Answered step by step

Verified Expert Solution

Question

1 Approved Answer

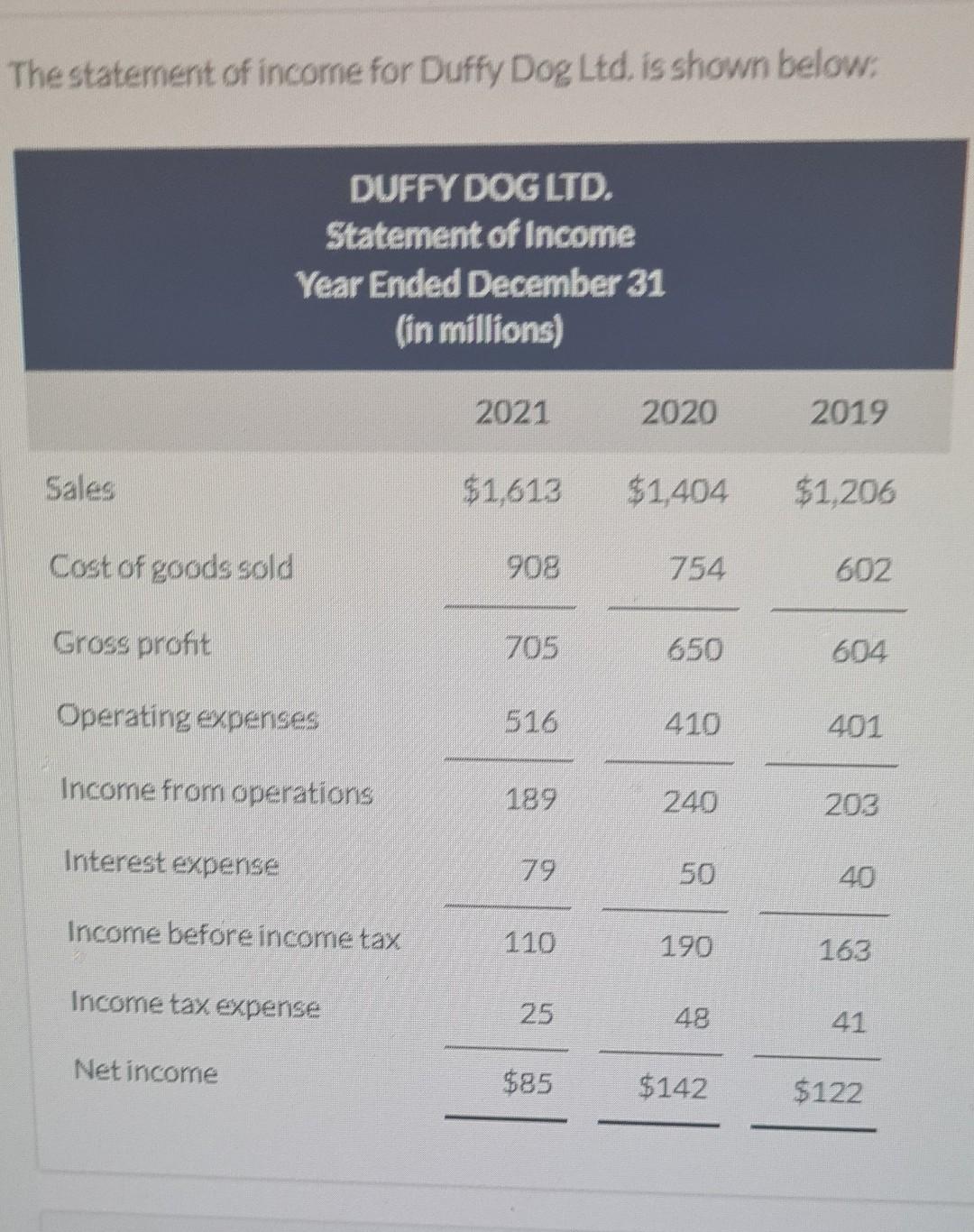

The statement of income for Duffy Dog Ltd. is shown below: DUFFY DOG LTD. Statement of Income Year Ended December 31 (in millions) 2021 2020

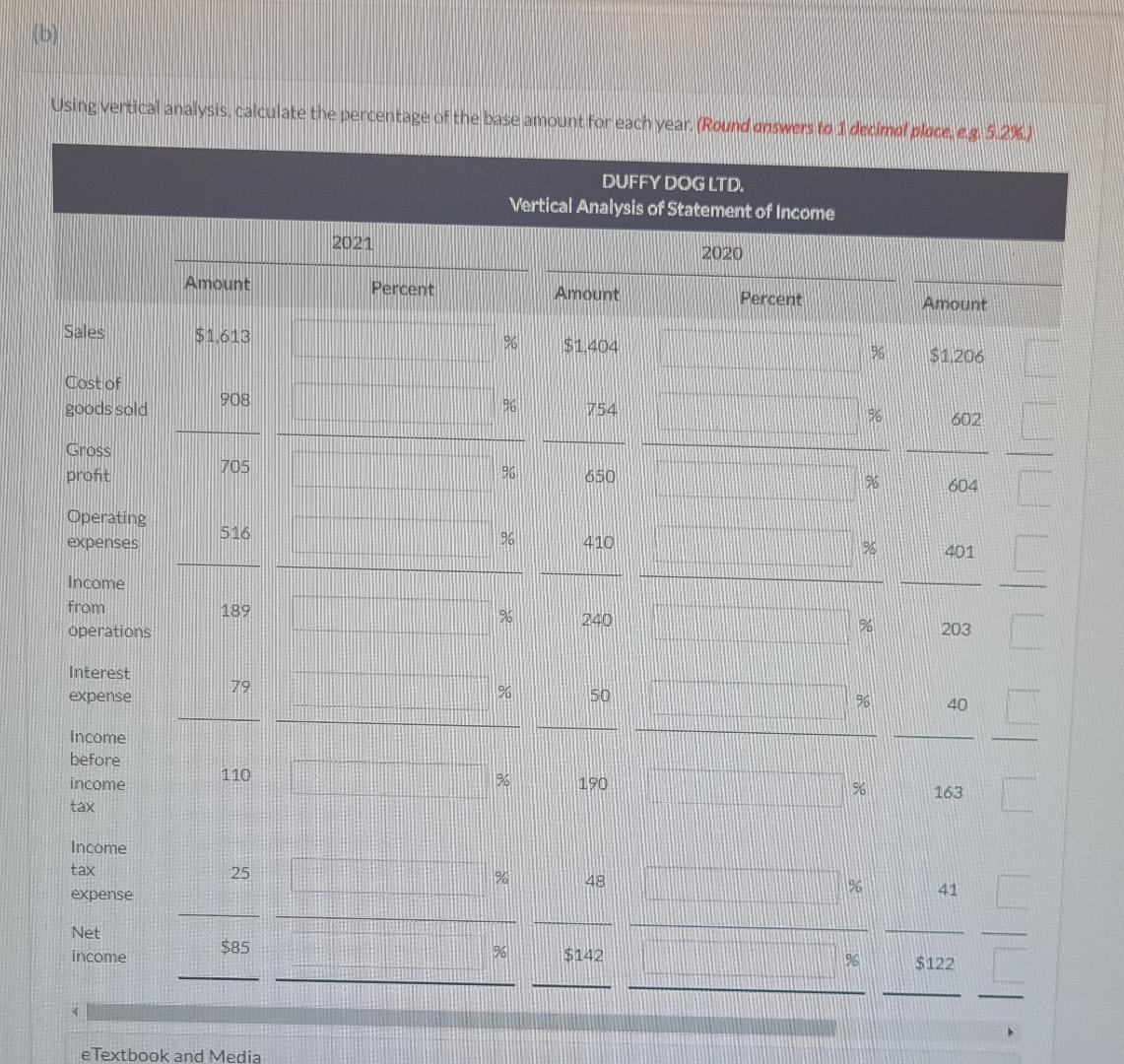

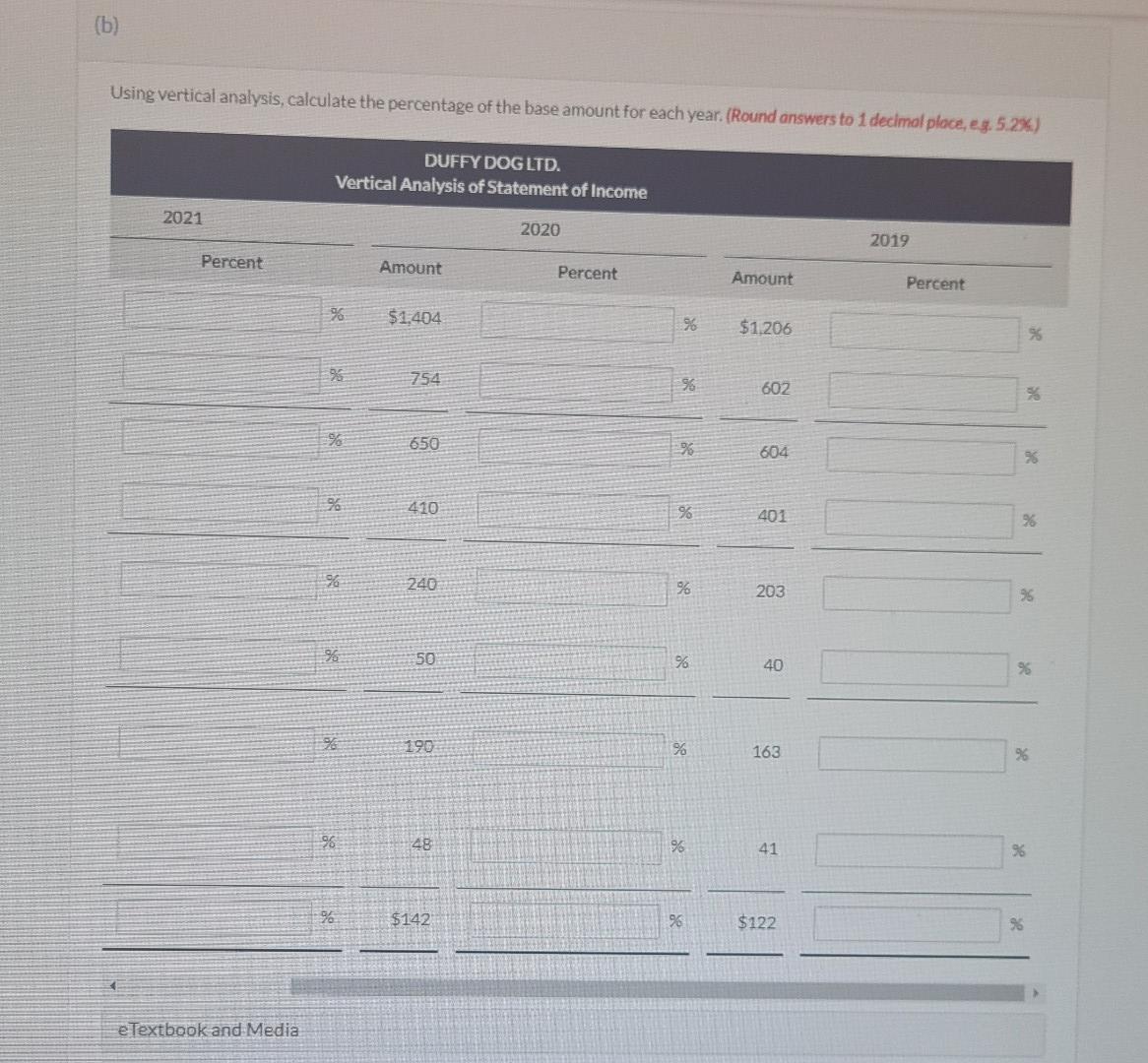

The statement of income for Duffy Dog Ltd. is shown below: DUFFY DOG LTD. Statement of Income Year Ended December 31 (in millions) 2021 2020 2019 Sales $1,613 $1,404 $1,206 Cost of goods sold 908 754 602 Gross profit 705 650 604 Operating expenses 516 410 401 Income from operations 189 240 203 Interest expense 79 50 40 Income before income tax 110 190 163 Income tax expense 25 48 41 Net income $85 $142 $122 Using vertical analysis, calculate the percentage of the base amount for each year. (Round answers to decimal place 520) DUFFY DOG LTD. Vertical Analysis of Statement of Income 2021 2020 Amount Percent Amount Percent Amount Sales $1.618 $1404 $1206 cost of goods sold 909 26 754 6 602 Gross 705 profit 28 650 604 Operating expenses 516 90 410 126 401 Income 189 from Operations 96 240 96 203 Interest expense 79 20 50 96 40 Income before income tax 110 96 190 % 163 Income tax expense 25 449 1% 41 Net income $85 % $142 26 $122 e Textbook and Media (b) Using vertical analysis, calculate the percentage of the base amount for each year. (Round answers to 1 decimal place, eg. 5.2%) DUFFY DOG LTD. Vertical Analysis of Statement of Income 2021 2020 2019 Percent Amount Percent Amount Percent 96 $1,404 % $1,206 95 754 56 602 % 650 26 604 26 se 410 % 401 %6 240 % 203 96 50 % 40 % % 190 % 163 % 96 48 % 41 96 96 $142 9 $122 56 e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started