Answered step by step

Verified Expert Solution

Question

1 Approved Answer

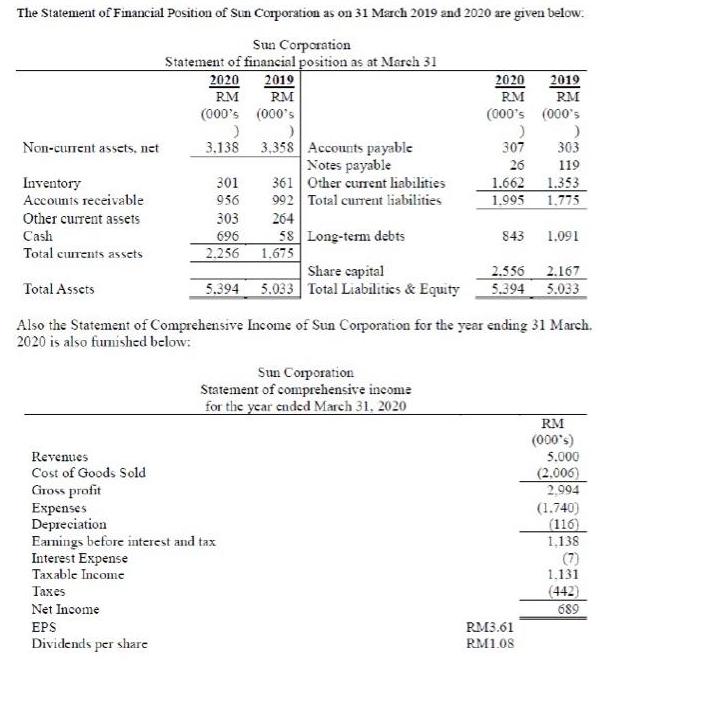

The Statement of Financial Position of Sun Corporation as on 31 March 2019 and 2020 are given below. Sun Corporation Statement of financial position

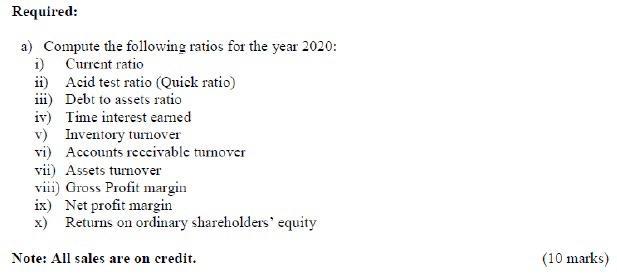

The Statement of Financial Position of Sun Corporation as on 31 March 2019 and 2020 are given below. Sun Corporation Statement of financial position as at March 31 Non-current assets, net Inventory Accounts receivable Other current assets Cash Total currents assets Revenues Cost of Goods Sold Gross profit Expenses Depreciation 2020 RM (000's Total Assets Also the Statement of Comprehensive 2020 is also fumished below: ) 3.138 Net Income EPS Dividends per share 301 956 303 696 2.256 5.394 Earnings before interest and tax Interest Expense Taxable Income Taxes 2019 RM (000's ) 3,358 Accounts payable Notes payable 361 Other current liabilities 992 Total current liabilities 264 58 Long-term debts 1.675 Sun Corporation Statement of comprehensive income for the year ended March 31, 2020 2020 2019 RM RM (000's (000's 307 26 1.662 1.995 ) 303 119 1.353 1.775 843 1.091 Share capital 5.033 Total Liabilities & Equity Income of Sun Corporation for the year ending 31 March. RM3.61 RM1.08 2.556 2.167 5.394 5.033 RM (000's) 5.000 (2,006) 2,994 (1.740) (116) 1,138 1.131 (442) 689 Required: a) Compute the following ratios for the year 2020: i) Current ratio ii) Acid test ratio (Quick ratio) iii) Debt to assets ratio iv) Time interest earned v) Inventory turnover vi) Accounts receivable turnover vii) Assets turnover viii) Gross Profit margin ix) Net profit margin x) Returns on ordinary shareholders' equity Note: All sales are on credit. (10 marks)

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution i RATIO FOR THE YEAR 2020 000 Current Ratio ii Quick ratio iii Debt to Total Assets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started