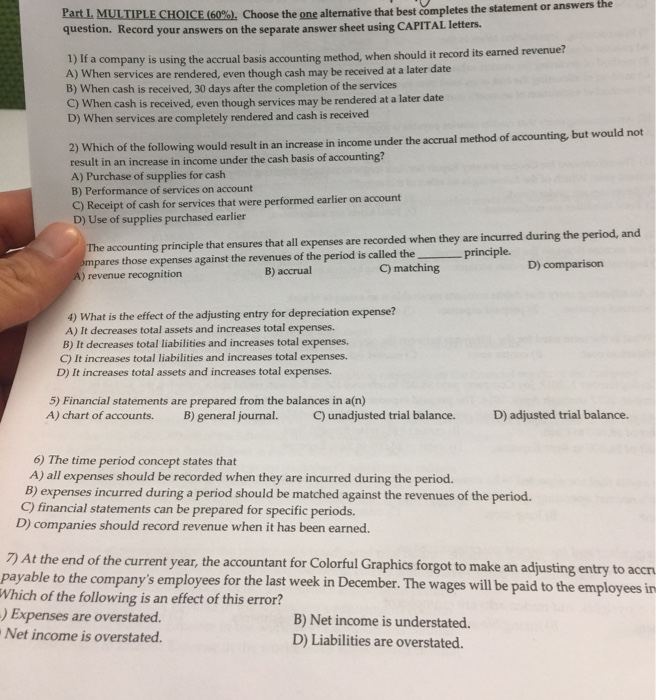

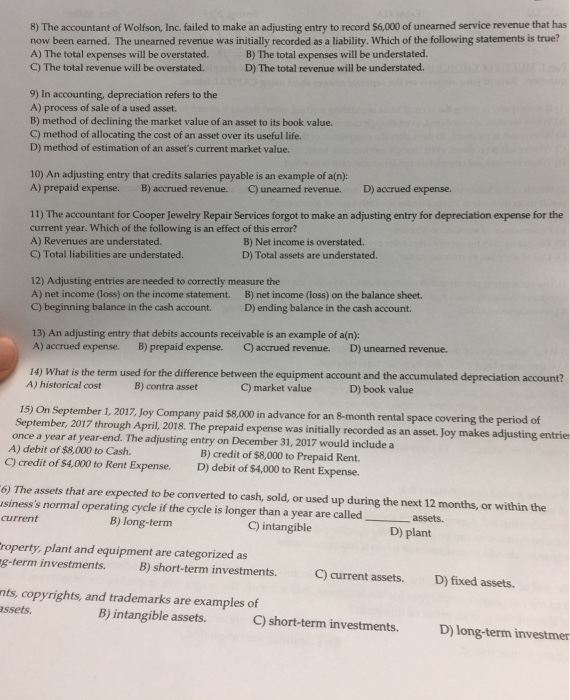

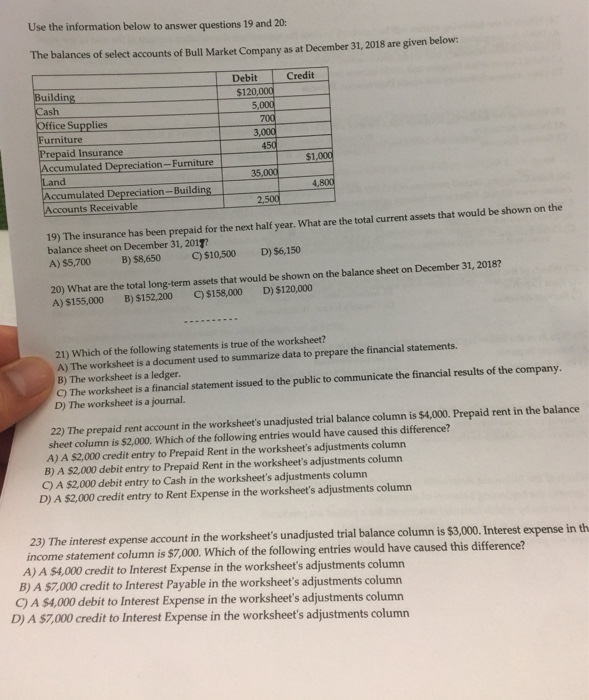

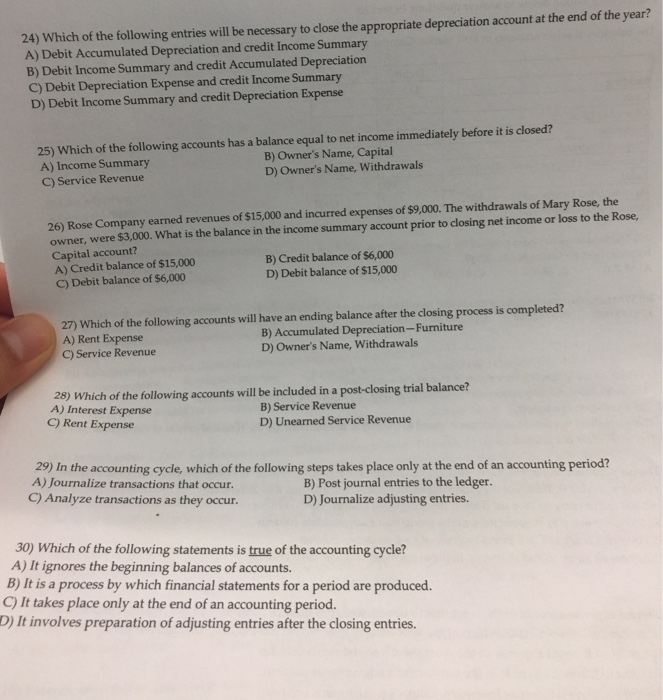

the statement or answers the PartL MULTIPLECHOICE(60%), alternative that question. Record your answers on the separate answer sheet using CAPTAL letters. Choose the one alternative that best completes 1) If a company is using the accrual basis accounting method, when should it record its ea A) When services are rendered, even though cash may be received at a later date B) When cash is received, 30 days after the completion of the services C) When cash is received, even though services may be rendered at a later date D) When services are completely rendered and cash is received rmed revenue? not ) Which of the following would result in an increase in income result in an increase in income under the cash basis of accounting? A) Purchase of supplies for cash B) Performance of services on account C) Receipt of cash for services that were performed earlier on account D) Use of supplies purchased earlier under the accrual method of accounting, but would The accounting principle that ensures that all expenses are recorded when they a principle. pares those expenses against the revenues of the period is called the- D) comparison B) accrual C) matching )revenue recognition 4) What is the effect of the adjusting entry for depreciation expense? A) It decreases total assets and increases total expenses. B) It decreases total liabilities and increases total expenses. C) It increases total liabilities and increases total expenses. D) It increases total assets and increases total expenses. 5) Financial statements are prepared from the balances in a(n) A) chart of accounts. B) general journal. C) unadjusted trial balance. D) adjusted trial balance. 6) The time period concept states that A) all expenses should be recorded when they are incurred during the period B) expenses incurred during a period should be matched against the revenues of the period. C) financial statements can be prepared for specific periods. D) companies should record revenue when it has been earned. 7) At the end of the current year, the accountant for Colorful Graphics forgot to make an adjusting entry to accr payable to the company's employees for the last week in December. The wages will be paid to the employees in Which of the following is an effect of this error? Expenses are overstated. B) Net income is understated. D) Liabilities are overstated. Net income is overstated. 8) The accountant of Wolfson, Inc. failed to make an adjusting entry to record $6,000 of unearned service revenue that has now been earned. The unearned revenue was initially recorded as a liability. Which of the following statements is true? A) The total expenses will be overstated. C) The total revenue will be overstated. B) The total expenses will be understated. D) The total revenue will be understated. 9) In accounting, depreciation refers to the A) process of sale of a used asset. B) method of declining the market value of an asset to its book value. C) method of allocating the cost of an asset over its useful life. D) method of estimation of an asset's current market value. 10) An adjusting entry that credits salaries payable is an example of a(n): A) prepaid expense. B) accrued revenue. C) unearned revenue. D) accrued expense. 11) The accountant for Cooper Jewelry Repair Services forgot to make an adjusting entry for depreciation expense for the current year. Which of the following is an effect of this error? A) Revenues are understated. C) Total liabilities are understated. B) Net income is overstated. D) Total assets are understated 12) Adjusting entries are needed to correctly measure the A) net income (loss) on the income statement. B) net income (loss) on the balance sheet C) beginning balance in the cash account. D) ending balance in the cash account. 13) An adjusting entry that debits accounts receivable is an example of a(n): A)accrued expense. B)prepaid expense- C)accrued revenue. D)unearned revenue. 14) What is the term used for the difference between the equipment account and the accumulated depreciation account? A) historical cost B) contra asset C) market value D) book value 15) On September 1, 2017, Joy Company paid $8,000 in advance for an 8-month rental space covering the period of September, 2017 through April, 2018. The prepaid expense was initially recorded as an asset. Joy once a year at year-end. The adjusting entry on December 31, 2017 would include a A) debit of $8,000 to Cash. B) credit of $8,000 to Prepaid Rent. D) debit of $4,000 to Rent Expense. C) credit of $4,000 to Rent Expense. 6) The assets that are expected to be converted to cash, sold, or used up during the next 12 months, or within the siness's normal operating cycle if the cycle is longer than a year are calledassets. current B) long-term C) intangible D) plant roperty, plant and equipment are categorized as g-term investments. B)short-term investments. C)current assets. D)fixed assets. nts, copyrights, and trademarks are examples of ssets. B) intangible assets. C) short-term investments.D) long-term investmer Use the information below to answer questions 19 and 20 The balances of select accounts of Bull Market Company as at December 31, 2018 are given below: Credit Debit $120 Cash 5,000 Office Supplies Furniture Prepaid Insurance $1 ccumulated Depreciation-Furniture nd lated 2, Accounts Receivable 19) The insurance has been prepaid for the next half year. What are the total current assets that would be shown on the balance sheet on December 31, 201? A) $5,700 B) $8,650 C)$10,500 D) $6,150 20) What are the total long-term assets that would be shown on the balance sheet on December 31, 2018? A) $155,000 B) $152,200 C)S158,000 D) $120,000 21) Which of the following statements is true of the worksheet? A) The worksheet is a document used to summarize data to prepare the financial statements B) The worksheet is a ledger C) The worksheet is a financial statement issued to the public to communicate the financial results of the company. D) The worksheet is a journal. 22) The prepaid rent account in the worksheet's unadjusted trial balance column is $4,000. Prepaid rent in the balance sheet column is $2,000. Which of the following entries would have caused this difference? A) A $2,000 credit entry to Prepaid Rent in the worksheet's adjustments column B) A $2,000 debit entry to Prepaid Rent in the worksheet's adjustments column C) A $2,000 debit entry to Cash in the worksheet's adjustments column D) A $2,000 credit entry to Rent Expense in the worksheet's adjustments column 23) The interest expense account in the worksheet's unadjusted trial balance column is $3,000. Interest expense in th income statement column is $7,000. Which of the following entries would have caused this difference? A) A $4,000 credit to Interest Expense in the worksheet's adjustments column B) A $7,000 credit to Interest Payable in the worksheet's adjustments column C) A $4,000 debit to Interest Expense in the worksheet's adjustments column D) A $7,000 credit to Interest Expense in the worksheet's adjustments column 24) Which of the following entries will be necessary to close the appropriate depreciation account at the end of the year? A) Debit Accumulated Depreciation and credit Income Summary B) Debit Income Summary and credit Accumulated Depreciation C) Debit Depreciation Expense and credit Income Summary D) Debit Income Summary and credit Depreciation Expense 25) Which of the following accounts has a balance equal to net income immediately before it is closed? A) Income Summary C) Service Revenue B) Owner's Name, Capital D) Owner's Name, Withdrawals 26) Rose Company earned revenues of $15,000 and incurred expenses of $9,000. The withdrawals of Mary Rose, the owner, were $3,000. What is the balance in the income summary account prior to closing net income or loss to the Rose, Capital account? A) Credit balance of $15,000 C) Debit balance of $6,000 B) Credit balance of $6,000 D) Debit balance of $15,000 27) Which of the following accounts will have an ending balance after the closing process is completed? A) Rent Expense C) Service Revenue B) Accumulated Depreciation-Furniture D) Owner's Name, Withdrawals 28) Which of the following accounts will be included in a post-closing trial balance? A) Interest Expense C) Rent Expense B) Service Revenue D) Unearned Service Revenue 29) In the accounting cycle, which of the following steps takes place only at the end of an accounting period? A) Journalize transactions that occur C) Analyze transactions as they occur. B) Post journal entries to the ledger. D) Journalize adjusting entries. 30) Which of the following statements is true of the accounting cycle? A) It ignores the beginning balances of accounts. B) It is a process by which financial statements for a period are produced. C) It takes place only at the end of an accounting period. D) It involves preparation of adjusting entries after the closing entries