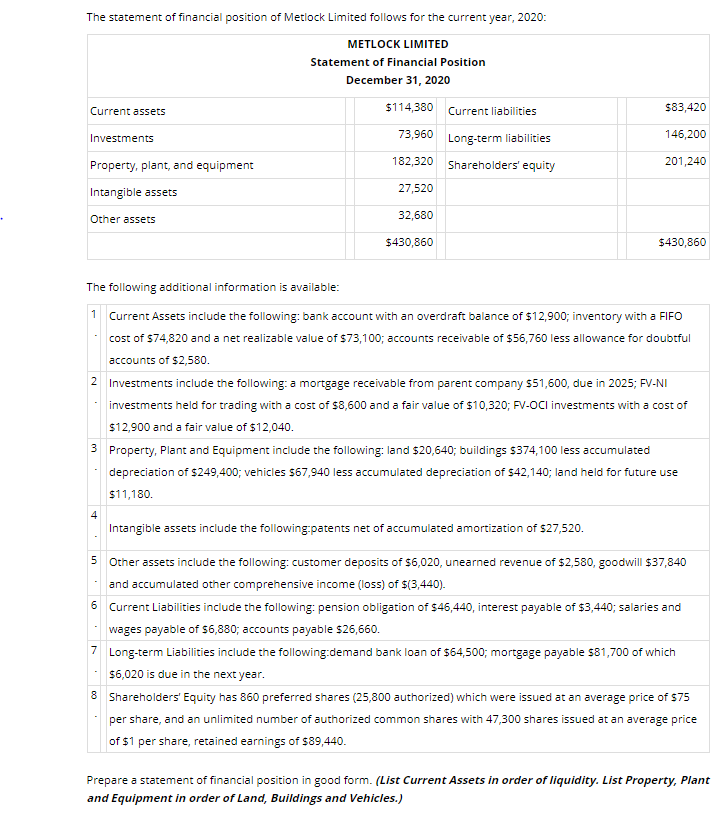

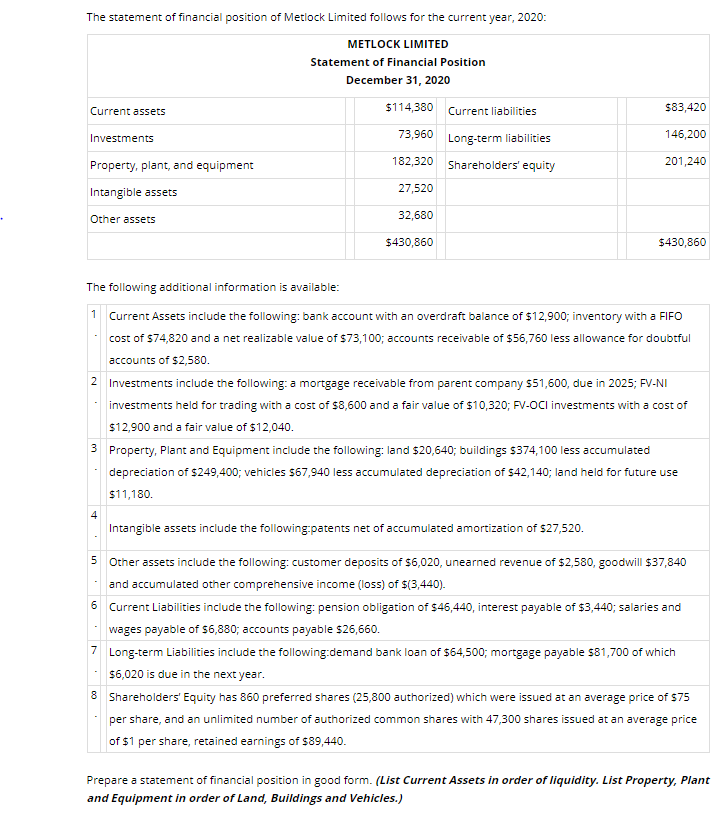

The statement of financial position of Metlock Limited follows for the current year, 2020: METLOCK LIMITED Statement of Financial Position December 31, 2020 Current assets $114,380 Current liabilities $83,420 Investments Long-term liabilities 146,200 73,960 182,320 Property, plant, and equipment Shareholders' equity 201,240 Intangible assets 27,520 Other assets 32,680 $430,860 $430,860 The following additional information is available: Current Assets include the following: bank account with an overdraft balance of $12,900; inventory with a FIFO cost of 574,820 and a net realizable value of $73,100; accounts receivable of $56,760 less allowance for doubtful accounts of $2,580. Investments include the following: a mortgage receivable from parent company 551,600, due in 2025; FV-NI investments held for trading with a cost of $8,600 and a fair value of $10,320; FV-OCl investments with a cost of $12,900 and a fair value of $12,040. Property, Plant and Equipment include the following: land $20,640; buildings 5374,100 less accumulated depreciation of $249,400; vehicles $67,940 less accumulated depreciation of $42,140; land held for future use $11,180. Intangible assets include the following patents net of accumulated amortization of $27,520. Other assets include the following: customer deposits of $6,020, unearned revenue of $2,580, goodwill $37,840 and accumulated other comprehensive income (loss) of $(3,440). Current Liabilities include the following: pension obligation of $46,440, interest payable of $3,440; salaries and wages payable of $6,880; accounts payable $26,660. Long-term Liabilities include the following demand bank loan of $64,500; mortgage payable 581,700 of which $6,020 is due in the next year. Shareholders' Equity has 860 preferred shares (25,800 authorized) which were issued at an average price of $75 per share, and an unlimited number of authorized common shares with 47,300 shares issued at an average price of $1 per share, retained earnings of $89,440. 8 Prepare a statement of financial position in good form. (List Current Assets in order of liquidity. List Property, Plant and Equipment in order of Land, Buildings and Vehicles.)