henley Fashions is a sole proprietorship owned by Joan Henley, how will the equity section of the Statement of Financial Position appear as of December 31, 20X8? E2.12 If Henley Fashions is a partnership owned by Joan Henley and Jennifer Smith, with each of these two partners holding an equal interest in the partnership on December 31, 20X8, how will the equity section of the Statement of Financial Position appear as of December 31, 20X8? E2.13 If Henley Fashions is a corporation which has issued 10,000 shares of common stock to shareholders at $5 per share since it was first organized a few years ago, how will the equity section of the Statement of Financial Position appear as of December 31, 20x8? E2.14 ABC Co., an architectural firm, performed client services for fees of S80,000 during December 20X5. But of this $80,000, only $50,000 was actually collected in December 20x5, and the remaining $30,000 was collected in the next fiscal year during January 20X6. ABC Co. also received payments in advance during December 20x5 of $19,000 for services that will be performed in January of 20X6. Under generally accepted accounting principles, service fees revenue recognized in 20x5 totaled a. S80,000 $50,000 Page 39 S69,000 Back to top 1. $99.000